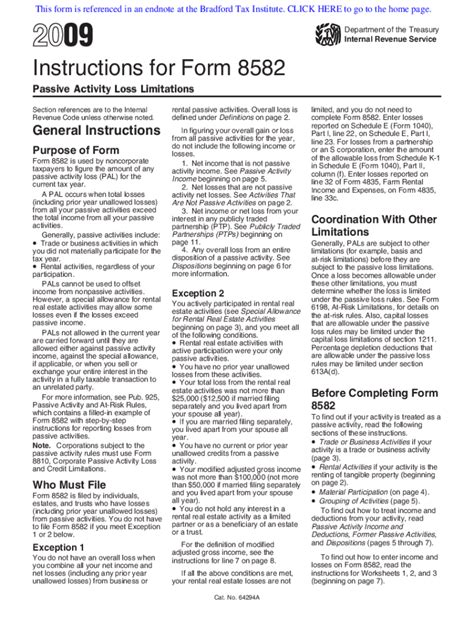

The Form 8582 is a crucial document for taxpayers who have rental real estate activities or other passive income sources. The form is used to calculate the passive loss limitations, which can significantly impact an individual's tax liability. In this article, we will provide a comprehensive guide to Form 8582 instructions, helping you navigate the complexities of passive loss limitations.

Understanding Passive Loss Limitations

Before diving into the Form 8582 instructions, it's essential to understand the concept of passive loss limitations. Passive losses are expenses incurred from rental real estate activities or other businesses in which the taxpayer does not actively participate. These losses can be used to offset passive income, but they are subject to certain limitations.

The passive loss limitation rules were enacted to prevent taxpayers from deducting excessive losses from passive activities, which could otherwise reduce their tax liability. The rules aim to ensure that taxpayers do not use passive losses to offset ordinary income, such as wages or interest income.

Who Needs to File Form 8582?

Form 8582 is required for taxpayers who have passive losses from rental real estate activities or other businesses. This includes:

- Rental real estate activities, such as renting out a primary residence or a vacation home

- Limited partnerships or limited liability companies (LLCs)

- S corporations

- Trusts and estates

If you have passive income or losses, you will need to complete Form 8582 to calculate the passive loss limitations.

Form 8582 Instructions: Step-by-Step Guide

To complete Form 8582, follow these steps:

Step 1: Gather Information

Before starting the form, gather all necessary information, including:

- Rental income and expenses

- Passive income from other sources, such as limited partnerships or S corporations

- Ordinary income, such as wages or interest income

Step 2: Determine Passive Income and Losses

Determine the total passive income and losses from all sources. This includes rental income and expenses, as well as income and losses from other passive activities.

Step 3: Calculate Passive Loss Limitations

Calculate the passive loss limitations by completing the following sections:

- Section 1: Passive income and losses

- Section 2: Net passive income

- Section 3: Passive loss limitations

Step 4: Complete Schedule 1

Complete Schedule 1 to calculate the total passive loss limitations. This schedule requires you to list all passive activities, including rental real estate activities and other businesses.

Step 5: Complete Schedule 2

Complete Schedule 2 to calculate the net passive income. This schedule requires you to list all passive income sources, including rental income and income from other passive activities.

Step 6: Complete Schedule 3

Complete Schedule 3 to calculate the passive loss limitations. This schedule requires you to list all passive losses, including rental losses and losses from other passive activities.

Form 8582 Instructions: Special Rules and Exceptions

There are several special rules and exceptions to be aware of when completing Form 8582:

- Rental Real Estate Activities: Rental real estate activities are subject to a special $25,000 exception. This exception allows taxpayers to deduct up to $25,000 of rental losses, even if they do not meet the active participation requirement.

- Active Participation: To qualify for the $25,000 exception, taxpayers must meet the active participation requirement. This means that they must participate in the rental activity for at least 500 hours per year.

- Real Estate Professionals: Real estate professionals, such as property managers or real estate agents, may be able to deduct rental losses without limitation. To qualify, they must meet the real estate professional requirement, which requires them to spend at least 750 hours per year in real estate activities.

Form 8582 Instructions: Common Mistakes to Avoid

When completing Form 8582, there are several common mistakes to avoid:

- Incorrect Calculation of Passive Loss Limitations: Make sure to calculate the passive loss limitations correctly, taking into account all passive income and losses.

- Failure to Meet Active Participation Requirement: Make sure to meet the active participation requirement, if applicable, to qualify for the $25,000 exception.

- Incorrect Reporting of Rental Income and Expenses: Make sure to report rental income and expenses correctly, taking into account all rental activities.

Conclusion

Completing Form 8582 requires careful attention to detail and a thorough understanding of passive loss limitations. By following the step-by-step guide and avoiding common mistakes, you can ensure accurate reporting of passive income and losses. Remember to consult with a tax professional if you have any questions or concerns about completing Form 8582.

FAQ Section

What is the purpose of Form 8582?

+Form 8582 is used to calculate the passive loss limitations, which can significantly impact an individual's tax liability.

Who needs to file Form 8582?

+Form 8582 is required for taxpayers who have passive losses from rental real estate activities or other businesses.

What is the $25,000 exception?

+The $25,000 exception allows taxpayers to deduct up to $25,000 of rental losses, even if they do not meet the active participation requirement.

We hope you found this article helpful in understanding the Form 8582 instructions. If you have any further questions or need additional guidance, please don't hesitate to ask.