As a nonprofit organization, navigating the complexities of tax-exempt status can be overwhelming. One crucial step in this process is filling out Form 1023, also known as the Application for Recognition of Exemption. This form is a lengthy and detailed document that requires careful attention to ensure accuracy and completeness. However, with the help of a fillable version, you can make the process much easier and less time-consuming.

Understanding Form 1023

Before diving into the fillable version, it's essential to understand the purpose and components of Form 1023. This form is used by the Internal Revenue Service (IRS) to determine whether an organization qualifies for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. The form requires detailed information about the organization's structure, mission, activities, and financial situation.

Components of Form 1023

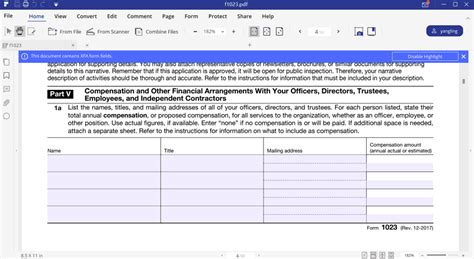

Form 1023 is divided into several sections, each requiring specific information:

- Part I: Identification of the organization

- Part II: Organizational structure

- Part III: Mission and activities

- Part IV: Financial information

- Part V: Compliance with federal tax laws

Benefits of a Fillable Version

Using a fillable version of Form 1023 can significantly simplify the application process. Here are some benefits:

- Increased accuracy: With a fillable version, you can avoid mistakes caused by handwriting or typing errors.

- Time-saving: The fillable version allows you to complete the form more quickly, as you can easily edit and revise information.

- Improved organization: The digital format helps you keep track of the required information and ensures that you don't miss any essential sections.

- Enhanced accessibility: A fillable version can be easily shared and accessed by multiple stakeholders, making it easier to collaborate and review the application.

How to Use a Fillable Version of Form 1023

Using a fillable version of Form 1023 is relatively straightforward. Here are some steps to follow:

- Download the fillable version of Form 1023 from a reputable source, such as the IRS website or a trusted nonprofit resource center.

- Save the form to your computer or cloud storage service.

- Complete the form section by section, using the fillable fields to enter the required information.

- Review and revise the form as needed, ensuring accuracy and completeness.

- Save the completed form and attach any required supporting documents.

- Submit the application to the IRS, either electronically or by mail.

Tips for Completing Form 1023

While using a fillable version can make the process easier, it's still essential to carefully review and complete the form. Here are some tips to keep in mind:

- Read the instructions carefully: Understand the requirements and guidelines for each section.

- Gather all necessary information: Ensure you have all the required documentation and data before starting the application.

- Use clear and concise language: Avoid ambiguity and ensure that your responses are easy to understand.

- Proofread carefully: Review the form multiple times to catch any errors or omissions.

- Seek professional help if needed: If you're unsure about any aspect of the application, consider consulting with a tax professional or nonprofit expert.

Common Mistakes to Avoid

When completing Form 1023, it's essential to avoid common mistakes that can delay or even reject your application. Here are some common errors to watch out for:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete, including names, addresses, and financial data.

- Failure to attach required documents: Make sure to include all required supporting documents, such as articles of incorporation and bylaws.

- Insufficient detail: Provide enough detail to demonstrate your organization's mission, activities, and financial situation.

Conclusion

Completing Form 1023 can be a daunting task, but using a fillable version can make the process much easier. By understanding the components of the form, following the tips and best practices outlined above, and avoiding common mistakes, you can ensure a successful application and secure tax-exempt status for your nonprofit organization.

What is Form 1023 used for?

+Form 1023 is used by the IRS to determine whether an organization qualifies for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

What are the benefits of using a fillable version of Form 1023?

+The benefits of using a fillable version include increased accuracy, time-saving, improved organization, and enhanced accessibility.

How do I submit my completed Form 1023 application?

+You can submit your completed application electronically or by mail to the IRS.