When it comes to dealing with the complexities of tax forms, accuracy and ease of use are top priorities. The IRS Form 3115, Application for Change in Accounting Method, is no exception. This form is used by businesses to request a change in their accounting method, which can have significant implications for their tax obligations. In this article, we will explore how to file Form 3115 with TurboTax, one of the most popular tax preparation software programs, easily and accurately.

Understanding Form 3115

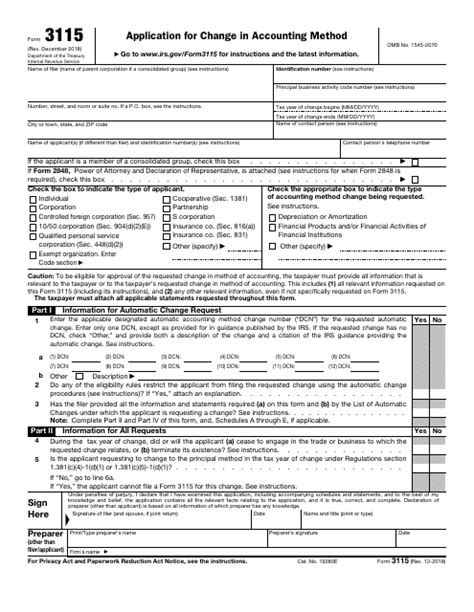

Before we dive into the process of filing Form 3115 with TurboTax, it's essential to understand the purpose and requirements of the form. The IRS requires businesses to use a consistent accounting method, which can be either the cash method or the accrual method. However, businesses may need to change their accounting method due to various reasons, such as a change in business operations or a desire to take advantage of new tax laws.

Form 3115 is used to request permission from the IRS to change the accounting method. The form requires businesses to provide detailed information about their current and proposed accounting methods, including the reasons for the change and the impact on their tax obligations.

Preparing to File Form 3115 with TurboTax

To file Form 3115 with TurboTax, you will need to have the following information and documents ready:

- Your business's current and proposed accounting methods

- The reasons for the change in accounting method

- The impact of the change on your tax obligations

- Your business's financial statements, including balance sheets and income statements

- Any supporting documentation, such as receipts and invoices

It's also essential to ensure that you have the correct version of TurboTax, as different versions may have varying levels of support for Form 3115.

Step-by-Step Guide to Filing Form 3115 with TurboTax

Once you have gathered all the necessary information and documents, you can follow these steps to file Form 3115 with TurboTax:

- Log in to your TurboTax account: Go to the TurboTax website and log in to your account. If you don't have an account, create one and follow the prompts to set up your profile.

- Select the correct tax year: Choose the tax year for which you are filing Form 3115.

- Choose the correct form: Select Form 3115 from the list of available forms.

- Enter your business information: Enter your business's name, address, and Employer Identification Number (EIN).

- Select the current and proposed accounting methods: Choose the current and proposed accounting methods from the drop-down menus.

- Enter the reasons for the change: Provide a detailed explanation of the reasons for the change in accounting method.

- Enter the impact on tax obligations: Estimate the impact of the change on your tax obligations, including any additional taxes owed or refunds due.

- Attach supporting documentation: Upload any supporting documentation, such as financial statements and receipts.

- Review and submit: Review your form carefully and submit it to the IRS through TurboTax.

Tips for Filing Form 3115 with TurboTax

To ensure accuracy and ease of use when filing Form 3115 with TurboTax, follow these tips:

- Use the correct version of TurboTax: Ensure that you have the correct version of TurboTax, as different versions may have varying levels of support for Form 3115.

- Gather all necessary information and documents: Make sure you have all the necessary information and documents ready before starting the filing process.

- Take your time: Don't rush through the filing process. Take your time to ensure accuracy and completeness.

- Seek professional help: If you are unsure about any aspect of the filing process, consider seeking professional help from a tax expert or accountant.

Benefits of Filing Form 3115 with TurboTax

Filing Form 3115 with TurboTax offers several benefits, including:

- Ease of use: TurboTax provides a user-friendly interface that guides you through the filing process.

- Accuracy: TurboTax's built-in error checking and validation features ensure accuracy and completeness.

- Speed: TurboTax allows you to file Form 3115 quickly and efficiently, saving you time and effort.

- Support: TurboTax offers support from tax experts and accountants, providing peace of mind and confidence in the filing process.

Common Mistakes to Avoid When Filing Form 3115 with TurboTax

To avoid common mistakes when filing Form 3115 with TurboTax, keep the following in mind:

- Inaccurate or incomplete information: Ensure that you provide accurate and complete information, including your business's name, address, and EIN.

- Incorrect accounting methods: Choose the correct current and proposed accounting methods from the drop-down menus.

- Insufficient supporting documentation: Upload all necessary supporting documentation, including financial statements and receipts.

- Failure to review and submit: Review your form carefully and submit it to the IRS through TurboTax.

Conclusion

Filing Form 3115 with TurboTax can be a straightforward process if you have the correct information and documents ready. By following the step-by-step guide and tips outlined in this article, you can ensure accuracy and ease of use when filing Form 3115. Remember to avoid common mistakes and seek professional help if you are unsure about any aspect of the filing process.

Call to Action

If you are ready to file Form 3115 with TurboTax, click the link below to get started. If you have any questions or need further assistance, don't hesitate to reach out to our team of tax experts.

FAQ Section

What is Form 3115?

+Form 3115 is the Application for Change in Accounting Method, used by businesses to request a change in their accounting method.

Why do I need to file Form 3115?

+You need to file Form 3115 to request permission from the IRS to change your accounting method, which can have significant implications for your tax obligations.

How do I file Form 3115 with TurboTax?

+Follow the step-by-step guide outlined in this article to file Form 3115 with TurboTax.