As a business owner or tax professional in Michigan, it's essential to be aware of the various tax forms and requirements that apply to your situation. One of the critical forms you may need to file is Michigan Form 4567, also known as the "Michigan Business Tax Annual Return." In this article, we will delve into the details of Michigan Form 4567, including its purpose, who needs to file it, and the steps to complete the form accurately.

What is Michigan Form 4567?

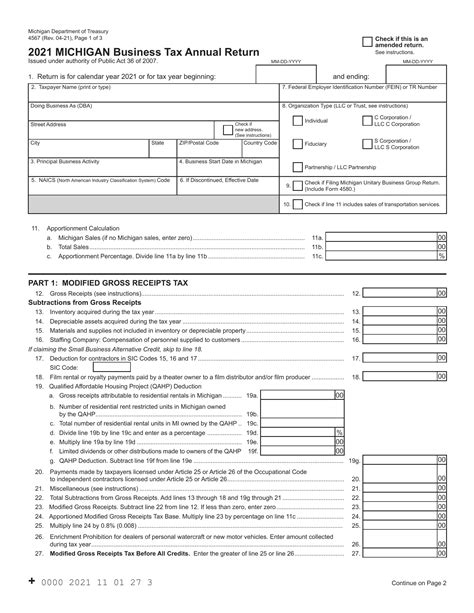

Michigan Form 4567 is an annual return form used by the Michigan Department of Treasury to collect business tax information from eligible entities. The form is designed to gather financial data, including income, deductions, and credits, to determine the taxpayer's liability for the Michigan Business Tax (MBT). The MBT is a business-level tax that applies to certain types of entities, including corporations, limited liability companies (LLCs), and partnerships.

Purpose of Michigan Form 4567

The primary purpose of Michigan Form 4567 is to report the taxpayer's business income, deductions, and credits for the tax year. The form is used to calculate the taxpayer's MBT liability, which is based on the entity's adjusted gross income. The form also requires taxpayers to report any changes to their business structure, ownership, or other relevant information.

Who Needs to File Michigan Form 4567?

Not all businesses in Michigan need to file Form 4567. The following entities are required to file the form:

- Corporations, including S corporations and C corporations

- Limited liability companies (LLCs) that are treated as corporations for federal tax purposes

- Partnerships, including limited liability partnerships (LLPs)

- Certain types of trusts and estates

It's essential to note that not all businesses in Michigan are subject to the MBT. For example, sole proprietorships and single-member LLCs that are disregarded for federal tax purposes are not required to file Form 4567.

Exemptions from Filing Michigan Form 4567

Some businesses may be exempt from filing Michigan Form 4567. For example:

- Entities that are exempt from the MBT under Michigan law

- Entities that have a total business income of $350,000 or less and are not required to file a federal income tax return

- Entities that are dissolved or terminated during the tax year

How to Complete Michigan Form 4567

Completing Michigan Form 4567 requires careful attention to detail and accuracy. Here are the steps to follow:

- Gather necessary documents: Collect all relevant financial documents, including the entity's federal tax return, financial statements, and supporting schedules.

- Determine the filing status: Determine the entity's filing status, including the business type, ownership structure, and any changes to the business during the tax year.

- Complete the form: Complete the form by reporting the entity's business income, deductions, and credits. Use the instructions provided with the form to ensure accuracy.

- Attach supporting schedules: Attach any required supporting schedules, including Schedule A (Business Income and Deductions) and Schedule B (Credits).

- Sign and date the form: Sign and date the form, including the entity's name, address, and federal employer identification number (FEIN).

Important Deadlines and Penalties

The deadline for filing Michigan Form 4567 is typically April 30th of each year, but this deadline may vary depending on the entity's federal tax filing deadline. Failure to file the form or pay the MBT liability by the deadline may result in penalties and interest.

Tips for Filing Michigan Form 4567

Here are some tips to keep in mind when filing Michigan Form 4567:

- Seek professional help: Consider hiring a tax professional or accountant to ensure accuracy and compliance.

- Use the correct form: Use the correct form for the tax year and entity type.

- Report all income: Report all business income, including income from passthrough entities.

- Claim eligible credits: Claim eligible credits, including the Michigan Business Development Program credit.

Conclusion

Filing Michigan Form 4567 is a critical requirement for eligible entities in Michigan. By understanding the purpose, requirements, and deadlines for filing the form, businesses can ensure compliance and avoid penalties. Remember to seek professional help if needed, and take advantage of eligible credits to minimize tax liability.

What is the deadline for filing Michigan Form 4567?

+The deadline for filing Michigan Form 4567 is typically April 30th of each year, but this deadline may vary depending on the entity's federal tax filing deadline.

Who needs to file Michigan Form 4567?

+Corporations, limited liability companies (LLCs), partnerships, and certain types of trusts and estates are required to file Michigan Form 4567.

What is the purpose of Michigan Form 4567?

+The primary purpose of Michigan Form 4567 is to report the taxpayer's business income, deductions, and credits for the tax year to determine the taxpayer's liability for the Michigan Business Tax (MBT).