Filing a life insurance claim can be a daunting task, especially during a difficult time. Unity Financial Life Insurance is committed to making the process as smooth and efficient as possible for their policyholders and beneficiaries. In this comprehensive guide, we will walk you through the Unity Financial Life Insurance claim form process, providing you with the necessary information and steps to ensure a hassle-free experience.

Unity Financial Life Insurance understands the importance of prompt and fair claim settlements. Their dedicated claims team is available to assist you throughout the process, ensuring that you receive the benefits you are entitled to. Whether you are a policyholder or a beneficiary, this guide will help you navigate the claim form process with ease.

Understanding the Unity Financial Life Insurance Claim Form Process

The Unity Financial Life Insurance claim form process typically involves the following steps:

- Notifying Unity Financial Life Insurance of the claim

- Completing and submitting the claim form

- Providing required documentation and evidence

- Review and processing of the claim

- Payment of the claim benefit

Notifying Unity Financial Life Insurance of the Claim

To initiate the claim process, you or your beneficiary will need to notify Unity Financial Life Insurance of the passing of the policyholder. This can be done by:

- Calling their dedicated claims hotline

- Submitting an online claim notification form

- Mailing or faxing a written notification

Completing and Submitting the Claim Form

Once you have notified Unity Financial Life Insurance of the claim, you will need to complete and submit the claim form. The claim form can be obtained by:

- Downloading it from the Unity Financial Life Insurance website

- Requesting it from their claims department via phone or email

- Picking it up from a local Unity Financial Life Insurance office

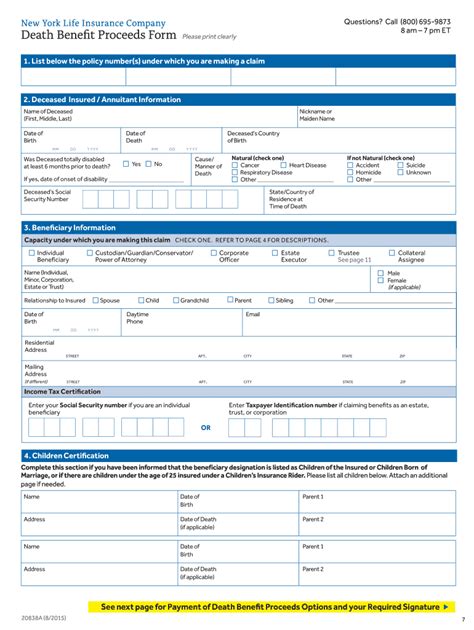

The claim form will require you to provide personal and policy information, as well as details about the deceased. Be sure to complete the form accurately and thoroughly to avoid any delays in the processing of your claim.

Providing Required Documentation and Evidence

In addition to the completed claim form, you will need to provide Unity Financial Life Insurance with certain documentation and evidence to support your claim. This may include:

- A certified copy of the death certificate

- Proof of identity and relationship to the policyholder

- Policy documents and records

- Medical records and reports

Review and Processing of the Claim

Once Unity Financial Life Insurance receives your completed claim form and supporting documentation, their dedicated claims team will review and process your claim. This may involve:

- Verifying the policy information and coverage

- Reviewing the documentation and evidence provided

- Conducting any necessary investigations or research

Payment of the Claim Benefit

After the claim has been reviewed and processed, Unity Financial Life Insurance will pay the claim benefit to the beneficiary or beneficiaries listed on the policy. The payment will be made in accordance with the terms and conditions of the policy.

Tips for Filing a Unity Financial Life Insurance Claim

To ensure a smooth and efficient claim process, keep the following tips in mind:

- Notify Unity Financial Life Insurance of the claim as soon as possible

- Complete the claim form accurately and thoroughly

- Provide all required documentation and evidence

- Keep a record of your correspondence with Unity Financial Life Insurance

- Follow up with Unity Financial Life Insurance if you have any questions or concerns

Conclusion: Navigating the Unity Financial Life Insurance Claim Form Process with Ease

Filing a life insurance claim can be a complex and overwhelming process, but with the right guidance and support, it can be navigated with ease. Unity Financial Life Insurance is committed to making the claim process as smooth and efficient as possible for their policyholders and beneficiaries.

By following the steps outlined in this guide and keeping the tips in mind, you can ensure a hassle-free experience and receive the benefits you are entitled to. If you have any questions or concerns about the claim process, don't hesitate to reach out to Unity Financial Life Insurance's dedicated claims team.

We hope this guide has been informative and helpful in navigating the Unity Financial Life Insurance claim form process. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is the Unity Financial Life Insurance claim form process?

+The Unity Financial Life Insurance claim form process involves notifying Unity Financial Life Insurance of the claim, completing and submitting the claim form, providing required documentation and evidence, review and processing of the claim, and payment of the claim benefit.

How do I notify Unity Financial Life Insurance of a claim?

+You can notify Unity Financial Life Insurance of a claim by calling their dedicated claims hotline, submitting an online claim notification form, or mailing or faxing a written notification.

What documentation and evidence do I need to provide to support my claim?

+You will need to provide Unity Financial Life Insurance with a certified copy of the death certificate, proof of identity and relationship to the policyholder, policy documents and records, and medical records and reports.