When it comes to compliance with Department of Labor (DOL) regulations, accuracy and attention to detail are crucial. One of the most critical forms required by the DOL is the CA-17 form, also known as the "Notice of Termination, Reduction in Force, or Partial Cessation of Operations Due to a Major Disaster." This form is used to notify the DOL of certain employment actions, and its completion requires careful consideration of various factors. In this article, we will guide you through the 5 essential steps to complete the DOL CA-17 form.

Understanding the Purpose of the CA-17 Form

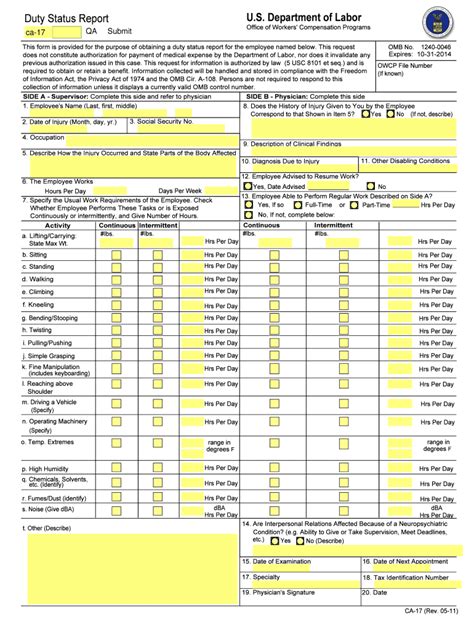

The CA-17 form is a critical document that notifies the DOL of employment actions, such as terminations, reductions in force, or partial cessations of operations, that are related to a major disaster. This form is essential for ensuring compliance with the Federal Employees' Compensation Act (FECA) and the Longshore and Harbor Workers' Compensation Act (LHWCA). By completing the CA-17 form accurately, employers can avoid potential penalties and ensure that their employees receive the necessary benefits.

Who Needs to Complete the CA-17 Form?

The CA-17 form is required for employers who are subject to the FECA or LHWCA and have experienced a major disaster that has resulted in employment actions. This includes federal agencies, private employers, and state and local governments. Employers must complete the CA-17 form for each affected employee and submit it to the DOL within the required timeframe.

Step 1: Determine the Type of Employment Action

The first step in completing the CA-17 form is to determine the type of employment action that has occurred. This may include:

- Termination of employment

- Reduction in force

- Partial cessation of operations

Employers must carefully review the circumstances surrounding the employment action to ensure that they select the correct type.

Step 1.1: Gather Relevant Information

Before completing the CA-17 form, employers must gather relevant information about the affected employees, including:

- Employee name and social security number

- Date of employment action

- Reason for employment action

- Job title and occupation

This information will be required to complete the CA-17 form accurately.

Step 2: Complete the Employer Information Section

The next step is to complete the employer information section of the CA-17 form. This includes:

- Employer name and address

- Federal tax identification number (FEIN)

- DOL case number (if applicable)

Employers must ensure that this information is accurate and up-to-date.

Step 2.1: Verify Employer Information

Employers must verify that the information provided in the employer information section is accurate and consistent with their records. This includes:

- Reviewing the employer's FEIN and DOL case number (if applicable)

- Verifying the employer's name and address

Step 3: Complete the Employee Information Section

The next step is to complete the employee information section of the CA-17 form. This includes:

- Employee name and social security number

- Date of employment action

- Reason for employment action

- Job title and occupation

Employers must ensure that this information is accurate and consistent with their records.

Step 3.1: Verify Employee Information

Employers must verify that the information provided in the employee information section is accurate and consistent with their records. This includes:

- Reviewing the employee's social security number and date of employment action

- Verifying the reason for employment action and job title

Step 4: Complete the Employment Action Section

The next step is to complete the employment action section of the CA-17 form. This includes:

- Type of employment action (termination, reduction in force, or partial cessation of operations)

- Date of employment action

- Reason for employment action

Employers must ensure that this information is accurate and consistent with their records.

Step 4.1: Verify Employment Action Information

Employers must verify that the information provided in the employment action section is accurate and consistent with their records. This includes:

- Reviewing the type of employment action and date of employment action

- Verifying the reason for employment action

Step 5: Submit the CA-17 Form

The final step is to submit the completed CA-17 form to the DOL. Employers must ensure that the form is submitted within the required timeframe and that all necessary information is included.

Step 5.1: Review and Verify the CA-17 Form

Before submitting the CA-17 form, employers must review and verify that all information is accurate and complete. This includes:

- Reviewing the employer and employee information sections

- Verifying the employment action information

- Ensuring that all necessary signatures are included

By following these 5 essential steps, employers can ensure that their CA-17 form is completed accurately and submitted on time. This will help to avoid potential penalties and ensure that affected employees receive the necessary benefits.

What is the purpose of the CA-17 form?

+The CA-17 form is used to notify the DOL of employment actions, such as terminations, reductions in force, or partial cessations of operations, that are related to a major disaster.

Who needs to complete the CA-17 form?

+The CA-17 form is required for employers who are subject to the FECA or LHWCA and have experienced a major disaster that has resulted in employment actions.

What information is required to complete the CA-17 form?

+The CA-17 form requires information about the employer, employee, and employment action, including the type of employment action, date of employment action, and reason for employment action.