Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. One such scenario involves filing taxes for a minor's investment income, which requires the use of Form 8615. In this article, we will delve into the world of Form 8615, providing a comprehensive guide on how to complete it accurately and efficiently.

The importance of Form 8615 cannot be overstated, as it helps to ensure that minors' investment income is reported correctly and that the necessary taxes are paid. Failure to file this form can result in penalties and fines, making it essential to understand the requirements and procedures involved.

What is Form 8615?

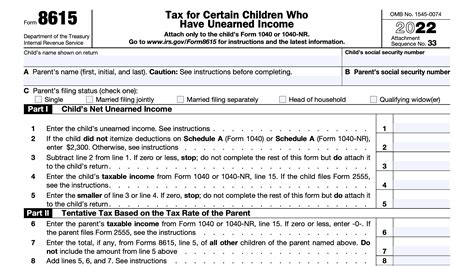

Form 8615, also known as the "Dependent's Investment Income" form, is used to report the investment income of minors, which includes interest, dividends, and capital gains. This form is typically filed by parents or guardians on behalf of their minor children, although it can also be filed by the minor themselves if they are eligible to do so.

Who Needs to File Form 8615?

Form 8615 is required for minors who have investment income exceeding $2,200 in a given tax year. This income can come from a variety of sources, including:

- Interest from savings accounts or bonds

- Dividends from stocks or mutual funds

- Capital gains from the sale of securities or real estate

In addition to the income threshold, the minor must also meet certain age requirements. Typically, minors under the age of 18 are required to file Form 8615, although this age may vary depending on the specific circumstances.

Step 1: Gather Required Documents

Before beginning the Form 8615 filing process, it is essential to gather all necessary documents, including:

- The minor's social security number or individual taxpayer identification number (ITIN)

- Investment account statements or 1099 forms showing interest, dividends, and capital gains

- Any relevant tax-related documents, such as W-2 forms or previous tax returns

Completing Form 8615

Once all required documents are in hand, it is time to begin completing Form 8615. The form is divided into several sections, each of which requires specific information.

- Section 1: Enter the minor's name, social security number or ITIN, and the parent's or guardian's name and social security number or ITIN.

- Section 2: Report the minor's investment income, including interest, dividends, and capital gains.

- Section 3: Calculate the minor's tax liability, taking into account any applicable deductions or credits.

Step 2: Calculate the Minor's Tax Liability

Calculating the minor's tax liability involves several steps, including:

- Determining the minor's taxable income

- Applying any applicable deductions or credits

- Calculating the tax due

Common Errors to Avoid

When completing Form 8615, it is essential to avoid common errors that can result in penalties or fines. Some of the most common mistakes include:

- Failure to report all investment income

- Incorrect calculation of tax liability

- Incomplete or inaccurate information

Step 3: File Form 8615

Once Form 8615 is complete, it must be filed with the IRS. This can be done electronically or by mail, depending on the specific circumstances.

Tips and Strategies for Filing Form 8615

To ensure a smooth and accurate filing process, consider the following tips and strategies:

- Use tax preparation software to simplify the filing process

- Consult with a tax professional if unsure about any aspect of the form

- Keep accurate records of investment income and tax-related documents

Conclusion

Filing Form 8615 can be a complex and time-consuming process, but with the right guidance and support, it can be completed accurately and efficiently. By following the steps outlined in this guide, parents and guardians can ensure that their minor children's investment income is reported correctly and that the necessary taxes are paid.

We encourage you to share your experiences with filing Form 8615 in the comments section below. If you have any questions or need further clarification on any aspect of the form, please don't hesitate to ask.

What is the deadline for filing Form 8615?

+The deadline for filing Form 8615 is typically April 15th of each year, although this date may vary depending on the specific circumstances.

Can I file Form 8615 electronically?

+What happens if I fail to file Form 8615?

+Failing to file Form 8615 can result in penalties and fines, so it is essential to complete and file the form accurately and on time.