Completing a tax return can be a daunting task, especially for individuals who are new to the process. In the state of Georgia, the GA Form 500 is a critical document that taxpayers must fill out accurately to ensure they meet their tax obligations. The GA Form 500, also known as the Individual Income Tax Return, is a comprehensive form that requires taxpayers to provide detailed information about their income, deductions, and credits.

In this article, we will provide a step-by-step guide on how to complete the GA Form 500 successfully. By following these steps, taxpayers can avoid common mistakes, reduce the risk of audits, and ensure they receive the refund they are entitled to.

Step 1: Gather Necessary Documents and Information

Before starting to fill out the GA Form 500, taxpayers should gather all necessary documents and information. This includes:

- W-2 forms from employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

Taxpayers should also have their social security number, driver's license, and other identification documents readily available.

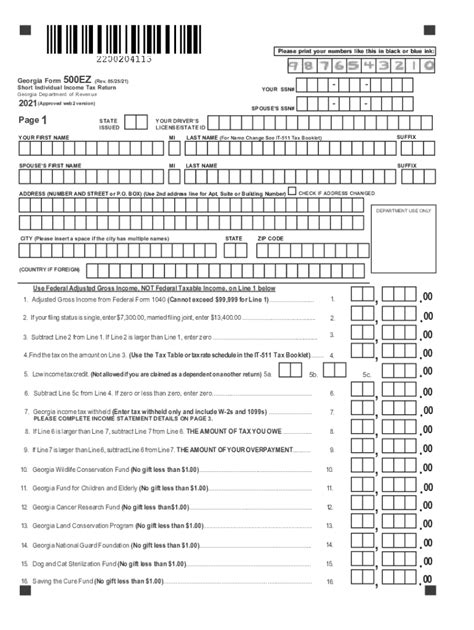

Understanding the Different Schedules and Forms

The GA Form 500 consists of multiple schedules and forms that taxpayers must complete. These include:

- Schedule 1: Income and Adjustments

- Schedule 2: Deductions and Credits

- Schedule 3: Tax Credits

- Form 500-EZ: Simplified Tax Return

Taxpayers should familiarize themselves with each schedule and form to ensure they complete the correct sections.

Step 2: Determine Your Filing Status

Taxpayers must determine their filing status before completing the GA Form 500. The filing status will determine the tax rates and deductions that apply. The five filing statuses are:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Taxpayers should choose the correct filing status based on their marital status, dependents, and other factors.

Choosing the Correct Filing Status

Taxpayers should be careful when choosing their filing status. For example, if a taxpayer is married, they can file jointly or separately. However, if they file separately, they may be subject to different tax rates and deductions.

Step 3: Report Income and Adjustments

Taxpayers must report all income earned during the tax year on Schedule 1. This includes:

- Wages and salaries

- Tips and commissions

- Self-employment income

- Interest and dividends

- Capital gains and losses

Taxpayers should also report any adjustments to income, such as:

- Alimony paid

- Student loan interest

- Educator expenses

Understanding Income Types

Taxpayers should understand the different types of income and how they are reported. For example, self-employment income is reported on Schedule C, while interest and dividends are reported on Schedule 1.

Step 4: Claim Deductions and Credits

Taxpayers can claim deductions and credits on Schedule 2. Deductions reduce taxable income, while credits reduce the tax liability. Common deductions and credits include:

- Standard deduction or itemized deductions

- Mortgage interest

- Charitable donations

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Taxpayers should be careful when claiming deductions and credits. For example, the standard deduction is a fixed amount, while itemized deductions require taxpayers to keep receipts and records.

Understanding Deduction Limits

Taxpayers should understand the limits on deductions. For example, the mortgage interest deduction is limited to $750,000 for single filers and $1 million for joint filers.

Step 5: Calculate Tax Liability

After reporting income, claiming deductions and credits, and calculating taxable income, taxpayers must calculate their tax liability. This involves:

- Applying the tax rates to taxable income

- Calculating any tax credits

- Adding any additional taxes, such as self-employment tax

Taxpayers can use the tax tables or tax calculator to determine their tax liability.

Understanding Tax Rates

Taxpayers should understand the tax rates and how they apply to their taxable income. For example, the tax rates range from 1% to 5.75% for single filers, depending on the taxable income.

Step 6: Complete Additional Forms and Schedules

Depending on their situation, taxpayers may need to complete additional forms and schedules. These include:

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

- Form 8962: Premium Tax Credit

- Form 8965: Health Coverage Exemptions

Taxpayers should carefully review the instructions and complete the required forms and schedules.

Understanding Form Requirements

Taxpayers should understand which forms and schedules are required based on their situation. For example, self-employed individuals must complete Schedule C, while individuals with capital gains must complete Schedule D.

Step 7: Review and Submit the Return

Finally, taxpayers should review their return carefully to ensure accuracy and completeness. They should:

- Check for math errors and typos

- Verify social security numbers and addresses

- Ensure all required forms and schedules are included

Taxpayers can submit their return electronically or by mail. If they owe taxes, they can pay online or by check.

Understanding Filing Options

Taxpayers should understand the filing options available. For example, electronic filing is faster and more accurate, while mail filing may take longer.

What is the deadline for filing the GA Form 500?

+The deadline for filing the GA Form 500 is April 15th of each year.

Can I file an extension for the GA Form 500?

+Yes, you can file an extension for the GA Form 500 using Form IT-303. The extension deadline is April 15th of each year.

How do I pay my tax liability for the GA Form 500?

+You can pay your tax liability online, by phone, or by mail using a check or money order.

By following these 7 steps, taxpayers can ensure they complete the GA Form 500 accurately and on time. Remember to gather all necessary documents, determine your filing status, report income and adjustments, claim deductions and credits, calculate tax liability, complete additional forms and schedules, and review and submit the return. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the Georgia Department of Revenue.