The world of insurance can be complex and overwhelming, especially when it comes to managing certificates and policies. As a business owner or individual, it's essential to have the right insurance coverage to protect yourself and your assets. However, dealing with paperwork and administrative tasks can be a significant burden. That's where the Acord 24 form fillable comes in – a game-changer for simplifying your insurance certificates.

In this article, we'll delve into the world of insurance certificates, explore the benefits of using the Acord 24 form fillable, and provide a step-by-step guide on how to fill it out correctly.

Understanding Insurance Certificates

Insurance certificates are documents that provide proof of insurance coverage. They're often required by third parties, such as lenders, landlords, or government agencies, to verify that you have the necessary insurance coverage. Insurance certificates typically include information about the policyholder, the type of coverage, the policy period, and the limits of liability.

Types of Insurance Certificates

There are several types of insurance certificates, including:

- Certificate of Liability Insurance (COI)

- Certificate of Property Insurance

- Certificate of Workers' Compensation Insurance

Each type of certificate serves a specific purpose and provides proof of insurance coverage for a particular aspect of your business or personal life.

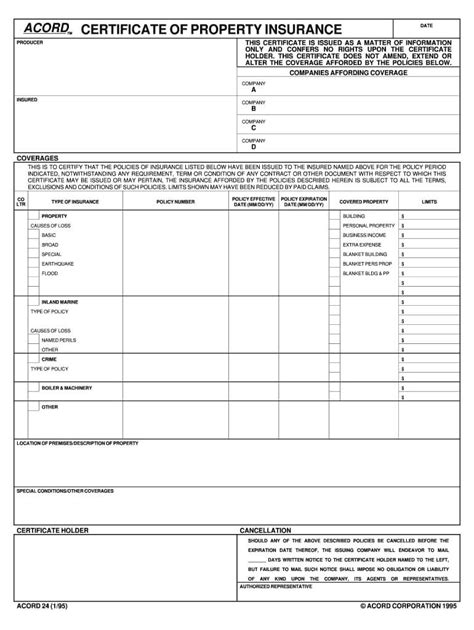

What is the Acord 24 Form Fillable?

The Acord 24 form fillable is a standardized form used to request and verify insurance coverage. It's a widely accepted format in the insurance industry, and its use can simplify the process of managing insurance certificates. The Acord 24 form fillable includes information about the policyholder, the type of coverage, the policy period, and the limits of liability.

Benefits of Using the Acord 24 Form Fillable

Using the Acord 24 form fillable can streamline your insurance management process in several ways:

- Simplifies the request and verification process

- Reduces errors and inconsistencies

- Provides a standardized format for insurance certificates

- Enhances communication between insurers, policyholders, and third parties

Filling Out the Acord 24 Form Fillable

Filling out the Acord 24 form fillable requires careful attention to detail. Here's a step-by-step guide to help you complete the form accurately:

- Policyholder Information: Enter the policyholder's name, address, and contact information.

- Policy Information: Provide the policy number, type of coverage, and policy period.

- Coverage Information: Specify the types of coverage, limits of liability, and deductibles.

- Certificate Holder Information: Enter the name and address of the certificate holder.

- Special Requirements: List any special requirements or conditions.

Common Mistakes to Avoid

When filling out the Acord 24 form fillable, be sure to avoid common mistakes such as:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Not including required attachments or documentation

Best Practices for Managing Insurance Certificates

Managing insurance certificates requires careful organization and attention to detail. Here are some best practices to keep in mind:

- Keep a centralized record of all insurance certificates

- Regularly review and update insurance coverage

- Use a standardized format for insurance certificates

- Ensure timely renewal of insurance policies

Technology Solutions for Insurance Management

Technology can play a significant role in streamlining insurance management. Consider using:

- Insurance management software

- Online platforms for certificate issuance and verification

- Automated reminders for policy renewals and updates

By implementing these best practices and leveraging technology solutions, you can simplify your insurance management process and reduce administrative burdens.

Conclusion

The Acord 24 form fillable is a powerful tool for simplifying your insurance certificates. By understanding the benefits and using the form correctly, you can streamline your insurance management process and reduce errors. Remember to avoid common mistakes, follow best practices, and leverage technology solutions to take your insurance management to the next level.

We invite you to share your experiences and tips for managing insurance certificates in the comments below. Don't forget to share this article with your colleagues and friends who may benefit from simplifying their insurance management process.

What is the purpose of an insurance certificate?

+Insurance certificates provide proof of insurance coverage and are often required by third parties to verify that you have the necessary insurance coverage.

What is the Acord 24 form fillable?

+The Acord 24 form fillable is a standardized form used to request and verify insurance coverage. It's a widely accepted format in the insurance industry.

How can I avoid common mistakes when filling out the Acord 24 form fillable?

+Be sure to provide complete and accurate information, sign and date the form, and include required attachments or documentation.