The world of taxes can be overwhelming, especially when dealing with complex forms and documents. One such document is Form 5106, also known as the "Statement of Material Facts," which is used by the Internal Revenue Service (IRS) to gather information from taxpayers. In this article, we will guide you through the process of downloading, filling, and understanding Form 5106, making it easier for you to navigate the world of taxes.

What is Form 5106?

Form 5106 is an IRS document used to request information from taxpayers regarding their tax returns, audits, or other tax-related matters. The form is typically used by the IRS to gather additional information or clarification on specific issues related to a taxpayer's account. It is essential to understand that Form 5106 is not a tax return form, but rather a statement of material facts that will help the IRS make an informed decision about a taxpayer's case.

Why is Form 5106 Important?

Form 5106 plays a crucial role in the tax examination process. By providing accurate and complete information, taxpayers can help the IRS resolve issues efficiently and effectively. The form helps to:

- Clarify discrepancies in tax returns

- Provide additional information for audits

- Support tax-related claims or disputes

- Ensure compliance with tax laws and regulations

How to Download Form 5106

To download Form 5106, you can follow these steps:

- Visit the official IRS website ()

- Click on the "Forms and Publications" tab

- Search for Form 5106 using the search bar

- Select the correct form and click on the "Download" button

- Save the form to your computer or print it out

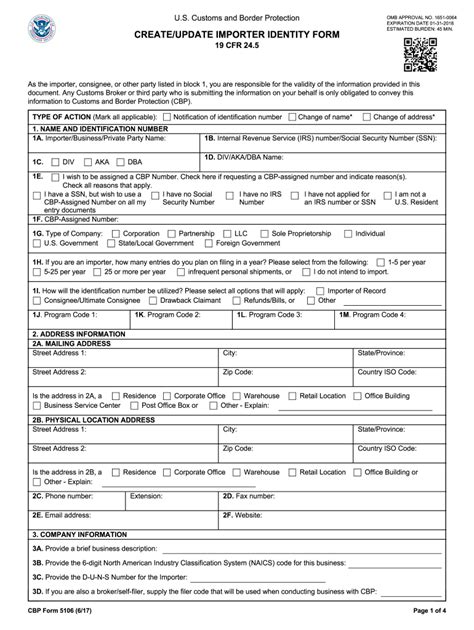

How to Fill Out Form 5106

Filling out Form 5106 requires careful attention to detail. Here are some tips to help you complete the form accurately:

- Read the instructions carefully before starting

- Use black ink and print legibly

- Provide complete and accurate information

- Answer all questions to the best of your ability

- Sign and date the form

Section 1: Taxpayer Information

- Provide your name, address, and Social Security number or Employer Identification Number (EIN)

- List your spouse's name and Social Security number (if applicable)

Section 2: Tax Period

- Identify the tax period or year being examined

- Provide the type of tax return filed (e.g., Form 1040, Form 1120, etc.)

Section 3: Statement of Material Facts

- Provide a clear and concise statement of the material facts related to the issue being examined

- Use additional sheets if necessary

Section 4: Certification

- Sign and date the form

- Certify that the information provided is true and accurate

Tips for Filling Out Form 5106

To ensure that you fill out Form 5106 accurately and efficiently, follow these tips:

- Use a separate sheet of paper to gather your thoughts before filling out the form

- Keep a copy of the completed form for your records

- Review the form carefully before submitting it to the IRS

- Seek professional help if you are unsure about any part of the form

Common Mistakes to Avoid

When filling out Form 5106, it is essential to avoid common mistakes that can delay or complicate the tax examination process. Some common mistakes to avoid include:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Not providing additional information or documentation when requested

- Not keeping a copy of the completed form for your records

Conclusion

Form 5106 is a critical document in the tax examination process. By understanding the purpose and importance of the form, you can ensure that you provide accurate and complete information to the IRS. Remember to download the form from the official IRS website, fill it out carefully, and avoid common mistakes. If you are unsure about any part of the form, seek professional help to ensure that you comply with tax laws and regulations.

We hope this article has helped you understand Form 5106 and how to fill it out accurately. If you have any questions or comments, please feel free to share them below.

What is the purpose of Form 5106?

+Form 5106 is used by the IRS to gather information from taxpayers regarding their tax returns, audits, or other tax-related matters.

How do I download Form 5106?

+You can download Form 5106 from the official IRS website () by searching for the form and clicking on the "Download" button.

What are some common mistakes to avoid when filling out Form 5106?

+Some common mistakes to avoid include incomplete or inaccurate information, failure to sign and date the form, and not providing additional information or documentation when requested.