Tax season is here, and for Massachusetts residents, it's time to navigate the MA Tax Form 1 instructions. The Massachusetts Form 1 is the state's individual income tax return, and understanding its intricacies can save you time, money, and stress. In this comprehensive guide, we'll walk you through the step-by-step process of completing the MA Tax Form 1 instructions, ensuring you're well-prepared for the tax filing season.

As you begin the tax preparation process, it's essential to gather all necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if applicable)

- Dependents' Social Security numbers or ITINs

- W-2 forms from your employer(s)

- 1099 forms for freelance work, self-employment, or other income sources

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax-related documents

Understanding the MA Tax Form 1

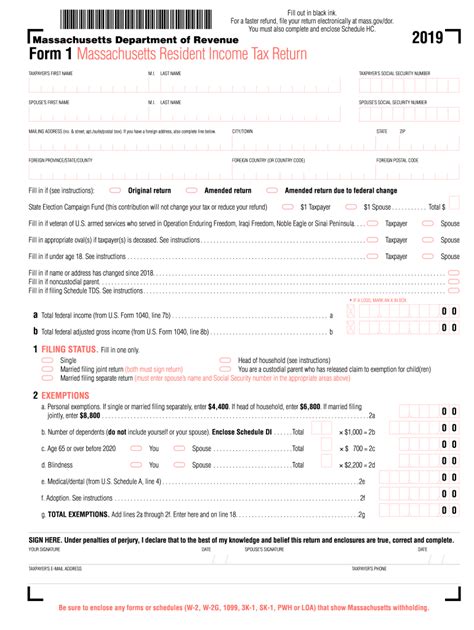

The Massachusetts Form 1 is divided into several sections, each addressing a specific aspect of your income tax return.

Section 1: Personal Information

In this section, you'll provide basic information, including your name, address, Social Security number, and filing status.

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Filing Status and Dependents

Your filing status determines your tax rates and eligibility for certain deductions. If you're claiming dependents, you'll need to provide their Social Security numbers or ITINs.

Section 2: Income

This section is where you'll report your income from various sources, including:

- W-2 wages

- 1099 income

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Unemployment benefits

Reporting Income from Multiple Sources

If you have income from multiple sources, such as a part-time job or freelance work, you'll need to report each source separately.

Section 3: Deductions and Credits

In this section, you'll claim deductions and credits that reduce your tax liability.

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable donations

- Medical expenses

- Earned Income Tax Credit (EITC)

Itemized Deductions vs. Standard Deduction

You can choose to itemize deductions or claim the standard deduction. Itemizing may be beneficial if your deductions exceed the standard deduction amount.

Section 4: Tax Computation

Here, you'll calculate your total tax liability based on your income and deductions.

- Taxable income

- Tax credits

- Tax payments and withholding

Understanding Tax Credits

Tax credits, such as the EITC, can significantly reduce your tax liability. Be sure to review the eligibility criteria and application process.

Section 5: Payment and Filing

In this final section, you'll report any tax payments, including withholding, and file your return.

- Total tax liability

- Payment due or refund

- Filing status and signature

Filing Options and Payment Methods

You can e-file your return or submit a paper return. Payment options include online payment, check, or money order.

Additional Tips and Reminders

- Ensure accuracy: Double-check your calculations and information to avoid errors.

- Meet the deadline: File your return by the specified deadline to avoid penalties.

- Seek professional help: Consult a tax professional if you're unsure about any aspect of the process.

By following these step-by-step instructions and understanding the MA Tax Form 1, you'll be well-equipped to navigate the tax filing process with confidence.

Get Help and Resources

If you need additional guidance or resources, consider the following:

- Massachusetts Department of Revenue: Visit the official website for tax forms, instructions, and FAQs.

- Tax professionals: Consult a certified public accountant (CPA) or enrolled agent (EA) for personalized assistance.

- Tax software: Utilize tax preparation software, such as TurboTax or H&R Block, for guidance and support.

Final Thoughts

Completing the MA Tax Form 1 instructions requires attention to detail and a solid understanding of the tax filing process. By following this step-by-step guide and seeking help when needed, you'll be able to navigate the process with ease and ensure a successful tax filing experience.

Share your thoughts and experiences with the MA Tax Form 1 instructions in the comments below. Have you encountered any challenges or found any helpful resources? Let's start the conversation!

What is the deadline for filing the Massachusetts Form 1?

+The deadline for filing the Massachusetts Form 1 is typically April 15th of each year. However, if you need an extension, you can file Form M-4868 by the original deadline to receive an automatic six-month extension.

Can I e-file my Massachusetts Form 1?

+Yes, you can e-file your Massachusetts Form 1 through the Massachusetts Department of Revenue's website or through tax preparation software like TurboTax or H&R Block.

What is the penalty for late filing or payment of the Massachusetts Form 1?

+The penalty for late filing or payment of the Massachusetts Form 1 is 1% of the unpaid tax per month or part of a month, up to a maximum of 25%. Additionally, you may be subject to interest charges on the unpaid amount.