As an Amazon Flex driver, you're considered an independent contractor, not an employee. This means you're responsible for reporting your own income and expenses on your tax return. One of the key documents you'll need to complete this process is the Amazon Flex 1099 form. In this article, we'll break down everything you need to know about the Amazon Flex 1099 form, including what it is, how to access it, and how to use it to file your taxes.

What is the Amazon Flex 1099 Form?

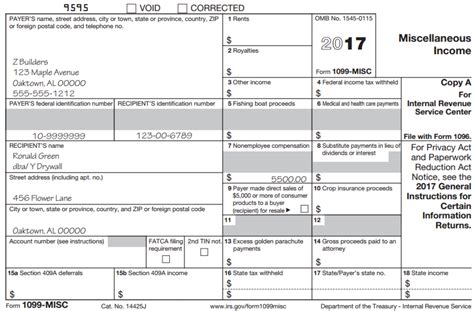

The Amazon Flex 1099 form, also known as the 1099-MISC form, is a document that reports the amount of money you earned as an independent contractor for Amazon Flex. This form is required by the Internal Revenue Service (IRS) and is used to report miscellaneous income, such as freelance work or independent contracting.

As an Amazon Flex driver, you'll receive a 1099 form from Amazon if you earned more than $600 in a calendar year. This form will show the total amount of money you earned from Amazon Flex, as well as any federal income tax withheld.

Why Do I Need the Amazon Flex 1099 Form?

The Amazon Flex 1099 form is an essential document for filing your taxes as an independent contractor. You'll need this form to report your income from Amazon Flex on your tax return, which is typically Form 1040. The 1099 form will help you calculate your net earnings from self-employment, which is the amount of money you earned from Amazon Flex minus any business expenses you incurred.

How to Access Your Amazon Flex 1099 Form

Amazon will typically mail your 1099 form to you by January 31st of each year. However, you can also access your 1099 form online through the Amazon Flex website. Here's how:

- Log in to your Amazon Flex account

- Click on the "Tax Documents" tab

- Select the tax year for which you want to view your 1099 form

- Click on the "View 1099 Form" button

You can also contact Amazon Flex support if you have any issues accessing your 1099 form.

What Information is Included on the Amazon Flex 1099 Form?

The Amazon Flex 1099 form will include the following information:

- Your name and address

- Amazon's name and address

- The amount of money you earned from Amazon Flex in the calendar year

- Any federal income tax withheld

- Any state or local taxes withheld

How to Use the Amazon Flex 1099 Form to File Your Taxes

To file your taxes using the Amazon Flex 1099 form, follow these steps:

- Gather all your tax documents, including your 1099 form, W-2 forms, and any other relevant documents

- Complete Form 1040, which is the standard form for personal income tax returns

- Report your income from Amazon Flex on Schedule C (Form 1040), which is the form for self-employment income

- Calculate your net earnings from self-employment, which is the amount of money you earned from Amazon Flex minus any business expenses you incurred

- Report your net earnings from self-employment on Schedule SE (Form 1040), which is the form for self-employment tax

Business Expenses for Amazon Flex Drivers

As an Amazon Flex driver, you may be eligible to deduct business expenses on your tax return. Some common business expenses for Amazon Flex drivers include:

- Gasoline and fuel expenses

- Vehicle maintenance and repair expenses

- Insurance expenses

- Business use of your home expenses

Keep accurate records of your business expenses throughout the year, as you'll need these records to complete your tax return.

Tips for Filing Your Taxes as an Amazon Flex Driver

Here are some tips for filing your taxes as an Amazon Flex driver:

- Keep accurate records of your income and expenses throughout the year

- Consult with a tax professional if you're unsure about how to file your taxes

- Take advantage of business expense deductions to reduce your taxable income

- File your taxes on time to avoid penalties and interest

Frequently Asked Questions

Here are some frequently asked questions about the Amazon Flex 1099 form:

- Q: What is the deadline for filing my taxes as an Amazon Flex driver? A: The deadline for filing your taxes is typically April 15th of each year.

- Q: Do I need to file a tax return if I earned less than $600 from Amazon Flex? A: Yes, you still need to file a tax return, even if you earned less than $600 from Amazon Flex.

- Q: Can I deduct business expenses on my tax return? A: Yes, you can deduct business expenses on your tax return, as long as you have accurate records to support your deductions.

What is the Amazon Flex 1099 form?

+The Amazon Flex 1099 form is a document that reports the amount of money you earned as an independent contractor for Amazon Flex.

How do I access my Amazon Flex 1099 form?

+You can access your Amazon Flex 1099 form online through the Amazon Flex website or by contacting Amazon Flex support.

What information is included on the Amazon Flex 1099 form?

+The Amazon Flex 1099 form includes your name and address, Amazon's name and address, the amount of money you earned from Amazon Flex, and any federal income tax withheld.

We hope this guide has been helpful in explaining the Amazon Flex 1099 form and how to use it to file your taxes. Remember to keep accurate records of your income and expenses throughout the year, and consult with a tax professional if you're unsure about how to file your taxes.