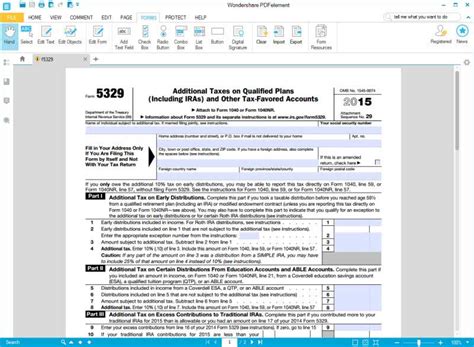

As the tax season approaches, many individuals and businesses are faced with the daunting task of navigating complex tax forms. One such form is the Form 5329, which is used to report penalties for failing to take required minimum distributions (RMDs) from qualified retirement accounts. In this article, we will provide a step-by-step example of how to fill out Form 5329, highlighting key sections and requirements.

Understanding the Purpose of Form 5329

Form 5329 is used to report penalties for failing to take RMDs from qualified retirement accounts, such as 401(k), 403(b), and IRA accounts. The IRS requires account holders to take RMDs starting at age 72, and failing to do so can result in significant penalties. By filing Form 5329, individuals can report and pay these penalties, avoiding additional fines and interest.

Gathering Required Information

Before filling out Form 5329, it is essential to gather the required information, including:

- Account holder's name and address

- Account number and type (e.g., 401(k), IRA)

- RMD amount for the tax year

- Reason for not taking the RMD

- Calculation of the penalty amount

Step-by-Step Example: Filling Out Form 5329

Section 1: Account Holder's Information

- Line 1: Enter the account holder's name and address.

- Line 2: Enter the account number and type.

Example:

| Line | Information |

|---|---|

| 1 | John Doe, 123 Main St, Anytown, USA 12345 |

| 2 | 401(k) account #1234567890 |

Section 2: RMD Information

- Line 3: Enter the RMD amount for the tax year.

- Line 4: Enter the reason for not taking the RMD.

Example:

| Line | Information |

|---|---|

| 3 | $10,000 |

| 4 | Forgot to take the distribution |

Section 3: Penalty Calculation

- Line 5: Enter the penalty amount calculated using the IRS's penalty calculator or the following formula: (RMD amount x 50%) / number of years not taken.

Example:

| Line | Information |

|---|---|

| 5 | $5,000 (50% of $10,000) |

Section 4: Additional Information

- Line 6: Enter any additional information or explanations.

Example:

| Line | Information |

|---|---|

| 6 | Attached a statement explaining the circumstances leading to the missed RMD |

Tips and Reminders

- Ensure accurate calculation of the penalty amount to avoid additional fines and interest.

- Attach supporting documentation, such as statements or letters explaining the circumstances leading to the missed RMD.

- File Form 5329 with the IRS by the tax filing deadline to avoid additional penalties.

Frequently Asked Questions

Q: What is the deadline for filing Form 5329?

A: The deadline for filing Form 5329 is the same as the tax filing deadline, typically April 15th.

Q: Can I file Form 5329 electronically?

A: Yes, Form 5329 can be filed electronically through the IRS's e-file system.

Q: What happens if I fail to file Form 5329?

A: Failure to file Form 5329 can result in additional penalties and interest.

What is the purpose of Form 5329?

+Form 5329 is used to report penalties for failing to take required minimum distributions (RMDs) from qualified retirement accounts.

How do I calculate the penalty amount?

+The penalty amount can be calculated using the IRS's penalty calculator or the following formula: (RMD amount x 50%) / number of years not taken.

What happens if I fail to file Form 5329?

+Failure to file Form 5329 can result in additional penalties and interest.

Conclusion: Final Thoughts on Form 5329

In conclusion, filling out Form 5329 requires careful attention to detail and accurate calculation of the penalty amount. By following the step-by-step example provided in this article, individuals can ensure compliance with the IRS's requirements and avoid additional fines and interest. Remember to attach supporting documentation and file Form 5329 by the tax filing deadline to avoid any further complications.

We hope this article has been informative and helpful in guiding you through the process of filling out Form 5329. If you have any further questions or concerns, please don't hesitate to reach out to us.