The tax code can be a complex and daunting beast, especially when it comes to passive activity loss limitations. Form 8582 is a crucial document for taxpayers who need to report losses from passive activities, such as rental properties or investments. In this article, we will delve into the world of Form 8582, exploring its importance, the types of passive activities it covers, and the step-by-step process for completing it.

Understanding Passive Activity Loss Limitations

Passive activity loss limitations are rules set by the Internal Revenue Service (IRS) to limit the amount of losses that can be deducted from passive activities. These rules are designed to prevent taxpayers from using losses from passive activities to offset income from other sources. The IRS defines a passive activity as any activity in which the taxpayer does not "materially participate."

Material participation is defined as regular, continuous, and substantial involvement in the activity. Examples of passive activities include:

- Rental properties, such as apartments or commercial buildings

- Investments in limited partnerships or limited liability companies (LLCs)

- Royalty income from intellectual property, such as patents or copyrights

- Income from oil and gas wells or other natural resources

Types of Passive Activities Covered by Form 8582

Form 8582 covers two main types of passive activities:

- Rental Real Estate Activities: This includes losses from rental properties, such as apartments, commercial buildings, or vacation homes.

- Non-Rental Real Estate Activities: This includes losses from other types of passive activities, such as investments in limited partnerships or LLCs, royalty income, or income from oil and gas wells.

Rental Real Estate Activities

Rental real estate activities are subject to special rules under the tax code. If you are a real estate professional, you may be able to deduct losses from rental properties against your ordinary income. However, if you are not a real estate professional, your losses may be subject to the passive activity loss limitations.

To qualify as a real estate professional, you must meet certain requirements, such as:

- Spending at least 750 hours per year on real estate activities

- Meeting the material participation test for each rental property

- Keeping accurate records of your real estate activities

Non-Rental Real Estate Activities

Non-rental real estate activities are subject to the passive activity loss limitations. This means that losses from these activities can only be deducted against income from other passive activities.

Examples of non-rental real estate activities include:

- Investments in limited partnerships or LLCs

- Royalty income from intellectual property

- Income from oil and gas wells or other natural resources

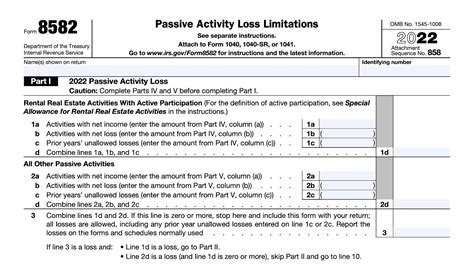

Completing Form 8582

Form 8582 is used to report losses from passive activities and to calculate the amount of losses that can be deducted against ordinary income. Here's a step-by-step guide to completing Form 8582:

- Identify Your Passive Activities: List all of your passive activities, including rental properties, investments, and royalty income.

- Calculate Your Losses: Calculate the losses from each passive activity. You can use Schedule K-1 (Form 1065) or Schedule K (Form 1120S) to report losses from partnerships or S corporations.

- Complete Part I: Complete Part I of Form 8582, which asks for information about your passive activities, such as the type of activity, the amount of losses, and the amount of income.

- Complete Part II: Complete Part II of Form 8582, which asks for information about your non-passive income, such as wages, salaries, and tips.

- Calculate Your Passive Activity Loss Limitations: Calculate your passive activity loss limitations by completing the worksheets in Part III of Form 8582.

- Report Your Losses: Report your losses from passive activities on Schedule 1 (Form 1040) or Schedule C (Form 1040).

FAQs About Form 8582

Q: What is Form 8582 used for? A: Form 8582 is used to report losses from passive activities and to calculate the amount of losses that can be deducted against ordinary income.

Q: What types of passive activities are covered by Form 8582? A: Form 8582 covers two main types of passive activities: rental real estate activities and non-rental real estate activities.

Q: How do I qualify as a real estate professional? A: To qualify as a real estate professional, you must meet certain requirements, such as spending at least 750 hours per year on real estate activities, meeting the material participation test for each rental property, and keeping accurate records of your real estate activities.

What is the purpose of Form 8582?

+Form 8582 is used to report losses from passive activities and to calculate the amount of losses that can be deducted against ordinary income.

What types of passive activities are covered by Form 8582?

+Form 8582 covers two main types of passive activities: rental real estate activities and non-rental real estate activities.

How do I qualify as a real estate professional?

+To qualify as a real estate professional, you must meet certain requirements, such as spending at least 750 hours per year on real estate activities, meeting the material participation test for each rental property, and keeping accurate records of your real estate activities.

We hope this article has provided you with a comprehensive guide to Form 8582 and passive activity loss limitations. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.