The state of Hawaii is renowned for its breathtaking natural beauty, pleasant tropical climate, and unique cultural heritage. However, when it comes to tax compliance, the Aloha State is no different from the rest of the country. As a Hawaii resident or business owner, it's essential to understand your tax obligations, particularly when it comes to filing the Hawaii Form HW-30.

In this article, we'll delve into the intricacies of Form HW-30, explaining what it is, who needs to file it, and how to complete it accurately. We'll also cover the importance of timely filing, potential penalties for non-compliance, and provide valuable tips to make the process smoother.

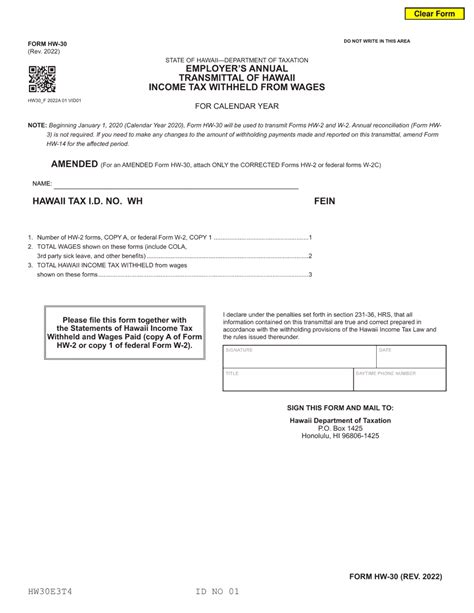

What is Hawaii Form HW-30?

Hawaii Form HW-30, also known as the "Annual Return and Reconciliation," is a tax form required by the Hawaii Department of Taxation. Its primary purpose is to reconcile the state income tax withheld from an employee's wages with the amount of tax actually due. This form is typically filed by employers, but in some cases, individuals may also need to submit it.

Who Needs to File Form HW-30?

Employers who withhold Hawaii state income tax from employee wages are required to file Form HW-30 annually. This includes:

- Private sector employers

- Government agencies

- Non-profit organizations

- Self-employed individuals who have employees

Additionally, certain individuals may need to file Form HW-30, such as:

- Self-employed individuals who have made payments to independent contractors

- Individuals who have received income that is subject to Hawaii state income tax withholding

How to Complete Form HW-30

Completing Form HW-30 requires careful attention to detail to ensure accuracy and avoid potential penalties. Here's a step-by-step guide to help you through the process:

- Gather necessary information: Collect all relevant tax documents, including W-2 forms, 1099 forms, and any other supporting documentation.

- Determine the filing frequency: Employers must file Form HW-30 annually, while individuals may need to file it quarterly or annually, depending on their tax obligations.

- Complete the form: Fill out the form accurately, using the provided instructions and examples to guide you.

- Reconcile tax withheld: Reconcile the tax withheld from employee wages with the amount of tax actually due.

- Report any discrepancies: If there are any discrepancies between the tax withheld and the tax due, report them on the form and explain the reasons for the difference.

Filing and Payment Requirements

Form HW-30 must be filed with the Hawaii Department of Taxation on or before the due date, which is typically April 20th for annual filers. Quarterly filers must submit the form by the last day of the month following the end of the quarter.

Employers who withhold Hawaii state income tax must also make timely payments to avoid penalties and interest. The payment schedule is as follows:

- Quarterly: April 20th, July 20th, October 20th, and January 20th

- Annually: April 20th

Penalties for Non-Compliance

Failure to file Form HW-30 or make timely payments can result in significant penalties and interest. The Hawaii Department of Taxation may impose:

- A penalty of up to 25% of the tax due for failure to file or pay on time

- Interest on the unpaid tax balance

- A penalty of up to $100 per employee for failure to provide W-2 forms

Tips for a Smooth Filing Process

To avoid errors and ensure a smooth filing process, follow these tips:

- Use the correct form: Make sure to use the latest version of Form HW-30, available on the Hawaii Department of Taxation website.

- Read the instructions carefully: Take the time to read the instructions and examples provided with the form.

- Double-check your calculations: Verify your calculations to ensure accuracy and avoid discrepancies.

- File electronically: Consider filing electronically to reduce errors and speed up the processing time.

Conclusion

Filing Hawaii Form HW-30 is a critical component of tax compliance in the Aloha State. By understanding the requirements, following the steps outlined in this guide, and taking advantage of the tips provided, you can ensure a smooth and accurate filing process. Remember to file on time, make timely payments, and double-check your calculations to avoid potential penalties and interest.

We hope this comprehensive guide has provided you with the necessary information to navigate the Form HW-30 filing process with confidence. If you have any further questions or concerns, feel free to comment below or reach out to the Hawaii Department of Taxation for assistance.

Frequently Asked Questions

What is the due date for filing Form HW-30?

+The due date for filing Form HW-30 is April 20th for annual filers. Quarterly filers must submit the form by the last day of the month following the end of the quarter.

Who needs to file Form HW-30?

+Employers who withhold Hawaii state income tax from employee wages are required to file Form HW-30 annually. Certain individuals, such as self-employed individuals who have made payments to independent contractors, may also need to file the form.

What is the penalty for failure to file or pay on time?

+The Hawaii Department of Taxation may impose a penalty of up to 25% of the tax due for failure to file or pay on time. Interest on the unpaid tax balance may also be charged.