Transferring your investments to a new brokerage firm can seem daunting, but with the right guidance, it can be a straightforward process. TD Ameritrade's Direct Registration Service (DRS) transfer form is designed to simplify the transfer process, ensuring that your assets are moved efficiently and accurately. In this article, we will break down the TD Ameritrade DRS transfer form, making it easier for you to navigate and complete the process.

Understanding the TD Ameritrade DRS Transfer Form

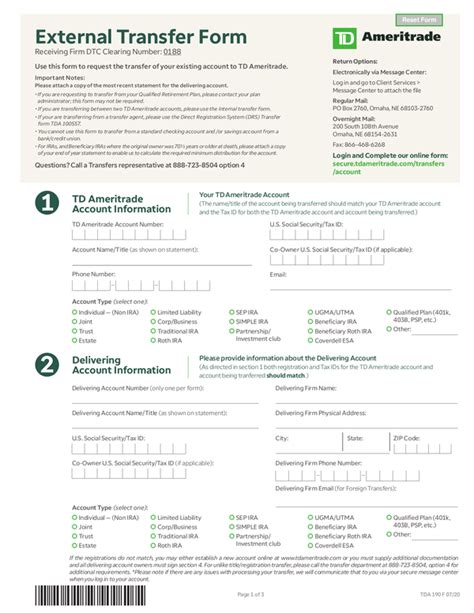

The TD Ameritrade DRS transfer form is used to transfer securities from another brokerage firm to your TD Ameritrade account. This form allows you to move your assets while maintaining their existing registration. To initiate the transfer process, you will need to complete the DRS transfer form, providing essential information about the securities you wish to transfer.

Benefits of Using the TD Ameritrade DRS Transfer Form

Using the TD Ameritrade DRS transfer form offers several benefits, including:

- Streamlined transfer process: The DRS transfer form simplifies the transfer process, ensuring that your assets are moved quickly and efficiently.

- Maintaining existing registration: By using the DRS transfer form, you can maintain the existing registration of your securities, avoiding the need for re-registration.

- Reduced paperwork: The DRS transfer form minimizes the amount of paperwork required, making it easier to transfer your assets.

Step-by-Step Guide to Completing the TD Ameritrade DRS Transfer Form

To complete the TD Ameritrade DRS transfer form, follow these steps:

- Gather required information: Before starting the transfer process, ensure you have the necessary information, including the name and account number of the delivering brokerage firm, the security details, and your TD Ameritrade account information.

- Download and print the DRS transfer form: You can obtain the DRS transfer form from the TD Ameritrade website or by contacting their customer support team.

- Complete the form: Fill out the form accurately, providing the required information, including the security details, delivering brokerage firm information, and your TD Ameritrade account details.

- Sign and date the form: Sign and date the form, ensuring that all parties have signed the document.

- Submit the form: Return the completed form to TD Ameritrade via mail or fax, following their instructions for submission.

Common Mistakes to Avoid When Completing the TD Ameritrade DRS Transfer Form

When completing the TD Ameritrade DRS transfer form, it is essential to avoid common mistakes that can delay the transfer process. These mistakes include:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Insufficient documentation

- Delayed submission of the form

Tips for a Smooth Transfer Process

To ensure a smooth transfer process, follow these tips:

- Plan ahead: Allow sufficient time for the transfer process to complete, taking into account any potential delays.

- Verify information: Double-check the information provided on the DRS transfer form to ensure accuracy.

- Keep records: Maintain a record of the transfer process, including the completed DRS transfer form and any communication with TD Ameritrade.

- Contact TD Ameritrade: If you have any questions or concerns, contact TD Ameritrade's customer support team for assistance.

Conclusion

Transferring your investments to TD Ameritrade using the DRS transfer form can be a straightforward process when you have the right guidance. By understanding the benefits and requirements of the DRS transfer form, following the step-by-step guide, and avoiding common mistakes, you can ensure a smooth transfer process. If you have any questions or concerns, do not hesitate to contact TD Ameritrade's customer support team.

We invite you to share your experiences or ask questions about the TD Ameritrade DRS transfer form in the comments section below. Your feedback and insights can help others navigate the transfer process.

What is the TD Ameritrade DRS transfer form?

+The TD Ameritrade DRS transfer form is used to transfer securities from another brokerage firm to your TD Ameritrade account while maintaining their existing registration.

How do I obtain the TD Ameritrade DRS transfer form?

+You can obtain the DRS transfer form from the TD Ameritrade website or by contacting their customer support team.

How long does the transfer process take?

+The transfer process typically takes 5-10 business days, but may vary depending on the delivering brokerage firm and the type of securities being transferred.