The ever-changing landscape of international taxation has brought about the introduction of new forms and schedules to ensure compliance with tax laws. One such addition is the Form 8992, Schedule B, which deals with Global Intangible Low-Taxed Income (GILTI). In this article, we will delve into the intricacies of Form 8992, Schedule B, and explore its significance in the realm of international taxation.

Understanding Form 8992 and Schedule B

Form 8992 is a relatively new addition to the tax forms family, introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017. The primary purpose of this form is to report Global Intangible Low-Taxed Income (GILTI), which is a crucial aspect of the TCJA's international tax provisions. Schedule B, in particular, focuses on the calculation of GILTI and the related income inclusions.

What is GILTI?

GILTI is a type of income that is subject to taxation under the TCJA. It refers to the intangible income earned by foreign subsidiaries of US-based companies, which is not subject to a minimum level of taxation. The TCJA aims to ensure that such income is taxed at a minimum rate, thereby preventing the shifting of profits to low-tax jurisdictions.

Calculating GILTI

Calculating GILTI involves a series of steps, which are outlined in Form 8992, Schedule B. The following are the key components of the GILTI calculation:

- Net CFC Tested Income: This is the starting point for the GILTI calculation. It includes the net income of the controlled foreign corporation (CFC), minus certain deductions and adjustments.

- QBAI: Qualified Business Asset Investment (QBAI) refers to the average of the quarterly values of the CFC's qualified business assets, such as tangible property and certain intangible assets.

- Foreign Tangible Assets: This includes the average of the quarterly values of the CFC's foreign tangible assets.

- GILTI Tax: The GILTI tax is calculated as the net CFC tested income, minus the deemed tangible income return (DTIR), which is based on the QBAI and foreign tangible assets.

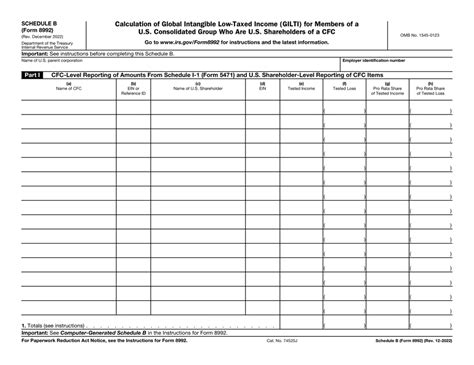

Components of Schedule B

Schedule B of Form 8992 is divided into several parts, each dealing with a specific aspect of the GILTI calculation. The components of Schedule B include:

- Part I: Net CFC Tested Income: This part requires the calculation of the net CFC tested income, which is the starting point for the GILTI calculation.

- Part II: QBAI and Foreign Tangible Assets: This part involves the calculation of QBAI and foreign tangible assets, which are used to determine the DTIR.

- Part III: GILTI Tax: This part requires the calculation of the GILTI tax, which is the net CFC tested income, minus the DTIR.

Importance of Form 8992, Schedule B

Form 8992, Schedule B plays a crucial role in ensuring compliance with the TCJA's international tax provisions. The GILTI calculation is a complex process, and Schedule B provides a structured framework for taxpayers to report their GILTI income. By accurately completing Schedule B, taxpayers can ensure that they are meeting their tax obligations and avoiding potential penalties.

Penalties for Non-Compliance

Failure to accurately complete Form 8992, Schedule B can result in significant penalties. The IRS may impose penalties for:

- Failure to file: Failure to file Form 8992, Schedule B can result in a penalty of up to $10,000.

- Failure to report: Failure to accurately report GILTI income can result in a penalty of up to 40% of the underreported tax.

Best Practices for Completing Form 8992, Schedule B

To ensure accurate completion of Form 8992, Schedule B, taxpayers should follow these best practices:

- Seek professional advice: Consult with a tax professional or attorney to ensure that you understand the GILTI calculation and the requirements of Form 8992, Schedule B.

- Maintain accurate records: Maintain accurate records of the CFC's financial statements, including income statements and balance sheets.

- Review and verify: Review and verify the GILTI calculation to ensure accuracy.

Conclusion

Form 8992, Schedule B is a critical component of the TCJA's international tax provisions. By understanding the GILTI calculation and accurately completing Schedule B, taxpayers can ensure compliance with tax laws and avoid potential penalties. As the international tax landscape continues to evolve, it is essential to stay informed and up-to-date on the latest developments.

What is GILTI?

+GILTI is a type of income that is subject to taxation under the TCJA. It refers to the intangible income earned by foreign subsidiaries of US-based companies, which is not subject to a minimum level of taxation.

What is the purpose of Form 8992, Schedule B?

+The primary purpose of Form 8992, Schedule B is to report Global Intangible Low-Taxed Income (GILTI) and the related income inclusions.

What are the penalties for non-compliance with Form 8992, Schedule B?

+Failure to accurately complete Form 8992, Schedule B can result in significant penalties, including a penalty of up to $10,000 for failure to file and a penalty of up to 40% of the underreported tax for failure to report.