Are you a New York State employer looking to navigate the complexities of Form NYS-100? Filing taxes and adhering to state regulations can be a daunting task, but with the right guidance, you can ensure compliance and avoid costly penalties. In this article, we will delve into the intricacies of Form NYS-100 and provide you with six ways to accurately fill it out.

Understanding Form NYS-100

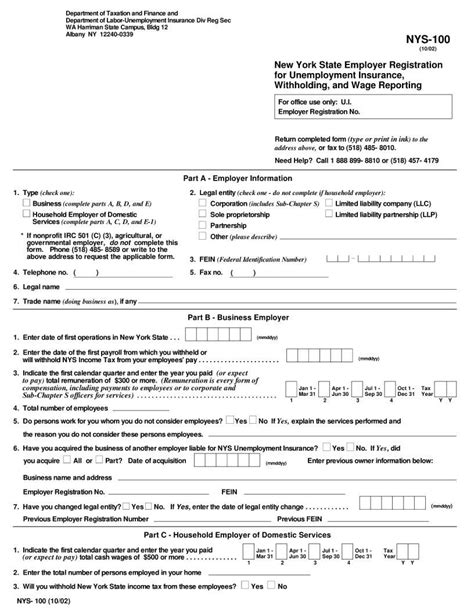

Form NYS-100, also known as the Employer's Quarterly Contribution Return, is a quarterly tax return that New York State employers must submit to report their employment taxes. This form is used to calculate the employer's quarterly contribution to the New York State Unemployment Insurance Fund.

Why is Accurate Filing Important?

Accurate filing of Form NYS-100 is crucial to avoid penalties, interest, and potential audits. Inaccurate or incomplete filings can lead to delayed processing, resulting in additional costs and administrative burdens. Moreover, failure to file or pay employment taxes can lead to severe consequences, including loss of business licenses and even criminal prosecution.

6 Ways to Fill Out Form NYS-100

1. Gather Required Information

Before filling out Form NYS-100, gather all necessary information, including:

- Employer's identification number (EIN)

- Business name and address

- Quarterly wage and tax data

- Employee information, including names, Social Security numbers, and wages earned

- Any applicable tax credits or deductions

2. Determine Your Filing Frequency

New York State employers must file Form NYS-100 on a quarterly basis, unless they meet specific requirements for annual or semiannual filing. Ensure you understand your filing frequency to avoid late penalties.

3. Calculate Quarterly Contributions

Calculate your quarterly contributions by multiplying the total taxable wages by the applicable contribution rate. You can find the contribution rate on the New York State Department of Labor's website.

4. Report Wages and Taxes

Report all wages paid to employees during the quarter, including:

- Gross wages

- Taxable wages

- Total taxes withheld

- Any applicable tax credits or deductions

5. Complete the Reconciliation Section

Complete the reconciliation section to ensure accuracy and transparency. This section requires you to reconcile your quarterly contributions with your annual unemployment insurance contribution rate.

6. Submit Form NYS-100 Electronically or by Mail

Submit Form NYS-100 electronically through the New York State Department of Labor's online portal or by mail to the address listed on the form. Ensure timely submission to avoid late penalties and interest.

Additional Tips and Reminders

- Keep accurate and detailed records of employee information, wages, and taxes.

- Verify employee Social Security numbers to avoid errors and penalties.

- Take advantage of tax credits and deductions available to New York State employers.

- Consult with a tax professional or accountant if you're unsure about any aspect of the filing process.

Frequently Asked Questions

What is the due date for filing Form NYS-100?

+Form NYS-100 is due on the last day of the month following the end of the quarter.

Can I file Form NYS-100 annually instead of quarterly?

+Yes, certain employers may be eligible for annual or semiannual filing. Check with the New York State Department of Labor for specific requirements.

What happens if I file Form NYS-100 late or inaccurately?

+Late or inaccurate filings can result in penalties, interest, and potential audits. Consult with a tax professional or accountant to ensure accurate and timely filing.

By following these six ways to fill out Form NYS-100, you can ensure accurate and timely filing, avoiding costly penalties and administrative burdens. Remember to stay informed about changing regulations and requirements to maintain compliance and minimize potential risks. Share your experiences and questions in the comments below, and don't hesitate to seek professional guidance if needed.