Identity theft and credit fraud have become increasingly common in today's digital age. With the rise of online transactions and data breaches, it's more important than ever to protect your personal and financial information. One effective way to safeguard your credit is by placing a security freeze on your credit report. In this article, we'll explore the Corelogic security freeze form and provide a comprehensive guide on how to protect your credit today.

What is a Security Freeze?

A security freeze, also known as a credit freeze, is a tool that restricts access to your credit report. When a security freeze is in place, creditors and lenders are unable to access your credit report, making it more difficult for identity thieves to open new accounts in your name. This added layer of protection can provide peace of mind and help prevent credit fraud.

How Does a Security Freeze Work?

When you place a security freeze on your credit report, you'll be required to provide personal identification and authentication information. This ensures that only authorized individuals can access your credit report. Once the freeze is in place, creditors and lenders will be unable to access your credit report, and any new account requests will be declined.

Benefits of a Security Freeze

There are several benefits to placing a security freeze on your credit report, including:

- Prevention of identity theft and credit fraud

- Reduced risk of new accounts being opened in your name

- Protection of your personal and financial information

- Ability to control who can access your credit report

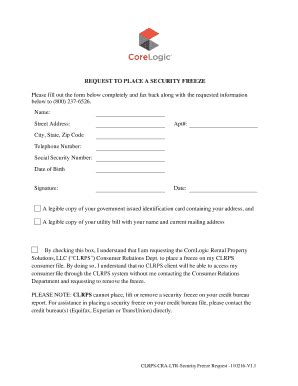

Corelogic Security Freeze Form

The Corelogic security freeze form is a simple and convenient way to place a security freeze on your credit report. To complete the form, you'll need to provide personal identification and authentication information, including:

- Your name and address

- Your date of birth and Social Security number

- A valid government-issued ID

- Proof of address

Once you've completed the form, you can submit it to Corelogic for processing.

How to Place a Security Freeze

To place a security freeze on your credit report, follow these steps:

- Visit the Corelogic website and download the security freeze form

- Complete the form and provide required identification and authentication information

- Submit the form to Corelogic for processing

- Receive confirmation of the security freeze

Temporary Lift or Removal of a Security Freeze

If you need to temporarily lift or remove a security freeze, you can do so by contacting Corelogic and providing the required information. This may be necessary if you're applying for a new credit account or loan.

Conclusion

In today's digital age, protecting your credit is more important than ever. A security freeze is a simple and effective way to safeguard your credit report and prevent identity theft and credit fraud. By completing the Corelogic security freeze form and placing a security freeze on your credit report, you can rest assured that your personal and financial information is protected. Don't wait until it's too late – take control of your credit today and place a security freeze on your credit report.

What is the difference between a security freeze and a credit lock?

+A security freeze and a credit lock are both tools used to restrict access to your credit report. However, a security freeze is a more permanent solution that requires a PIN or password to lift, while a credit lock is a temporary solution that can be easily lifted online or through a mobile app.

How long does a security freeze last?

+A security freeze typically lasts until you request to have it lifted or removed. In some states, a security freeze may expire after a certain period, usually 7 years.

Can I place a security freeze on my child's credit report?

+Yes, you can place a security freeze on your child's credit report. This is a great way to protect their credit from identity theft and credit fraud.