Updating a business name with the IRS is a crucial step for any company undergoing a name change. A business name change can be necessary for various reasons, such as a merger, acquisition, or rebranding. The IRS requires businesses to update their name to ensure accurate tax reporting and compliance. In this article, we will outline the 5 steps to update a business name with the IRS.

Understanding the Importance of Updating Your Business Name

Before we dive into the steps, it's essential to understand why updating your business name with the IRS is crucial. The IRS uses your business name to identify your company and process tax returns, payments, and correspondence. If your business name is not updated, you may experience delays or issues with your tax filings, refunds, or other IRS-related matters.

Step 1: Determine the Type of Business Name Change

The first step is to determine the type of business name change you are making. There are two types of name changes:

- Minor Name Change: A minor name change involves a slight modification to your existing business name, such as changing the spelling or adding/removing a word.

- Major Name Change: A major name change involves a significant change to your business name, such as changing the business entity type (e.g., from sole proprietorship to corporation).

Step 2: Update Your Business Registration

Once you have determined the type of name change, you need to update your business registration with the state. This involves filing the necessary paperwork with your state's business registration agency, such as the Secretary of State or Business Registration Division. The specific requirements and forms needed may vary depending on your state and business type.

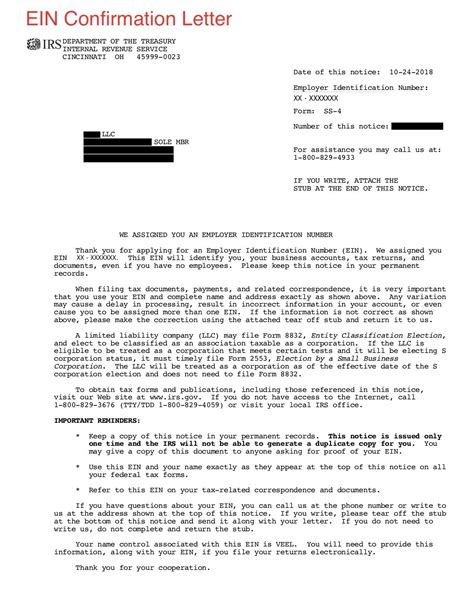

Step 3: Obtain a New Employer Identification Number (EIN)

If you are making a major name change, you may need to obtain a new Employer Identification Number (EIN) from the IRS. An EIN is a unique nine-digit number assigned to your business for tax purposes. You can apply for a new EIN online through the IRS website or by mail/fax using Form SS-4.

Step 4: Update Your Business Tax Returns and Filings

After obtaining a new EIN (if necessary), you need to update your business tax returns and filings with the IRS. This includes:

- Form 1040: Update your business name and EIN (if new) on your individual tax return (Form 1040).

- Form 1120: Update your business name and EIN (if new) on your corporate tax return (Form 1120).

- Form 941: Update your business name and EIN (if new) on your quarterly employment tax return (Form 941).

Step 5: Notify the IRS and Other Government Agencies

The final step is to notify the IRS and other government agencies of your business name change. This includes:

- IRS: Notify the IRS of your business name change by filing Form 8822, Change of Address or Responsible Party.

- Social Security Administration: Notify the Social Security Administration of your business name change to ensure accurate reporting of employee wages and taxes.

- State and Local Agencies: Notify your state and local agencies of your business name change, such as the state department of revenue and local business licensing agencies.

Take Action Today!

Updating your business name with the IRS is a critical step to ensure accurate tax reporting and compliance. By following these 5 steps, you can ensure a smooth transition and avoid any potential issues with your tax filings or other IRS-related matters. Take action today and update your business name with the IRS!

What is the purpose of updating my business name with the IRS?

+Updating your business name with the IRS ensures accurate tax reporting and compliance. The IRS uses your business name to identify your company and process tax returns, payments, and correspondence.

Do I need to obtain a new EIN if I make a minor name change?

+No, you do not need to obtain a new EIN if you make a minor name change. However, if you make a major name change, you may need to obtain a new EIN from the IRS.

How do I notify the IRS of my business name change?

+You can notify the IRS of your business name change by filing Form 8822, Change of Address or Responsible Party.