As the tax season approaches, many individuals and businesses are preparing to file their tax returns. One often-overlooked form is the Form 3922, also known as the Exercise of an Incentive Stock Option Under Section 422(b). This form is used to report the exercise of an incentive stock option (ISO) and is filed with the individual's tax return, typically Form 1040. In this article, we will discuss the three essential steps to file Form 3922 with Form 1040.

Understanding Form 3922

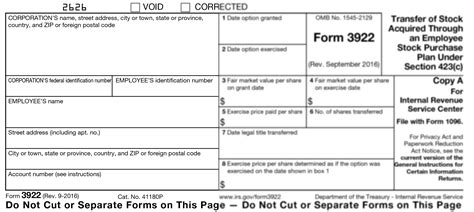

Before we dive into the steps, it's essential to understand what Form 3922 is and why it's necessary. Form 3922 is used to report the exercise of an ISO, which is a type of stock option that allows employees to purchase company stock at a discounted price. The form is used to report the exercise of the option, including the number of shares exercised, the exercise price, and the fair market value of the shares on the exercise date.

Step 1: Gather Required Information

To file Form 3922, you'll need to gather some essential information. This includes:

- The name and address of the corporation that issued the ISO

- The date the ISO was granted

- The date the ISO was exercised

- The number of shares exercised

- The exercise price per share

- The fair market value of the shares on the exercise date

You can find this information in your ISO agreement or by contacting the corporation that issued the option.

Step 2: Complete Form 3922

Once you have the required information, you can complete Form 3922. The form is relatively straightforward and requires you to report the following information:

- Part I: Corporation Information

- Name and address of the corporation

- Date the ISO was granted

- Part II: Option Information

- Date the ISO was exercised

- Number of shares exercised

- Exercise price per share

- Fair market value of the shares on the exercise date

- Part III: Certification

- Certification that the information reported is accurate

Make sure to complete all the required fields and sign the form.

Step 3: File Form 3922 with Form 1040

After completing Form 3922, you'll need to file it with your individual tax return, typically Form 1040. You'll need to attach Form 3922 to Form 1040 and submit it to the IRS by the tax filing deadline.

It's essential to note that you may need to complete additional forms, such as Schedule D (Capital Gains and Losses) or Form 8949 (Sales and Other Dispositions of Capital Assets), if you sold or disposed of the stock after exercising the ISO.

Common Mistakes to Avoid

When filing Form 3922 with Form 1040, there are several common mistakes to avoid:

- Failing to report the exercise of an ISO

- Incorrectly reporting the exercise price or fair market value

- Failing to sign the form

- Not attaching Form 3922 to Form 1040

These mistakes can result in delays or even penalties, so it's essential to double-check your information and ensure you're filing the form correctly.

Conclusion

Filing Form 3922 with Form 1040 is a relatively straightforward process, but it requires attention to detail and accurate reporting. By following the three essential steps outlined above, you can ensure you're meeting your tax obligations and avoiding common mistakes. Remember to gather the required information, complete Form 3922 accurately, and file it with your individual tax return by the tax filing deadline.

Frequently Asked Questions

What is Form 3922 used for?

+Form 3922 is used to report the exercise of an incentive stock option (ISO) under Section 422(b). It's filed with the individual's tax return, typically Form 1040.

What information do I need to complete Form 3922?

+You'll need to gather information about the corporation that issued the ISO, the date the ISO was granted and exercised, the number of shares exercised, the exercise price, and the fair market value of the shares on the exercise date.

Can I file Form 3922 electronically?

+Yes, you can file Form 3922 electronically through the IRS e-file system. However, you'll need to attach it to your individual tax return, typically Form 1040.