The world of taxes can be overwhelming, especially when dealing with unpaid taxes, penalties, and interest. However, there's hope for Connecticut residents who are struggling to pay their tax debts. The Connecticut Department of Revenue Services (DRS) offers a tax forgiveness program, which allows eligible individuals to settle their tax liabilities for less than the full amount owed. One crucial form required for this program is the CT-8379. In this article, we'll delve into the details of Connecticut tax forgiveness and explain the CT-8379 form.

What is the Connecticut Tax Forgiveness Program?

The Connecticut Tax Forgiveness Program, also known as the Offer in Compromise (OIC) program, is designed to help individuals and businesses resolve their tax debts when they're unable to pay the full amount. This program allows taxpayers to settle their tax liabilities for less than the full amount owed, providing a fresh start. The program is only available for certain types of taxes, including income tax, sales tax, and withholding tax.

Eligibility Requirements

To be eligible for the Connecticut Tax Forgiveness Program, you must meet specific requirements:

- You must have filed all required tax returns and paid any current tax liabilities.

- You must be unable to pay the full amount of tax debt, including penalties and interest.

- You must not be in bankruptcy or have any outstanding tax appeals.

- You must have a valid reason for requesting tax forgiveness, such as financial hardship or uncertainty.

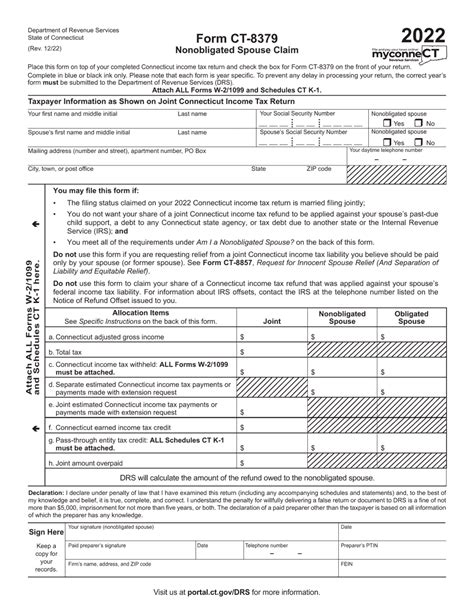

Understanding Form CT-8379

Form CT-8379 is a crucial document required for the Connecticut Tax Forgiveness Program. It's a comprehensive form that requires taxpayers to provide detailed financial information, including income, expenses, assets, and liabilities. The form is used to evaluate your financial situation and determine whether you're eligible for tax forgiveness.

Completing Form CT-8379

Completing Form CT-8379 requires careful attention to detail. You'll need to provide the following information:

- Your name, address, and Social Security number

- A detailed list of your income, including wages, salaries, and investments

- A detailed list of your expenses, including rent, utilities, and debt payments

- A list of your assets, including bank accounts, investments, and real estate

- A list of your liabilities, including credit card debt, loans, and mortgages

How to Apply for Connecticut Tax Forgiveness

To apply for Connecticut tax forgiveness, you'll need to submit Form CT-8379 along with supporting documentation, including:

- Proof of income, such as pay stubs and tax returns

- Proof of expenses, such as rent and utility bills

- Proof of assets, such as bank statements and investment accounts

- Proof of liabilities, such as credit card statements and loan documents

You can submit your application online, by mail, or in person at a DRS office.

What to Expect After Submitting Your Application

After submitting your application, the DRS will review your financial information and determine whether you're eligible for tax forgiveness. If your application is approved, you'll receive a letter outlining the terms of your settlement, including the amount you'll need to pay and any conditions or requirements.

If your application is denied, you'll receive a letter explaining the reason for the denial and any next steps you can take to appeal the decision.

Conclusion

Connecticut tax forgiveness is a valuable program that can help individuals and businesses resolve their tax debts and start fresh. Form CT-8379 is a critical component of the application process, requiring detailed financial information to determine eligibility. By understanding the program and the application process, you can take the first step towards resolving your tax debt and achieving financial freedom.

Take Action Today

If you're struggling with unpaid taxes, don't wait any longer to take action. Review the Connecticut Tax Forgiveness Program and Form CT-8379 to see if you're eligible for tax forgiveness. Submit your application today and take the first step towards resolving your tax debt and starting fresh.

What is the Connecticut Tax Forgiveness Program?

+The Connecticut Tax Forgiveness Program, also known as the Offer in Compromise (OIC) program, is designed to help individuals and businesses resolve their tax debts when they're unable to pay the full amount.

What is Form CT-8379?

+Form CT-8379 is a comprehensive form required for the Connecticut Tax Forgiveness Program. It requires taxpayers to provide detailed financial information, including income, expenses, assets, and liabilities.

How do I apply for Connecticut tax forgiveness?

+To apply for Connecticut tax forgiveness, you'll need to submit Form CT-8379 along with supporting documentation, including proof of income, expenses, assets, and liabilities. You can submit your application online, by mail, or in person at a DRS office.