Colorado employers are required to file an Unemployment Insurance Tax Return (Form UITR-1) on a quarterly basis to report wages paid and taxes owed to the state. This return is a critical component of the unemployment insurance system, which provides financial assistance to eligible workers who have lost their jobs through no fault of their own. In this article, we will guide you through the process of completing the Colorado Form UITR-1, highlighting key aspects, and providing practical examples to ensure you stay compliant.

Understanding the Purpose of Form UITR-1

The primary purpose of Form UITR-1 is to report the wages paid to employees and the taxes owed by the employer to the Colorado Department of Labor and Employment (CDLE). The information provided on this return is used to determine the employer's unemployment insurance tax rate, which is used to fund the state's unemployment insurance program.

Who Must File Form UITR-1?

All Colorado employers who are subject to the Colorado Employment Security Act (CESA) must file Form UITR-1 on a quarterly basis. This includes:

- Most private-sector employers

- Governmental agencies

- Non-profit organizations

- Indian tribes

When is Form UITR-1 Due?

The Form UITR-1 is due on the last day of the month following the end of each quarter. The due dates are:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

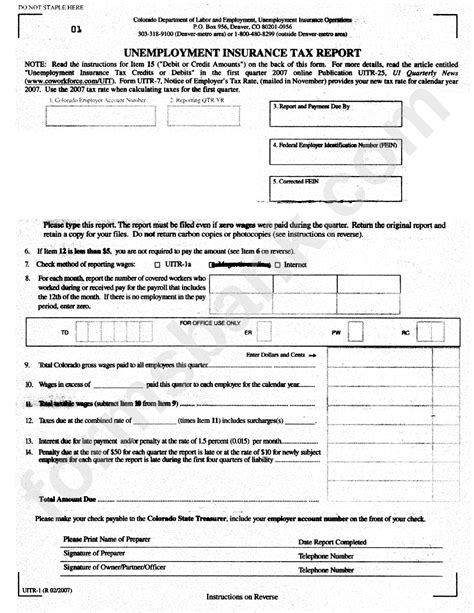

Completing Form UITR-1

Form UITR-1 consists of several sections that require employers to provide specific information about their business and employees. The following sections must be completed:

- Employer Information: Provide the employer's name, address, and account number.

- Wage Information: Report the total wages paid to employees during the quarter, including:

- Total wages paid

- Wages paid to employees who are subject to unemployment insurance

- Wages paid to employees who are exempt from unemployment insurance

- Tax Information: Calculate the unemployment insurance tax owed based on the wages reported.

- Additional Information: Provide any additional information required by the CDLE, such as:

- Number of employees

- Type of business

Calculating Unemployment Insurance Tax

To calculate the unemployment insurance tax owed, employers must first determine their tax rate. The tax rate is based on the employer's experience rating, which is calculated by the CDLE. The experience rating takes into account the employer's history of unemployment claims and taxes paid.

Once the tax rate is determined, the employer must calculate the tax owed based on the wages reported. The tax is calculated as a percentage of the wages paid to employees who are subject to unemployment insurance.

Penalties for Late or Inaccurate Filings

Employers who fail to file Form UITR-1 on time or who provide inaccurate information may be subject to penalties and interest. The CDLE may impose penalties of up to $100 per day for late filings, and interest may be charged on the unpaid tax.

Tips for Filing Form UITR-1

To ensure accurate and timely filings, employers should:

- Keep accurate records of wages paid and taxes owed

- Verify the accuracy of the information reported on Form UITR-1

- File Form UITR-1 on time to avoid penalties and interest

- Keep a copy of the filed return for their records

Common Mistakes to Avoid

When filing Form UITR-1, employers should avoid the following common mistakes:

- Failing to report all wages paid to employees

- Miscalculating the unemployment insurance tax owed

- Failing to file the return on time

- Providing inaccurate information

Conclusion

Filing the Colorado Form UITR-1 is a critical component of an employer's obligations under the Colorado Employment Security Act. By understanding the purpose and requirements of this return, employers can ensure compliance and avoid penalties and interest. Remember to keep accurate records, verify the accuracy of the information reported, and file the return on time to avoid common mistakes.

FAQs

What is the purpose of Form UITR-1?

+The primary purpose of Form UITR-1 is to report the wages paid to employees and the taxes owed by the employer to the Colorado Department of Labor and Employment (CDLE).

Who must file Form UITR-1?

+All Colorado employers who are subject to the Colorado Employment Security Act (CESA) must file Form UITR-1 on a quarterly basis.

What is the due date for filing Form UITR-1?

+The Form UITR-1 is due on the last day of the month following the end of each quarter.