The Federal Energy Regulatory Commission (FERC) plays a crucial role in regulating the energy industry in the United States. As part of its regulatory framework, FERC requires certain entities to submit annual reports, known as FERC Form 561, to ensure compliance with its regulations. In this article, we will delve into the world of FERC Form 561, exploring its purpose, requirements, and the benefits of compliance.

Understanding FERC Form 561

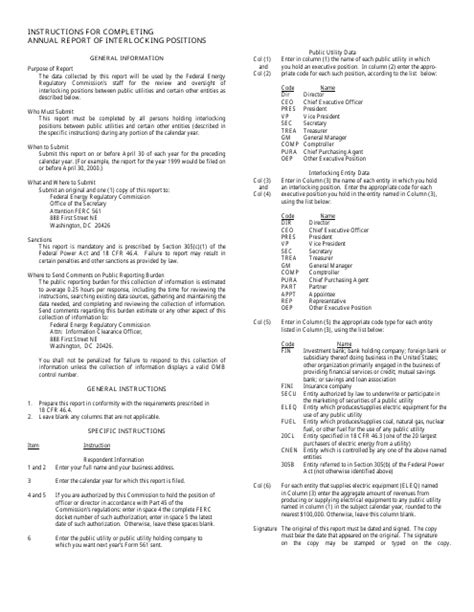

FERC Form 561 is an annual report that must be submitted by certain entities, including natural gas companies, oil pipelines, and electric utilities. The report is designed to provide FERC with information about the entity's operations, finances, and compliance with FERC regulations. The report is typically due on April 18th of each year, and it must be filed electronically through FERC's eFiling system.

Purpose of FERC Form 561

The primary purpose of FERC Form 561 is to provide FERC with the information it needs to ensure that entities are complying with its regulations. The report helps FERC to:

- Monitor entities' compliance with FERC regulations

- Identify potential issues or areas of non-compliance

- Track changes in the energy industry

- Make informed decisions about regulatory policies

Requirements for FERC Form 561

To ensure compliance with FERC regulations, entities must submit a complete and accurate FERC Form 561 report. The report requires entities to provide detailed information about their operations, finances, and compliance with FERC regulations. Some of the key requirements include:

- Entity information: Entities must provide basic information about themselves, including their name, address, and contact information.

- Operational data: Entities must provide data about their operations, including the volume of natural gas or oil transported, the amount of electricity generated or transmitted, and the number of customers served.

- Financial data: Entities must provide financial data, including their revenue, expenses, and net income.

- Compliance data: Entities must provide information about their compliance with FERC regulations, including any violations or notices of non-compliance.

Benefits of Compliance

Compliance with FERC Form 561 requirements is essential for entities that are subject to FERC regulation. Some of the benefits of compliance include:

- Avoidance of penalties: Failure to comply with FERC Form 561 requirements can result in significant penalties, including fines and reputational damage.

- Improved transparency: Compliance with FERC Form 561 helps to promote transparency and accountability in the energy industry.

- Enhanced credibility: Entities that comply with FERC Form 561 requirements demonstrate their commitment to regulatory compliance and enhance their credibility with stakeholders.

- Better decision-making: The data provided in FERC Form 561 helps FERC to make informed decisions about regulatory policies and ensures that entities are operating in a safe and reliable manner.

Best Practices for FERC Form 561 Compliance

To ensure compliance with FERC Form 561 requirements, entities should follow these best practices:

- Establish a compliance program: Entities should establish a compliance program to ensure that they are meeting FERC Form 561 requirements.

- Designate a compliance officer: Entities should designate a compliance officer to oversee the completion and submission of FERC Form 561.

- Conduct regular audits: Entities should conduct regular audits to ensure that their data is accurate and complete.

- Provide training: Entities should provide training to employees who are responsible for completing and submitting FERC Form 561.

Common Challenges and Solutions

Entities may face several challenges when completing and submitting FERC Form 561. Some common challenges and solutions include:

- Data collection: Entities may struggle to collect the data required for FERC Form 561. Solution: Establish a data collection process to ensure that all required data is collected and reported accurately.

- Timeliness: Entities may struggle to meet the April 18th deadline for submitting FERC Form 561. Solution: Establish a project plan to ensure that the report is completed and submitted on time.

- Accuracy: Entities may struggle to ensure that their data is accurate and complete. Solution: Conduct regular audits to ensure that data is accurate and complete.

Conclusion

FERC Form 561 is an essential part of the regulatory framework for the energy industry. Entities that are subject to FERC regulation must submit a complete and accurate FERC Form 561 report each year. By understanding the requirements and benefits of FERC Form 561, entities can ensure compliance and avoid penalties. By following best practices and overcoming common challenges, entities can ensure that their FERC Form 561 report is accurate, complete, and submitted on time.

Take the Next Step

If you are an entity that is subject to FERC regulation, it is essential that you understand the requirements and benefits of FERC Form 561. Take the next step by:

- Reviewing the FERC Form 561 instructions and requirements

- Establishing a compliance program to ensure that you are meeting FERC Form 561 requirements

- Designating a compliance officer to oversee the completion and submission of FERC Form 561

- Conducting regular audits to ensure that your data is accurate and complete

By taking these steps, you can ensure compliance with FERC Form 561 requirements and avoid penalties.

What is FERC Form 561?

+FERC Form 561 is an annual report that must be submitted by certain entities, including natural gas companies, oil pipelines, and electric utilities.

What is the purpose of FERC Form 561?

+The primary purpose of FERC Form 561 is to provide FERC with the information it needs to ensure that entities are complying with its regulations.

What are the benefits of compliance with FERC Form 561?

+Compliance with FERC Form 561 helps entities avoid penalties, improves transparency, enhances credibility, and promotes better decision-making.