Wisconsin Form 4: A Comprehensive Guide to Instructions and Filing

As a resident of Wisconsin, it's essential to understand the state's tax laws and regulations. One of the critical tax forms for Wisconsin residents is Form 4, which is used to report state income tax. In this article, we'll provide a detailed guide to Wisconsin Form 4 instructions and filing, helping you navigate the process with ease.

Wisconsin's tax laws can be complex, and failing to comply with the regulations can result in penalties and fines. According to the Wisconsin Department of Revenue, taxpayers who fail to file their state income tax return on time may be subject to a penalty of up to 5% of the unpaid tax, plus interest. Therefore, it's crucial to understand the Form 4 instructions and filing process to avoid any issues.

What is Wisconsin Form 4?

Wisconsin Form 4 is the state's individual income tax return form. It's used to report an individual's state income tax, including income from various sources such as employment, self-employment, investments, and more. The form is also used to claim tax credits and deductions, which can help reduce the amount of tax owed.

Who Needs to File Wisconsin Form 4?

Not everyone needs to file Wisconsin Form 4. According to the Wisconsin Department of Revenue, you need to file a state income tax return if you meet any of the following conditions:

- You have gross income of $12,000 or more, regardless of age or filing status.

- You have gross income of $9,000 or more and are 65 or older.

- You have gross income of $9,000 or more and are blind.

- You have gross income of $5,000 or more and are claimed as a dependent on someone else's return.

- You have net earnings from self-employment of $400 or more.

- You have tax withheld and want to claim a refund.

Wisconsin Form 4 Instructions

To file Wisconsin Form 4, you'll need to follow these instructions:

- Gather necessary documents: Collect all necessary documents, including W-2 forms, 1099 forms, and any other relevant tax documents.

- Choose your filing status: Determine your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report income: Report all income from various sources, including employment, self-employment, investments, and more.

- Claim deductions and credits: Claim any deductions and credits you're eligible for, such as the standard deduction, itemized deductions, and tax credits.

- Calculate tax owed: Calculate the amount of tax you owe, taking into account any tax withheld and tax credits.

Wisconsin Form 4 Filing Options

You can file Wisconsin Form 4 in several ways:

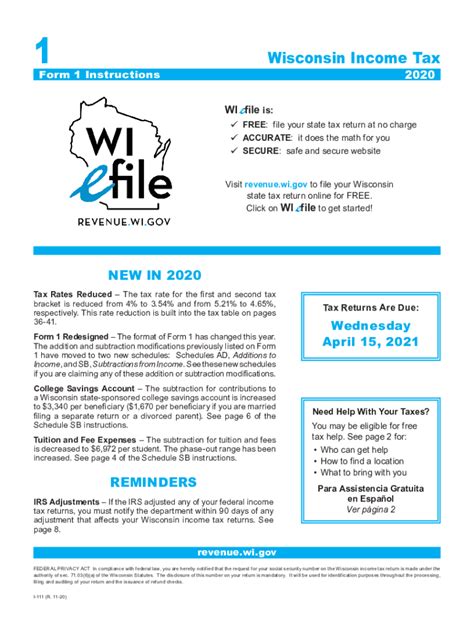

- E-file: File electronically using the Wisconsin Department of Revenue's website or through a tax preparation software.

- Mail: Mail your completed Form 4 to the address listed in the instructions.

- In-person: File in person at a local Department of Revenue office.

Wisconsin Form 4 Deadline

The deadline for filing Wisconsin Form 4 is typically April 15th of each year. However, if you need more time to file, you can request an automatic six-month extension by submitting Form 1-ES.

Wisconsin Form 4 Amendments

If you need to make changes to your previously filed Form 4, you can file an amended return using Form 1X. You'll need to explain the changes you're making and provide supporting documentation.

Wisconsin Form 4 Refund

If you're due a refund, you can choose to receive it by direct deposit, paper check, or prepaid debit card.

Common Mistakes to Avoid

When filing Wisconsin Form 4, avoid these common mistakes:

- Failing to report all income

- Not claiming deductions and credits

- Miscalculating tax owed

- Failing to sign and date the form

- Not keeping records of supporting documentation

Conclusion

Filing Wisconsin Form 4 can be a complex process, but by following the instructions and guidelines outlined in this article, you can ensure you're in compliance with the state's tax laws. Remember to gather all necessary documents, report all income, and claim any deductions and credits you're eligible for. If you're unsure about any aspect of the filing process, consider consulting a tax professional or seeking guidance from the Wisconsin Department of Revenue.

What is the deadline for filing Wisconsin Form 4?

+The deadline for filing Wisconsin Form 4 is typically April 15th of each year.

Can I file Wisconsin Form 4 electronically?

+What happens if I don't file Wisconsin Form 4?

+If you don't file Wisconsin Form 4, you may be subject to penalties and fines. The Wisconsin Department of Revenue may also send you a notice requesting that you file a return.