Filing a life insurance claim can be a daunting task, especially during a difficult time. Colonial Penn Life Insurance is a well-established insurance company that provides coverage to many individuals. If you're a beneficiary of a Colonial Penn Life Insurance policy, it's essential to understand the claims process to receive the benefits you're entitled to. Here's a step-by-step guide to help you navigate the process.

Understanding the Claims Process

Before we dive into the steps, it's crucial to understand the overall claims process. When a policyholder passes away, the beneficiary must notify Colonial Penn Life Insurance and provide necessary documentation to initiate the claims process. The company will then review the claim, verify the information, and make a decision.

Step 1: Gather Required Documents

To file a claim, you'll need to provide specific documents to Colonial Penn Life Insurance. These documents typically include:

- Death certificate: An original or certified copy of the policyholder's death certificate.

- Policy documents: The original policy document or a certified copy.

- Identification: Your government-issued ID, such as a driver's license or passport.

- Claim form: You can download the claim form from the Colonial Penn Life Insurance website or request one by phone.

Step 2: Notify Colonial Penn Life Insurance

You can notify Colonial Penn Life Insurance by phone, email, or mail. Be prepared to provide the policy number, policyholder's name, and your relationship to the policyholder.

- Phone: Call the claims department at (800) 523-0650 (Monday to Friday, 8:00 a.m. to 5:00 p.m. ET).

- Email: .

- Mail: Send a written notification to Colonial Penn Life Insurance, Claims Department, P.O. Box 26093, Philadelphia, PA 19176-6093.

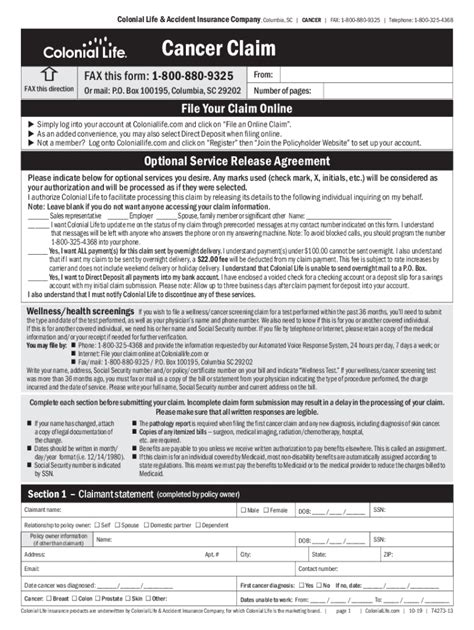

Step 3: Complete the Claim Form

Once you've notified Colonial Penn Life Insurance, you'll need to complete the claim form. This form will ask for details about the policyholder, the policy, and your relationship to the policyholder.

- Download the claim form from the Colonial Penn Life Insurance website.

- Complete the form accurately and thoroughly.

- Sign and date the form.

Step 4: Submit the Claim

After completing the claim form, submit it to Colonial Penn Life Insurance along with the required documents. You can submit the claim by mail or fax.

- Mail: Send the claim form and supporting documents to Colonial Penn Life Insurance, Claims Department, P.O. Box 26093, Philadelphia, PA 19176-6093.

- Fax: Fax the claim form and supporting documents to (215) 845-4655.

Step 5: Follow Up and Receive the Benefits

After submitting the claim, Colonial Penn Life Insurance will review the information and make a decision. This process typically takes a few weeks. If additional information is required, the company will contact you.

- Follow up: If you haven't received a response within a few weeks, you can follow up with the claims department to check the status of your claim.

- Receive the benefits: Once the claim is approved, Colonial Penn Life Insurance will mail a check to you, the beneficiary.

By following these steps, you can navigate the Colonial Penn Life Insurance claims process with ease. Remember to stay organized, provide accurate information, and follow up with the claims department if necessary.

Additional Tips and Considerations

- Keep records: Keep a record of all correspondence with Colonial Penn Life Insurance, including dates, times, and details of conversations.

- Seek help: If you're unsure about the claims process or need assistance, consider seeking help from a licensed insurance professional.

- Review the policy: Take the time to review the policy documents and understand the terms and conditions.

By being prepared and understanding the claims process, you can ensure a smoother experience and receive the benefits you're entitled to.

Common Challenges and Solutions

During the claims process, you may encounter some challenges. Here are some common issues and solutions:

Missing Documents

- Solution: Check the policy documents and ensure you have all required documents. If you're missing a document, contact Colonial Penn Life Insurance or the issuing authority.

Inaccurate Information

- Solution: Double-check the information on the claim form and policy documents. If you notice any errors, correct them and resubmit the claim.

Delays in Processing

- Solution: Follow up with the claims department to check the status of your claim. If there are any issues, provide additional information or clarification to expedite the process.

Conclusion

Filing a Colonial Penn Life Insurance claim can be a complex process, but by following these steps and understanding the claims process, you can ensure a smoother experience. Remember to stay organized, provide accurate information, and follow up with the claims department if necessary. If you're unsure about the claims process or need assistance, consider seeking help from a licensed insurance professional.

Frequently Asked Questions

How long does the claims process take?

+The claims process typically takes a few weeks. However, the exact timeframe may vary depending on the complexity of the claim and the speed of processing.

What documents do I need to file a claim?

+You'll need to provide the original or certified copy of the death certificate, policy documents, identification, and the completed claim form.

Can I file a claim online?

+No, you cannot file a claim online. You'll need to download the claim form from the Colonial Penn Life Insurance website, complete it, and submit it by mail or fax.