As an employer in New York State, it's essential to comply with the New York State Department of Labor's (NYSDOL) requirements regarding wage acknowledgement forms. The NYSDOL mandates that employers provide employees with a written acknowledgement of their wages, which includes the employee's rate of pay, frequency of pay, and other essential details. In this article, we'll delve into the world of NY wage acknowledgement forms, providing you with a fillable template and a comprehensive guide on how to use it.

The Importance of Wage Acknowledgement Forms

Wage acknowledgement forms serve as a critical document that ensures transparency and compliance with labor laws. By providing employees with a clear understanding of their wages, employers can prevent misunderstandings and potential disputes. Moreover, these forms help employers maintain accurate records, which can be essential in case of audits or investigations.

Understanding the NY Wage Acknowledgement Form

The NY wage acknowledgement form is a document that employers must provide to employees within 10 days of hiring or within 10 days of a change in the employee's wage rate. The form must include the following information:

- Employee's name and address

- Employee's rate of pay

- Frequency of pay (e.g., weekly, bi-weekly, monthly)

- Overtime rate of pay (if applicable)

- Benefits (e.g., health insurance, retirement plans)

- Any deductions or additions to wages

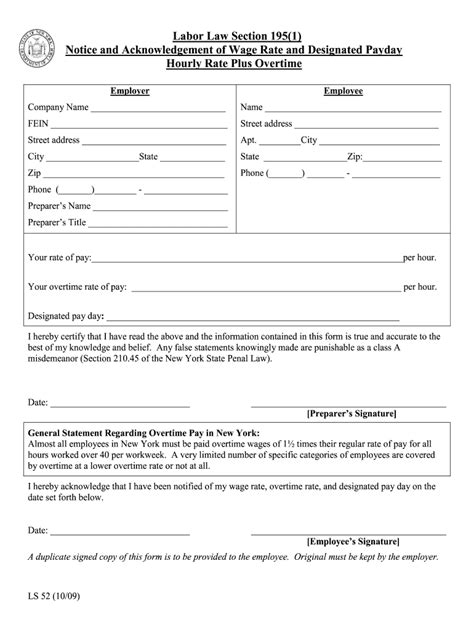

Fillable NY Wage Acknowledgement Form Template

To help you comply with the NYSDOL's requirements, we've created a fillable NY wage acknowledgement form template. You can download and customize this template to suit your needs.

[Insert Fillable Template]

How to Fill Out the NY Wage Acknowledgement Form

Filling out the NY wage acknowledgement form is a straightforward process. Here's a step-by-step guide to help you complete the form:

- Employee Information: Enter the employee's name, address, and any other relevant contact information.

- Rate of Pay: Specify the employee's hourly or salary rate of pay.

- Frequency of Pay: Indicate how often the employee will be paid (e.g., weekly, bi-weekly, monthly).

- Overtime Rate of Pay: If the employee is eligible for overtime pay, specify the overtime rate.

- Benefits: List any benefits provided to the employee, such as health insurance or retirement plans.

- Deductions or Additions: Specify any deductions or additions to the employee's wages, such as taxes or union dues.

- Acknowledgement: Have the employee sign and date the form, acknowledging receipt of the wage information.

Best Practices for Using the NY Wage Acknowledgement Form

To ensure compliance with the NYSDOL's regulations, follow these best practices when using the NY wage acknowledgement form:

- Provide the form to employees within 10 days of hiring or within 10 days of a change in the employee's wage rate.

- Ensure the form is complete and accurate, including all required information.

- Obtain the employee's signature and date on the form.

- Maintain a record of the completed form for at least six years.

- Update the form whenever there are changes to the employee's wage rate or benefits.

Common Mistakes to Avoid

When using the NY wage acknowledgement form, avoid the following common mistakes:

- Failing to provide the form within the required timeframe.

- Omitting essential information, such as the employee's rate of pay or benefits.

- Not obtaining the employee's signature and date on the form.

- Failing to maintain accurate records of the completed form.

Conclusion

In conclusion, the NY wage acknowledgement form is a critical document that ensures transparency and compliance with labor laws. By providing employees with a clear understanding of their wages, employers can prevent misunderstandings and potential disputes. Use our fillable NY wage acknowledgement form template and follow the best practices outlined in this guide to ensure compliance with the NYSDOL's regulations.

What is the purpose of the NY wage acknowledgement form?

+The NY wage acknowledgement form is used to provide employees with a clear understanding of their wages, including their rate of pay, frequency of pay, and benefits.

When must the NY wage acknowledgement form be provided to employees?

+The NY wage acknowledgement form must be provided to employees within 10 days of hiring or within 10 days of a change in the employee's wage rate.

What information must be included on the NY wage acknowledgement form?

+The NY wage acknowledgement form must include the employee's name and address, rate of pay, frequency of pay, overtime rate of pay (if applicable), benefits, and any deductions or additions to wages.