The world of customs and border protection can be complex and overwhelming, especially when it comes to navigating the various forms and regulations. One crucial form that importers and exporters should be familiar with is the CBP Form 6043. In this article, we will delve into the details of this form, exploring its purpose, requirements, and benefits.

What is CBP Form 6043?

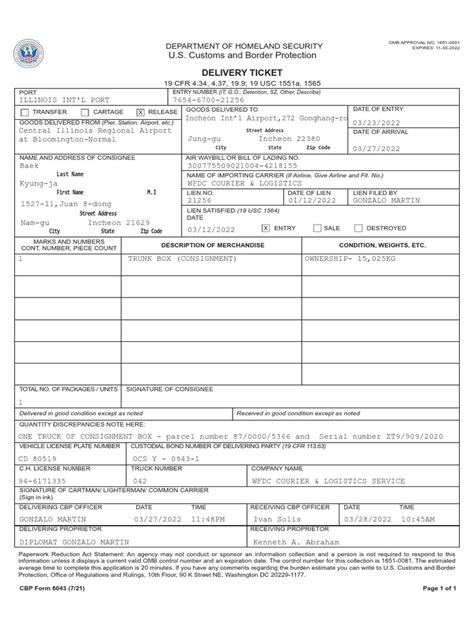

CBP Form 6043, also known as the "Customs Declaration - Merchandise" form, is a document required by U.S. Customs and Border Protection (CBP) for the importation and exportation of goods. The form serves as a declaration of the merchandise being transported, providing critical information about the shipment, including the type of goods, their value, and the country of origin.

Importance of Accurate Information on CBP Form 6043

Accurate and complete information on CBP Form 6043 is crucial to ensure compliance with customs regulations and to avoid any potential issues or penalties. Inaccurate or incomplete information can lead to delays, fines, or even the seizure of goods.

Who Needs to Fill Out CBP Form 6043?

CBP Form 6043 is required for various types of import and export transactions, including:

- Importers and exporters of commercial goods

- Carriers and freight forwarders

- Customs brokers and agents

Required Information on CBP Form 6043

The form requires a range of information, including:

- Shipper's and consignee's names and addresses

- Description of the merchandise, including the Harmonized System (HS) code

- Country of origin and country of export

- Value of the goods

- Mode of transportation and carrier information

Benefits of Using CBP Form 6043

Using CBP Form 6043 provides several benefits, including:

- Compliance with customs regulations

- Reduced risk of delays and penalties

- Improved efficiency and accuracy in the import and export process

- Enhanced transparency and visibility in the supply chain

Electronic Filing Options for CBP Form 6043

In recent years, CBP has introduced electronic filing options for CBP Form 6043, making it easier and more efficient to submit the form. Electronic filing options include:

- Automated Broker Interface (ABI)

- Automated Export System (AES)

Common Mistakes to Avoid When Filling Out CBP Form 6043

To avoid any potential issues or penalties, it's essential to avoid common mistakes when filling out CBP Form 6043, including:

- Inaccurate or incomplete information

- Failure to provide required documentation

- Incorrect classification of goods

- Failure to file the form on time

Best Practices for Filling Out CBP Form 6043

To ensure compliance and avoid any potential issues, follow these best practices when filling out CBP Form 6043:

- Verify the accuracy of all information

- Use the correct HS code classification

- Provide all required documentation

- File the form on time

Conclusion: Mastering CBP Form 6043

Mastering CBP Form 6043 is crucial for importers, exporters, and customs brokers to ensure compliance with customs regulations and avoid any potential issues or penalties. By understanding the purpose, requirements, and benefits of the form, as well as following best practices for filling it out, you can navigate the complex world of customs and border protection with confidence.

We hope this article has provided you with a comprehensive understanding of CBP Form 6043. If you have any questions or comments, please don't hesitate to share them with us.

What is the purpose of CBP Form 6043?

+CBP Form 6043 is a document required by U.S. Customs and Border Protection (CBP) for the importation and exportation of goods. The form serves as a declaration of the merchandise being transported, providing critical information about the shipment.

Who needs to fill out CBP Form 6043?

+CBP Form 6043 is required for various types of import and export transactions, including importers and exporters of commercial goods, carriers and freight forwarders, and customs brokers and agents.

What are the benefits of using CBP Form 6043?

+Using CBP Form 6043 provides several benefits, including compliance with customs regulations, reduced risk of delays and penalties, improved efficiency and accuracy in the import and export process, and enhanced transparency and visibility in the supply chain.