As a crucial document in the world of business and finance, the Declaration Form MC 030 is an essential tool for companies to declare and verify the authenticity of certain transactions. In this article, we will delve into the world of Declaration Form MC 030, exploring its importance, benefits, and a step-by-step guide on how to fill it out accurately.

In today's fast-paced business environment, companies are required to comply with various regulations and laws to ensure transparency and accountability. One such regulation is the Declaration Form MC 030, which plays a vital role in facilitating smooth business transactions.

The Declaration Form MC 030 is a critical document that serves as a declaration of authenticity, ensuring that certain transactions are genuine and comply with the relevant laws and regulations. This form is typically used in conjunction with other documents, such as invoices and receipts, to provide a comprehensive record of business transactions.

Benefits of Using Declaration Form MC 030

The Declaration Form MC 030 offers several benefits to businesses, including:

- Enhanced credibility: By using the Declaration Form MC 030, companies can demonstrate their commitment to transparency and accountability, thereby enhancing their credibility in the eyes of their customers, suppliers, and regulatory bodies.

- Streamlined transactions: The Declaration Form MC 030 helps to facilitate smooth business transactions by providing a standardized format for declaring the authenticity of certain transactions.

- Compliance with regulations: The Declaration Form MC 030 ensures that companies comply with relevant laws and regulations, reducing the risk of non-compliance and associated penalties.

Step-by-Step Guide to Filling Out Declaration Form MC 030

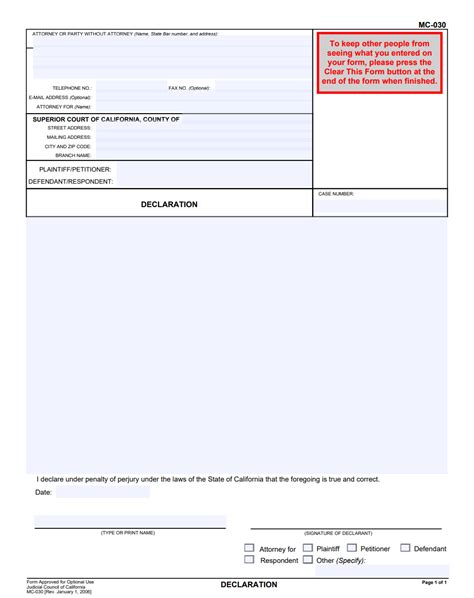

To ensure accuracy and compliance, it's essential to fill out the Declaration Form MC 030 correctly. Here's a step-by-step guide to help you navigate the process:

- Obtain the correct form: Ensure that you have the latest version of the Declaration Form MC 030. You can obtain the form from the relevant regulatory body or download it from their official website.

- Fill out the header section: The header section typically requires information such as the company name, address, and contact details.

- Specify the transaction details: Provide details of the transaction, including the date, amount, and description of the goods or services.

- Declare the authenticity of the transaction: Sign and date the declaration, confirming that the transaction is genuine and compliant with relevant laws and regulations.

- Attach supporting documents: Attach relevant documents, such as invoices and receipts, to support the declaration.

Common Mistakes to Avoid When Filling Out Declaration Form MC 030

To ensure accuracy and avoid delays, it's essential to avoid common mistakes when filling out the Declaration Form MC 030. Here are some common mistakes to watch out for:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete, including dates, amounts, and descriptions.

- Failure to attach supporting documents: Attach all relevant documents, including invoices and receipts, to support the declaration.

- Unsigned or undated declaration: Ensure that the declaration is signed and dated, confirming that the transaction is genuine and compliant with relevant laws and regulations.

Best Practices for Managing Declaration Form MC 030

To ensure efficient management of the Declaration Form MC 030, follow these best practices:

- Maintain accurate records: Keep accurate and up-to-date records of all declarations, including supporting documents.

- Use a standardized process: Establish a standardized process for filling out and managing the Declaration Form MC 030.

- Regularly review and update: Regularly review and update the Declaration Form MC 030 to ensure compliance with changing regulations and laws.

Conclusion

The Declaration Form MC 030 is a critical document that plays a vital role in facilitating smooth business transactions. By following the step-by-step guide and best practices outlined in this article, companies can ensure accuracy and compliance, thereby enhancing their credibility and streamlining their transactions.

We hope this article has provided you with valuable insights into the world of Declaration Form MC 030. If you have any questions or comments, please feel free to share them below.

What is the purpose of the Declaration Form MC 030?

+The Declaration Form MC 030 serves as a declaration of authenticity, ensuring that certain transactions are genuine and comply with relevant laws and regulations.

What are the benefits of using the Declaration Form MC 030?

+The Declaration Form MC 030 offers several benefits, including enhanced credibility, streamlined transactions, and compliance with regulations.

How do I fill out the Declaration Form MC 030?

+Follow the step-by-step guide outlined in this article to ensure accuracy and compliance when filling out the Declaration Form MC 030.