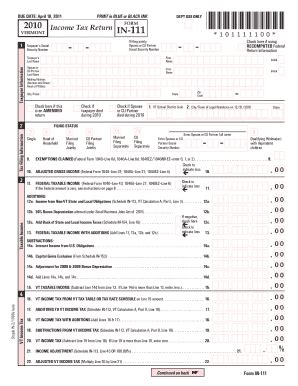

Filing taxes can be a daunting task, especially for those who are new to the process. The VT Form In-111 is a crucial document for Vermont residents who need to report their income and claim deductions. However, navigating the complexities of tax filing can be overwhelming. In this article, we will break down the VT Form In-111 filing process into 5 simple steps, making it easier for you to understand and complete.

Step 1: Gather Required Documents and Information

Before you start filling out the VT Form In-111, make sure you have all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Vermont driver's license or state ID

- Your W-2 forms from all employers

- Your 1099 forms for any freelance or contract work

- Your interest statements from banks and investments

- Your charitable donation receipts

- Your medical expense records

Having all these documents ready will save you time and reduce the likelihood of errors.

Why is it Important to Have Accurate Information?

Accurate information is crucial when filing taxes. Inaccurate or missing information can lead to delays, penalties, or even audits. Take your time to gather all the necessary documents and double-check your information to ensure accuracy.

Step 2: Determine Your Filing Status

Your filing status is an essential part of the VT Form In-111. You will need to determine your filing status based on your marital status, dependents, and other factors. The most common filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Your filing status will affect your tax rates, deductions, and credits. Make sure to choose the correct filing status to avoid any errors.

How Does Filing Status Affect Your Taxes?

Your filing status plays a significant role in determining your tax rates, deductions, and credits. For example, married couples who file jointly may be eligible for more deductions and credits than those who file separately. On the other hand, single individuals may have higher tax rates than married couples.

Step 3: Calculate Your Income and Deductions

Now it's time to calculate your income and deductions. You will need to report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income and expenses

You will also need to calculate your deductions, including:

- Standard deductions

- Itemized deductions

- Charitable donations

- Medical expenses

Make sure to use the correct forms and schedules to report your income and deductions.

What are the Most Common Deductions?

The most common deductions include:

- Standard deductions

- Itemized deductions

- Charitable donations

- Medical expenses

- Mortgage interest and property taxes

Take advantage of these deductions to reduce your taxable income and lower your tax bill.

Step 4: Claim Credits and Complete the Form

After calculating your income and deductions, it's time to claim credits and complete the VT Form In-111. You may be eligible for various credits, including:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Retirement savings credits

Make sure to complete all the required sections and schedules, and sign and date the form.

What are the Most Common Tax Credits?

The most common tax credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Retirement savings credits

Take advantage of these credits to reduce your tax bill and increase your refund.

Step 5: File Your Return and Pay Any Taxes Owed

Finally, it's time to file your return and pay any taxes owed. You can file your return electronically or by mail. If you owe taxes, you can pay online, by phone, or by mail.

Make sure to keep a copy of your return and supporting documents for at least three years in case of an audit.

What Happens After I File My Return?

After you file your return, the Vermont Department of Taxes will review your return for accuracy and completeness. If everything is in order, you will receive your refund within a few weeks. If you owe taxes, you will need to pay the amount due to avoid penalties and interest.

Now that you've completed the 5 simple steps, you're ready to file your VT Form In-111. Remember to take your time, gather all the necessary documents, and double-check your information to ensure accuracy. If you're still unsure, consider consulting a tax professional or seeking guidance from the Vermont Department of Taxes.

What is the deadline for filing the VT Form In-111?

+The deadline for filing the VT Form In-111 is typically April 15th of each year.

Can I file my return electronically?

+Yes, you can file your return electronically through the Vermont Department of Taxes website or through a tax preparation software.

What if I need an extension to file my return?

+If you need an extension to file your return, you can file Form 4868 with the Vermont Department of Taxes.

By following these 5 simple steps, you'll be able to file your VT Form In-111 with confidence and accuracy. Remember to stay organized, take your time, and seek guidance if needed. Happy filing!