The world of tax filing can be a daunting one, especially for single-member LLCs. As a single-member LLC owner, you're likely no stranger to wearing multiple hats - from CEO to accountant, and everything in between. But when it comes to tax season, it's essential to get it right to avoid any unwanted attention from the IRS. That's where Form 568 comes in - a crucial document for single-member LLCs to report their tax obligations. In this article, we'll delve into the ins and outs of Form 568, explaining what it is, who needs to file it, and how to do it correctly.

What is Form 568?

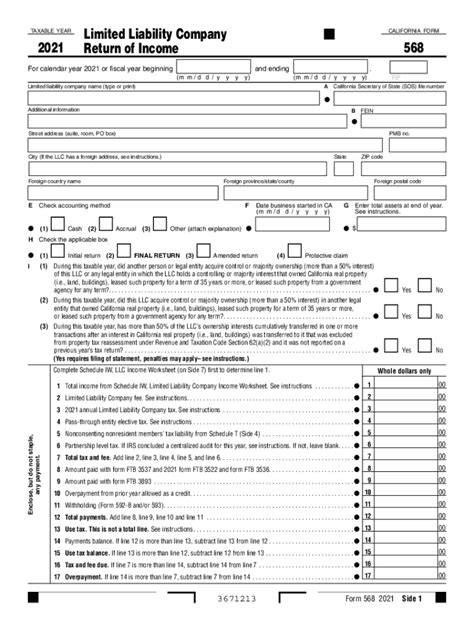

Form 568, also known as the "Limited Liability Company Return of Income," is a tax form used by single-member LLCs to report their annual income and expenses to the California Franchise Tax Board (FTB). This form is specific to California-based single-member LLCs and is used to determine the company's tax liability. Even if your single-member LLC doesn't have any income, you're still required to file Form 568 annually.

Who needs to file Form 568?

As a single-member LLC owner in California, you're required to file Form 568 if:

- Your LLC is registered in California

- Your LLC has a single owner (i.e., you're the only member)

- Your LLC has income or expenses to report

If your LLC has multiple members, you'll need to file Form 568 for each member, as well as a separate return for the LLC itself.

What information do I need to file Form 568?

To file Form 568, you'll need to gather the following information:

- Your LLC's name, address, and Employer Identification Number (EIN)

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your LLC's income and expenses for the tax year, including:

- Gross income

- Business expenses

- Depreciation and amortization

- Other deductions

- Any taxes owed or payments made to the FTB

How to file Form 568

Filing Form 568 is a relatively straightforward process, but it does require some attention to detail. Here are the steps to follow:

- Gather your documents: Collect all the necessary information and documents, including your LLC's financial records, invoices, and receipts.

- Complete the form: Fill out Form 568, making sure to include all the required information. You can download the form from the FTB website or use tax preparation software to help you complete it.

- Calculate your tax liability: Use the form to calculate your LLC's tax liability, taking into account any credits or deductions you're eligible for.

- Submit the form: File Form 568 with the FTB by the deadline (usually March 15th for calendar-year filers).

- Pay any taxes owed: If you owe taxes, make sure to pay them by the deadline to avoid penalties and interest.

Penalties for not filing Form 568

Failure to file Form 568 can result in penalties and fines, including:

- A penalty of $250 for failure to file

- Interest on any taxes owed

- Potential loss of your LLC's good standing with the state

Tips for single-member LLC owners

As a single-member LLC owner, here are some tips to keep in mind:

- Keep accurate records: Keep detailed records of your LLC's income and expenses to make filing Form 568 easier.

- Consult a tax professional: If you're unsure about how to file Form 568 or have complex tax situations, consider consulting a tax professional.

- File on time: Make sure to file Form 568 by the deadline to avoid penalties and fines.

Conclusion

Filing Form 568 is a crucial step in maintaining your single-member LLC's good standing with the state of California. By understanding what Form 568 is, who needs to file it, and how to do it correctly, you can ensure your LLC is in compliance with state tax laws. Remember to keep accurate records, consult a tax professional if needed, and file on time to avoid any unwanted penalties or fines.

Frequently Asked Questions

What is the deadline for filing Form 568?

+The deadline for filing Form 568 is usually March 15th for calendar-year filers.

Do I need to file Form 568 if my LLC has no income?

+Yes, even if your LLC has no income, you're still required to file Form 568 annually.

Can I file Form 568 electronically?

+Yes, you can file Form 568 electronically through the FTB's website or using tax preparation software.