As an executor or personal representative of an estate, one of the most critical tasks you'll face is filing the estate's income tax return. In New Jersey, this is done using the NJ Form 1041, also known as the Fiduciary Income Tax Return. This form is used to report the estate's income, deductions, and credits, and to calculate the amount of tax due. In this article, we'll take a closer look at the NJ Form 1041 and provide guidance on how to file an estate income tax return in New Jersey.

Understanding the NJ Form 1041

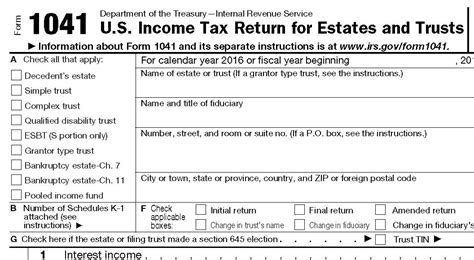

The NJ Form 1041 is a critical document that requires careful preparation and attention to detail. The form is used to report the estate's income from various sources, including:

- Interest and dividends from investments

- Rent and royalties from real estate and intellectual property

- Capital gains from the sale of assets

- Business income from partnerships and S corporations

In addition to reporting income, the NJ Form 1041 also requires the estate to claim deductions and credits, such as:

- Funeral expenses

- Administrative costs

- Charitable contributions

- New Jersey taxes withheld

Who Must File the NJ Form 1041?

The NJ Form 1041 must be filed by the executor or personal representative of the estate, also known as the fiduciary. This person is responsible for managing the estate's assets, paying debts and taxes, and distributing the remaining assets to beneficiaries.

To determine if the NJ Form 1041 is required, the fiduciary must consider the following:

- Was the decedent a resident of New Jersey at the time of death?

- Did the decedent have income-generating assets, such as investments or real estate?

- Are there any beneficiaries who will receive income from the estate?

If the answer to any of these questions is yes, the NJ Form 1041 is likely required.

How to File the NJ Form 1041

Filing the NJ Form 1041 involves several steps, including:

- Gathering necessary documents and information, such as:

- The decedent's tax returns for the previous year

- Statements from financial institutions and investment accounts

- Records of income and expenses

- Completing the NJ Form 1041, including:

- Reporting income from various sources

- Claiming deductions and credits

- Calculating the estate's tax liability

- Paying any taxes due, including:

- New Jersey income tax

- Federal income tax (if applicable)

- Filing the NJ Form 1041 with the New Jersey Division of Taxation, including:

- Submitting the completed form and supporting documents

- Paying any required fees or penalties

Deadlines and Penalties

The NJ Form 1041 must be filed by the 15th day of the fourth month following the close of the estate's tax year. For example, if the estate's tax year ends on December 31st, the NJ Form 1041 must be filed by April 15th.

Failure to file the NJ Form 1041 or pay taxes due can result in penalties and interest, including:

- Late filing penalty: 5% of the tax due per month, up to a maximum of 25%

- Late payment penalty: 1% of the tax due per month, up to a maximum of 25%

- Interest on unpaid taxes: 6% per annum

Additional Requirements and Considerations

In addition to filing the NJ Form 1041, the fiduciary may need to consider other requirements and considerations, including:

- Obtaining an Employer Identification Number (EIN) for the estate

- Filing federal tax returns, such as the Form 1041 and Schedule K-1

- Paying New Jersey inheritance tax, if applicable

- Distributing income to beneficiaries and reporting income on their tax returns

Seeking Professional Guidance

Filing the NJ Form 1041 can be a complex and time-consuming process, especially for those with little experience in tax preparation. To ensure accuracy and compliance with all requirements, it's recommended that the fiduciary seek professional guidance from a qualified tax professional or attorney.

By understanding the NJ Form 1041 and following the steps outlined in this article, the fiduciary can ensure that the estate's income tax return is filed accurately and on time, minimizing the risk of penalties and interest.

We hope this article has provided valuable guidance on filing the NJ Form 1041. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may benefit from this information.

Who is responsible for filing the NJ Form 1041?

+The executor or personal representative of the estate, also known as the fiduciary, is responsible for filing the NJ Form 1041.

What is the deadline for filing the NJ Form 1041?

+The NJ Form 1041 must be filed by the 15th day of the fourth month following the close of the estate's tax year.

What are the consequences of failing to file the NJ Form 1041?

+Failure to file the NJ Form 1041 or pay taxes due can result in penalties and interest, including late filing and payment penalties, and interest on unpaid taxes.