As the world becomes increasingly digital, the need for streamlined and efficient documentation processes has never been more pressing. One such document that plays a critical role in various transactions, particularly in the realm of finance and commerce, is Form 480.6c. Despite its importance, the intricacies of this form often leave individuals and organizations alike scratching their heads. In this article, we aim to demystify the complexities surrounding Form 480.6c, providing a comprehensive guide that simplifies its understanding and application.

What is Form 480.6c?

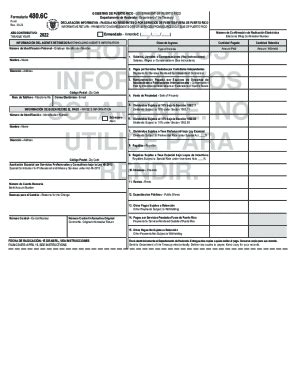

Form 480.6c is a standardized document used for reporting and disclosure purposes in various financial transactions. It is designed to provide a clear and concise overview of the terms and conditions of a specific agreement or contract. The form typically includes essential information such as the names of the parties involved, the nature of the transaction, the amount or value of the transaction, and any other relevant details.

Key Components of Form 480.6c

To understand the full scope of Form 480.6c, it is crucial to familiarize oneself with its key components. These include:

- Identification of Parties: This section requires the names, addresses, and contact information of all parties involved in the transaction.

- Transaction Details: This section outlines the nature of the transaction, including the type of goods or services being exchanged, the amount or value of the transaction, and any other relevant details.

- Terms and Conditions: This section specifies the terms and conditions of the agreement, including payment terms, delivery schedules, and any warranties or guarantees.

- Signatures and Dates: This section requires the signatures and dates of all parties involved, confirming their agreement to the terms and conditions outlined in the form.

Benefits of Using Form 480.6c

The use of Form 480.6c offers numerous benefits to individuals and organizations alike. Some of the most significant advantages include:

- Streamlined Documentation: Form 480.6c provides a standardized template for documenting financial transactions, reducing the risk of errors and inconsistencies.

- Improved Transparency: The form ensures that all parties involved in the transaction have a clear understanding of the terms and conditions, reducing the risk of disputes and misunderstandings.

- Enhanced Accountability: By requiring signatures and dates from all parties involved, Form 480.6c provides a clear audit trail, making it easier to track and verify transactions.

Common Applications of Form 480.6c

Form 480.6c is widely used in various industries and sectors, including:

- Financial Services: The form is commonly used in banking, lending, and investment transactions.

- Commerce: Form 480.6c is used in the sale and purchase of goods and services, including import and export transactions.

- Real Estate: The form is used in property transactions, including the sale and purchase of residential and commercial properties.

Best Practices for Completing Form 480.6c

To ensure that Form 480.6c is completed accurately and effectively, it is essential to follow best practices. These include:

- Carefully Review the Form: Before completing the form, carefully review the terms and conditions of the transaction to ensure that all parties are in agreement.

- Use Clear and Concise Language: Use clear and concise language when completing the form, avoiding ambiguity and confusion.

- Ensure Accuracy: Double-check all information entered on the form to ensure accuracy and completeness.

Tips for Avoiding Common Mistakes

To avoid common mistakes when completing Form 480.6c, follow these tips:

- Use the Correct Version of the Form: Ensure that you are using the most up-to-date version of the form.

- Complete All Required Fields: Ensure that all required fields are completed, including signatures and dates.

- Proofread Carefully: Carefully proofread the form for errors and inconsistencies before submitting it.

Conclusion and Next Steps

In conclusion, Form 480.6c is a critical document that plays a vital role in various financial transactions. By understanding the key components, benefits, and applications of the form, individuals and organizations can ensure that their transactions are documented accurately and effectively. To take the next step, we invite you to share your thoughts and experiences with Form 480.6c in the comments section below. Additionally, we encourage you to share this article with others who may benefit from a simplified guide to Form 480.6c.

What is the purpose of Form 480.6c?

+Form 480.6c is used for reporting and disclosure purposes in various financial transactions, providing a clear and concise overview of the terms and conditions of a specific agreement or contract.

Who uses Form 480.6c?

+Form 480.6c is widely used in various industries and sectors, including financial services, commerce, and real estate.

How do I complete Form 480.6c accurately?

+To complete Form 480.6c accurately, carefully review the form, use clear and concise language, and ensure accuracy and completeness.