When starting a business, one of the first decisions entrepreneurs must make is choosing the right ownership structure. Among the various options available, sole proprietorship stands out as the most common business ownership form. In this article, we will delve into the world of sole proprietorship, exploring its benefits, drawbacks, and everything in between.

Sole proprietorship is a business owned and operated by one individual, who has complete control and responsibility for the company's operations, finances, and liabilities. This type of ownership structure is often chosen by small businesses, freelancers, and entrepreneurs who want to maintain control and flexibility.

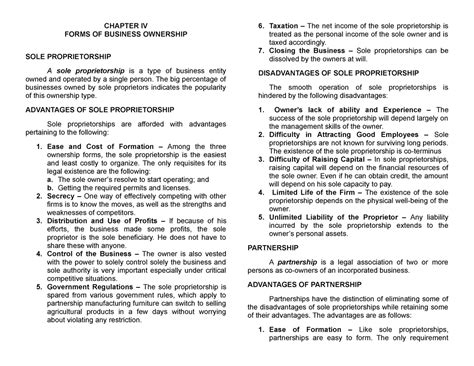

Benefits of Sole Proprietorship

Sole proprietorship offers several benefits that make it an attractive option for many entrepreneurs. Some of the advantages of sole proprietorship include:

Ease of Formation

Forming a sole proprietorship is relatively simple and straightforward. There are no complex paperwork or regulatory requirements to navigate, making it an ideal choice for small businesses or individuals who want to start a business quickly.

Complete Control

As the sole owner, you have complete control over the business, allowing you to make decisions quickly and without needing to consult with others. This level of autonomy is particularly beneficial for entrepreneurs who value independence and flexibility.

Tax Benefits

Sole proprietorships are pass-through entities, meaning that the business income is only taxed at the individual level. This eliminates the need for double taxation, which can be a significant advantage for small businesses.

Less Formality

Sole proprietorships require minimal formalities, such as annual meetings or board of directors' meetings. This lack of formality makes it an attractive option for entrepreneurs who want to focus on running their business rather than dealing with administrative tasks.

Drawbacks of Sole Proprietorship

While sole proprietorship offers several benefits, it also has some significant drawbacks. Some of the disadvantages of sole proprietorship include:

Unlimited Liability

As a sole proprietor, you are personally responsible for all business debts and liabilities. This means that your personal assets, such as your home or savings, can be at risk in the event of business failure.

Limited Access to Capital

Sole proprietorships often struggle to attract investors or secure funding, as there is no separation between personal and business assets. This can limit the business's ability to grow and expand.

Perception of Instability

Some customers or partners may perceive a sole proprietorship as unstable or less professional than other business structures. This can make it more challenging to establish credibility and build trust with clients.

How to Form a Sole Proprietorship

Forming a sole proprietorship is a relatively straightforward process. Here are the steps to follow:

Choose a Business Name

Choose a unique and memorable business name that reflects your brand and values. Make sure to check if the name is available and compliant with your state's business registration requirements.

Register Your Business

Register your business with the state and obtain any necessary licenses or permits. This will typically involve filing a fictitious business name statement (also known as a DBA, or "doing business as" statement) with your local government.

Obtain Necessary Licenses and Permits

Obtain any necessary licenses or permits to operate your business. This may include zoning permits, health department permits, or other regulatory approvals.

Taxation and Accounting for Sole Proprietorship

As a sole proprietor, you will need to report your business income on your personal tax return. Here are some key tax and accounting considerations:

Business Income Taxation

Business income is reported on Schedule C (Form 1040), which is filed with your personal tax return. You will need to report all business income, including profits and losses.

Self-Employment Taxes

As a sole proprietor, you are responsible for paying self-employment taxes on your business income. This includes paying both the employer and employee portions of payroll taxes.

Accounting and Record-Keeping

Maintain accurate and detailed financial records, including income statements, balance sheets, and cash flow statements. This will help you track your business performance and make informed decisions.

Common Mistakes to Avoid as a Sole Proprietor

As a sole proprietor, it's essential to avoid common mistakes that can put your business at risk. Here are some mistakes to watch out for:

Commingling Personal and Business Finances

Keep your personal and business finances separate to avoid commingling funds and potentially jeopardizing your personal assets.

Failing to Register Your Business

Register your business with the state and obtain necessary licenses and permits to avoid fines and penalties.

Not Maintaining Accurate Records

Maintain accurate and detailed financial records to track your business performance and make informed decisions.

Conclusion

Sole proprietorship is the most common business ownership form, offering numerous benefits, including ease of formation, complete control, and tax benefits. However, it also has significant drawbacks, such as unlimited liability, limited access to capital, and perception of instability. By understanding the advantages and disadvantages of sole proprietorship, entrepreneurs can make informed decisions about their business structure and set themselves up for success.

What do you think about sole proprietorship? Share your thoughts and experiences in the comments below!

What is the main advantage of a sole proprietorship?

+The main advantage of a sole proprietorship is the ease of formation and complete control over the business.

What is the main disadvantage of a sole proprietorship?

+The main disadvantage of a sole proprietorship is unlimited liability, which means that the owner's personal assets can be at risk in the event of business failure.

How do I register my sole proprietorship?

+To register your sole proprietorship, you will need to file a fictitious business name statement (also known as a DBA, or "doing business as" statement) with your local government and obtain any necessary licenses or permits.