Missing the deadline to file your New Jersey state taxes can result in penalties and interest, adding to your tax liability. However, if you need more time to prepare and submit your tax return, you can file for a tax extension. Filing a tax extension in New Jersey is a straightforward process that can be completed online, and this article will guide you through it.

Filing for a tax extension in New Jersey provides you with an additional six months to submit your tax return, which can help reduce stress and give you the time you need to ensure accuracy. An extension of time to file does not, however, extend the time to pay any taxes owed, and you should make an estimated tax payment by the original deadline to avoid penalties and interest.

Who Needs to File a New Jersey Tax Extension?

If you are a New Jersey resident or non-resident and need more time to file your state tax return, you should file for a tax extension. This includes individuals, businesses, and fiduciaries who are required to file a tax return in New Jersey. Some common reasons for filing a tax extension include:

- Needing more time to gather necessary documents or information

- Being out of town or unable to file by the deadline

- Experiencing unexpected events or circumstances that make it difficult to file on time

- Requiring more time to prepare complex tax returns

Benefits of Filing a Tax Extension in New Jersey

Filing a tax extension in New Jersey provides several benefits, including:

- Avoiding late-filing penalties and interest

- Giving you more time to prepare and ensure accuracy

- Allowing you to make an estimated tax payment to reduce penalties and interest

- Providing an additional six months to submit your tax return

How to File a New Jersey Tax Extension

To file a tax extension in New Jersey, you can follow these steps:

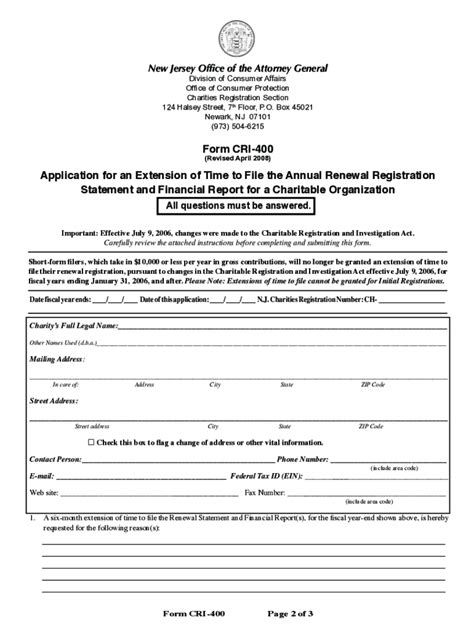

- Determine if you need to file a tax extension and which form to use:

- Form NJ-630: Application for Extension of Time to File New Jersey Gross Income Tax Return

- Form NJ-630-EXT: Application for Extension of Time to File New Jersey Fiduciary Return

- Form NJ-630-B: Application for Extension of Time to File New Jersey Business Return

- Complete the applicable form and attach any required documentation, such as estimated tax payments or proof of federal extension.

- Submit the form online through the New Jersey Division of Taxation's website or by mail to the address listed on the form.

- Make an estimated tax payment by the original deadline to reduce penalties and interest.

Estimated Tax Payments and Penalties

When filing a tax extension in New Jersey, it is essential to make an estimated tax payment by the original deadline to reduce penalties and interest. You can make an estimated tax payment online, by phone, or by mail.

If you fail to make an estimated tax payment or underpay, you may be subject to penalties and interest. The New Jersey Division of Taxation calculates penalties and interest based on the unpaid tax amount and the number of days past the deadline.

Tips for Filing a New Jersey Tax Extension

Here are some tips to keep in mind when filing a tax extension in New Jersey:

- File your tax extension as soon as possible to avoid penalties and interest.

- Make an estimated tax payment by the original deadline to reduce penalties and interest.

- Ensure you complete the correct form and attach any required documentation.

- Submit your tax extension application online or by mail to the address listed on the form.

- Keep a copy of your tax extension application and supporting documentation for your records.

Avoiding Common Mistakes When Filing a Tax Extension

When filing a tax extension in New Jersey, it is essential to avoid common mistakes that can result in penalties, interest, or even denial of your extension request. Some common mistakes to avoid include:

- Failing to make an estimated tax payment by the original deadline

- Submitting an incomplete or inaccurate tax extension application

- Failing to attach required documentation, such as proof of federal extension

- Missing the deadline to file your tax extension

Conclusion

Filing a tax extension in New Jersey is a straightforward process that can provide you with the additional time you need to prepare and submit your tax return. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth and successful tax extension process.

Do you have any questions or concerns about filing a tax extension in New Jersey? Share your thoughts in the comments below!

What is the deadline to file a tax extension in New Jersey?

+The deadline to file a tax extension in New Jersey is typically April 15th for individual taxpayers and March 15th for business taxpayers. However, it's essential to check the New Jersey Division of Taxation's website for any updates or changes to the deadline.

Do I need to file a federal tax extension if I file a New Jersey tax extension?

+No, filing a New Jersey tax extension does not automatically extend the deadline to file your federal tax return. You must file a separate federal tax extension, Form 4868, with the Internal Revenue Service (IRS) to extend your federal tax deadline.

How do I make an estimated tax payment when filing a New Jersey tax extension?

+You can make an estimated tax payment online, by phone, or by mail. The New Jersey Division of Taxation provides a payment voucher, Form NJ-630-V, which you can use to make an estimated tax payment. You can also make an online payment through the New Jersey Division of Taxation's website.