As a non-profit organization, filing Form 990 with the IRS is a crucial step in maintaining tax-exempt status. One of the most important schedules in the Form 990 series is Schedule D, which provides detailed information about an organization's investments, land, buildings, and other assets. In this article, we will delve into the instructions for Form 990 Schedule D, providing a step-by-step guide to help non-profits accurately complete this critical schedule.

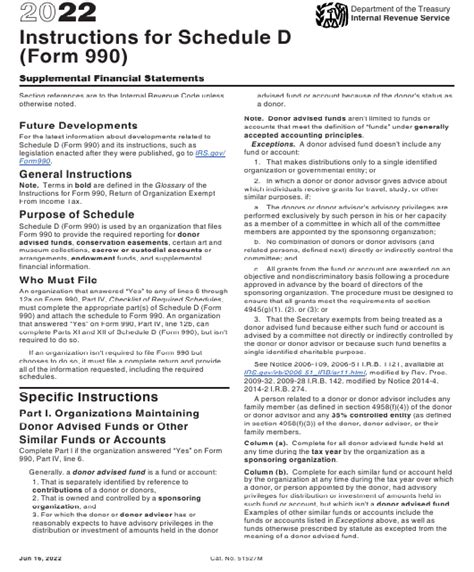

Understanding the Purpose of Schedule D

Before we dive into the instructions, it's essential to understand the purpose of Schedule D. This schedule is designed to provide the IRS with a comprehensive picture of an organization's assets, including investments, real estate, and other significant holdings. By reporting this information, non-profits demonstrate transparency and accountability, which are essential for maintaining public trust and tax-exempt status.

Step 1: Gather Required Information

To complete Schedule D, you'll need to gather information from various sources within your organization. This includes:

- Investment records, such as brokerage statements and portfolio reports

- Real estate documents, including property deeds and appraisals

- Information about other significant assets, such as artwork, collectibles, or intellectual property

- Financial statements, including balance sheets and income statements

Step 2: Complete Part I - Investments

Part I of Schedule D focuses on investments, including:

- Stocks and bonds

- Mutual funds

- Real estate investment trusts (REITs)

- Other investment vehicles

For each investment, report the following information:

- Description of the investment

- Fair market value (FMV) at the beginning of the tax year

- FMV at the end of the tax year

- Gross income from the investment

- Expenses related to the investment

Step 3: Complete Part II - Land, Buildings, and Equipment

Part II of Schedule D focuses on land, buildings, and equipment, including:

- Real estate properties

- Buildings and other structures

- Equipment and machinery

For each asset, report the following information:

- Description of the asset

- FMV at the beginning of the tax year

- FMV at the end of the tax year

- Depreciation method used

- Accumulated depreciation

Step 4: Complete Part III - Other Assets

Part III of Schedule D focuses on other significant assets, including:

- Artwork and collectibles

- Intellectual property

- Other unique assets

For each asset, report the following information:

- Description of the asset

- FMV at the beginning of the tax year

- FMV at the end of the tax year

- Gross income from the asset

- Expenses related to the asset

Step 5: Complete Part IV - Debt Financing

Part IV of Schedule D focuses on debt financing, including:

- Mortgages and other debt obligations

- Lines of credit

For each debt financing arrangement, report the following information:

- Description of the debt

- Outstanding balance at the beginning of the tax year

- Outstanding balance at the end of the tax year

- Interest paid during the tax year

Step 6: Review and Certify

Once you've completed Schedule D, review the information carefully to ensure accuracy and completeness. Certify that the information is true and accurate by signing and dating the schedule.

Tips and Reminders

- Use Schedule D to report all significant assets, including investments, real estate, and other holdings.

- Ensure accuracy and completeness when reporting asset values and financial information.

- Use the correct depreciation method for assets reported in Part II.

- Review and certify the schedule carefully to avoid errors or inaccuracies.

By following these step-by-step instructions, non-profits can accurately complete Form 990 Schedule D and demonstrate transparency and accountability to the IRS and the public.

Final Thoughts

Completing Form 990 Schedule D requires attention to detail and a thorough understanding of an organization's assets and financial information. By following these instructions and tips, non-profits can ensure accuracy and completeness when reporting their investments, land, buildings, and other significant assets. Remember to review and certify the schedule carefully to avoid errors or inaccuracies.

FAQ Section

What is the purpose of Form 990 Schedule D?

+Form 990 Schedule D provides detailed information about an organization's investments, land, buildings, and other assets.

What types of investments should be reported on Schedule D?

+Report all significant investments, including stocks, bonds, mutual funds, REITs, and other investment vehicles.

How do I determine the fair market value of assets reported on Schedule D?

+Use appraisal reports, brokerage statements, or other reliable sources to determine the fair market value of assets.

We hope this article has provided valuable insights and guidance on completing Form 990 Schedule D. If you have any further questions or concerns, please don't hesitate to reach out.