The DD Form 1300 is a crucial document used by the US Department of Defense (DoD) to report casualty information and determine the total award amount for the Combat-Related Special Compensation (CRSC) program. The CRSC program provides tax-free compensation to eligible retired veterans who have combat-related injuries or diseases.

Understanding the DD Form 1300 is essential for veterans who are seeking compensation for their combat-related injuries or diseases. In this article, we will delve into the details of the DD Form 1300, its purpose, and how it is used to determine the total award amount for CRSC.

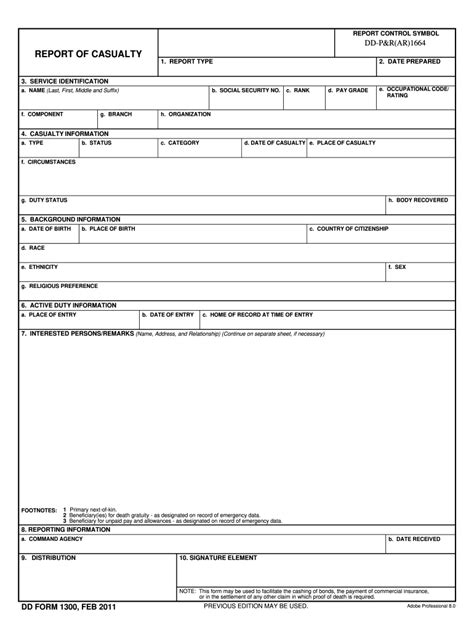

What is the DD Form 1300?

The DD Form 1300, also known as the Report of Casualty, is a document used by the DoD to report information about a service member's casualty status. The form is completed by the service member's unit or a medical professional and provides details about the nature of the injury or disease, the circumstances surrounding the incident, and the resulting disability.

Information Contained in the DD Form 1300

The DD Form 1300 contains the following information:

- Service member's name and Social Security number

- Date and location of the incident

- Type of injury or disease

- Severity of the injury or disease

- Medical treatment received

- Current duty status

- Casualty classification (e.g., wounded in action, injured in a training exercise)

Purpose of the DD Form 1300

The primary purpose of the DD Form 1300 is to provide a standardized document for reporting casualty information. The form is used to:

- Document injuries or diseases resulting from combat or other military-related activities

- Determine eligibility for CRSC and other benefits

- Calculate the total award amount for CRSC

- Provide information for medical evaluation and treatment

Eligibility for CRSC

To be eligible for CRSC, a veteran must meet the following criteria:

- Be a retired veteran with a combat-related injury or disease

- Have a combat-related disability rating of 10% or higher

- Be receiving military retired pay

- Not be receiving VA disability compensation for the same condition

Calculating the Total Award Amount for CRSC

The total award amount for CRSC is calculated based on the severity of the combat-related injury or disease, as documented on the DD Form 1300. The award amount is tax-free and is paid in addition to military retired pay.

The calculation process involves the following steps:

- Determine the veteran's combat-related disability rating

- Calculate the veteran's monthly retired pay

- Calculate the veteran's CRSC award amount based on the disability rating and retired pay

CRSC Award Amount Chart

The CRSC award amount chart is used to determine the award amount based on the disability rating and retired pay. The chart is as follows:

| Disability Rating | Retired Pay | CRSC Award Amount |

|---|---|---|

| 10% | $1,000 | $100 |

| 20% | $2,000 | $200 |

| 30% | $3,000 | $300 |

| 40% | $4,000 | $400 |

| 50% | $5,000 | $500 |

| 60% | $6,000 | $600 |

| 70% | $7,000 | $700 |

| 80% | $8,000 | $800 |

| 90% | $9,000 | $900 |

| 100% | $10,000 | $1,000 |

Conclusion

In conclusion, the DD Form 1300 is a critical document used to report casualty information and determine the total award amount for CRSC. Understanding the purpose and contents of the form is essential for veterans seeking compensation for their combat-related injuries or diseases. By following the calculation process and using the CRSC award amount chart, veterans can determine their eligibility and award amount for CRSC.

What is the purpose of the DD Form 1300?

+The DD Form 1300 is used to report casualty information and determine the total award amount for CRSC.

How is the total award amount for CRSC calculated?

+The total award amount for CRSC is calculated based on the severity of the combat-related injury or disease, as documented on the DD Form 1300.

What is the CRSC award amount chart used for?

+The CRSC award amount chart is used to determine the award amount based on the disability rating and retired pay.