Filling out tax forms can be a daunting task, especially for those who are new to the process. Form 6198, also known as the At-Risk Limitations, is one of the many forms that individuals and businesses must complete to report their tax obligations. In this article, we will provide 7 essential tips for filling out Form 6198 accurately and efficiently.

Understanding Form 6198

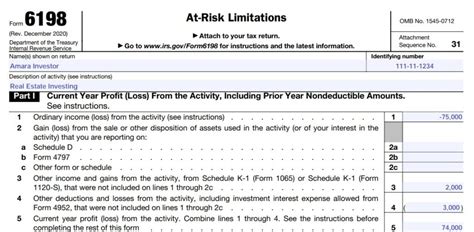

Before we dive into the tips, it's essential to understand the purpose of Form 6198. This form is used to report the at-risk limitations for individuals and businesses that have invested in activities such as real estate, farming, or other business ventures. The at-risk rules limit the amount of loss that can be deducted on tax returns.

What is At-Risk Limitation?

The at-risk limitation is a tax rule that limits the amount of loss that can be deducted on tax returns. This rule applies to individuals and businesses that have invested in activities that have a high potential for loss, such as real estate or farming. The at-risk limitation ensures that taxpayers do not deduct losses that exceed their actual investment in the activity.

Tips for Filling Out Form 6198

Here are 7 essential tips for filling out Form 6198:

Tip 1: Identify the Activity Type

When filling out Form 6198, it's essential to identify the type of activity you are reporting. The form requires you to specify whether the activity is a real estate activity, a farming activity, or another type of business venture. Make sure to choose the correct activity type to ensure that you are reporting the correct information.

Tip 2: Determine the At-Risk Amount

The at-risk amount is the amount of money that you have invested in the activity. This amount includes cash, property, and other assets that you have contributed to the activity. Make sure to determine the correct at-risk amount to ensure that you are reporting the correct information.

Tip 3: Calculate the Loss Limitation

The loss limitation is the amount of loss that you can deduct on your tax return. To calculate the loss limitation, you need to multiply the at-risk amount by the percentage of loss that you are allowed to deduct. Make sure to calculate the loss limitation correctly to ensure that you are deducting the correct amount of loss.

Tip 4: Report the Activity's Income and Expenses

Form 6198 requires you to report the activity's income and expenses. Make sure to report the correct income and expenses to ensure that you are accurately reporting the activity's financial performance.

Tip 5: Complete the Form Accurately and Completely

Make sure to complete Form 6198 accurately and completely. Review the form carefully to ensure that you have provided all the required information. Incomplete or inaccurate forms may be rejected by the IRS, which can delay your tax refund.

Tip 6: Attach Supporting Documentation

Form 6198 requires you to attach supporting documentation, such as receipts and invoices, to support the income and expenses reported on the form. Make sure to attach the required documentation to ensure that your form is complete and accurate.

Tip 7: Seek Professional Help if Needed

Filling out Form 6198 can be complex, especially if you are new to the process. If you need help, consider seeking the assistance of a tax professional. They can help you complete the form accurately and ensure that you are taking advantage of all the deductions and credits available to you.

Common Mistakes to Avoid

When filling out Form 6198, there are several common mistakes to avoid. Here are a few:

- Failing to report the correct activity type

- Miscalculating the at-risk amount

- Failing to attach supporting documentation

- Reporting incorrect income and expenses

- Failing to sign and date the form

By avoiding these common mistakes, you can ensure that your Form 6198 is accurate and complete.

Conclusion

Filling out Form 6198 can be a complex process, but with the right guidance, you can ensure that your form is accurate and complete. By following these 7 essential tips, you can avoid common mistakes and ensure that you are taking advantage of all the deductions and credits available to you. Remember to seek professional help if needed, and don't hesitate to contact the IRS if you have any questions or concerns.

We encourage you to share your experiences and tips for filling out Form 6198 in the comments below. Your feedback can help others who may be struggling with the process.

FAQ Section:

What is Form 6198 used for?

+Form 6198 is used to report the at-risk limitations for individuals and businesses that have invested in activities such as real estate, farming, or other business ventures.

What is the at-risk limitation?

+The at-risk limitation is a tax rule that limits the amount of loss that can be deducted on tax returns.

How do I determine the at-risk amount?

+The at-risk amount is the amount of money that you have invested in the activity, including cash, property, and other assets.