Transferring property ownership without the need for probate can be a convenient and cost-effective way to ensure that your loved ones receive their inheritance without undue hassle. One tool that Michigan residents can use to achieve this is the Transfer on Death Deed (TODD) form. In this article, we will explore five ways to use a Michigan Transfer on Death Deed form, its benefits, and how it can be an essential part of your estate planning strategy.

Understanding the Michigan Transfer on Death Deed Form

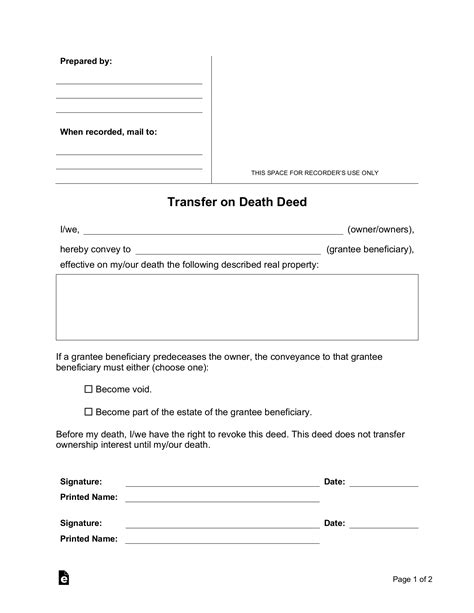

A Transfer on Death Deed form is a type of deed that allows you to transfer ownership of a property to a beneficiary upon your death, while maintaining control and ownership of the property during your lifetime. This type of deed is also known as a "beneficiary deed" or "lady bird deed." The Michigan Transfer on Death Deed form is a statutory form that must be used to transfer property ownership in the state of Michigan.

5 Ways to Use a Michigan Transfer on Death Deed Form

1. Avoid Probate

One of the primary benefits of using a Michigan Transfer on Death Deed form is that it allows you to avoid probate. Probate is the court-supervised process of administering a deceased person's estate, which can be time-consuming, costly, and public. By using a TODD, you can transfer ownership of your property directly to your beneficiaries, bypassing the probate process altogether.

Example:

John, a Michigan resident, owns a vacation home in Petoskey. He wants to ensure that his children inherit the property without going through probate. John can use a Michigan Transfer on Death Deed form to transfer ownership of the property to his children, effective upon his death.

2. Maintain Control and Ownership During Lifetime

A Michigan Transfer on Death Deed form allows you to maintain control and ownership of your property during your lifetime. You can continue to use, sell, or mortgage the property as you see fit, without affecting the transfer of ownership to your beneficiaries upon your death.

Example:

Sarah, a Michigan resident, owns a rental property in Ann Arbor. She wants to ensure that her granddaughter inherits the property upon her death, but she still wants to collect rental income and manage the property during her lifetime. Sarah can use a Michigan Transfer on Death Deed form to transfer ownership of the property to her granddaughter, effective upon her death, while maintaining control and ownership during her lifetime.

3. Reduce Estate Taxes

Using a Michigan Transfer on Death Deed form can also help reduce estate taxes. By transferring ownership of your property to your beneficiaries during your lifetime, you can reduce the value of your taxable estate, which can result in lower estate taxes.

Example:

Mark, a Michigan resident, owns a large estate in Bloomfield Hills. He wants to reduce his estate taxes and ensure that his children inherit the property upon his death. Mark can use a Michigan Transfer on Death Deed form to transfer ownership of the property to his children, effective upon his death, which can help reduce his estate taxes.

4. Provide for Minor Children or Disabled Beneficiaries

A Michigan Transfer on Death Deed form can also be used to provide for minor children or disabled beneficiaries. By transferring ownership of your property to a trust or a conservator, you can ensure that your beneficiaries are taken care of and that their interests are protected.

Example:

Emily, a Michigan resident, has a minor child with special needs. She wants to ensure that her child is taken care of and that her property is used for her child's benefit upon her death. Emily can use a Michigan Transfer on Death Deed form to transfer ownership of her property to a trust, effective upon her death, which can provide for her child's needs.

5. Plan for Long-Term Care

Finally, a Michigan Transfer on Death Deed form can be used to plan for long-term care. By transferring ownership of your property to a beneficiary or a trust, you can ensure that your property is not used to pay for long-term care costs, such as nursing home care.

Example:

David, a Michigan resident, is concerned about the cost of long-term care. He wants to ensure that his property is not used to pay for nursing home care, and that his wife can continue to live in their home upon his death. David can use a Michigan Transfer on Death Deed form to transfer ownership of their home to his wife, effective upon his death, which can help protect their assets from long-term care costs.

How to Use a Michigan Transfer on Death Deed Form

Using a Michigan Transfer on Death Deed form is a relatively straightforward process. Here are the steps you need to follow:

- Complete the form: You can obtain a Michigan Transfer on Death Deed form from the Michigan Department of Treasury or from a reputable online source.

- Fill in the required information: You will need to fill in the required information, including your name, the name of the beneficiary, and a description of the property.

- Sign the form: You will need to sign the form in front of a notary public.

- Record the form: You will need to record the form with the county register of deeds in the county where the property is located.

Conclusion

A Michigan Transfer on Death Deed form can be a useful tool in your estate planning strategy. By using this type of deed, you can avoid probate, maintain control and ownership of your property during your lifetime, reduce estate taxes, provide for minor children or disabled beneficiaries, and plan for long-term care. We hope this article has provided you with a better understanding of how to use a Michigan Transfer on Death Deed form and how it can benefit your estate planning goals.

What is a Transfer on Death Deed form?

+A Transfer on Death Deed form is a type of deed that allows you to transfer ownership of a property to a beneficiary upon your death, while maintaining control and ownership of the property during your lifetime.

How do I obtain a Michigan Transfer on Death Deed form?

+You can obtain a Michigan Transfer on Death Deed form from the Michigan Department of Treasury or from a reputable online source.

Do I need to record the Michigan Transfer on Death Deed form?

+Yes, you will need to record the Michigan Transfer on Death Deed form with the county register of deeds in the county where the property is located.