Divorce can be a complex and emotionally challenging process, especially when it comes to financial disclosures. In California, the FL 142 form is a crucial document that plays a significant role in the divorce process. In this article, we will delve into the world of California divorce disclosure, exploring what the FL 142 form is, its purpose, and how to navigate the process.

What is the FL 142 Form?

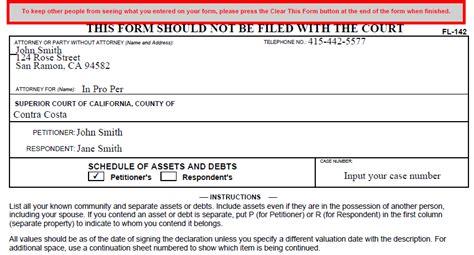

The FL 142 form, also known as the "Declaration of Disclosure," is a mandatory document that must be completed by both parties in a California divorce proceeding. The form is designed to ensure that both spouses provide full and accurate disclosure of their financial information, assets, and liabilities.

Purpose of the FL 142 Form

The primary purpose of the FL 142 form is to promote transparency and fairness in the divorce process. By requiring both parties to disclose their financial information, the court can make informed decisions regarding property division, spousal support, and other financial matters. The form also helps to prevent one spouse from hiding assets or income, which can be a common issue in divorce cases.

What Information is Required on the FL 142 Form?

The FL 142 form requires both parties to provide detailed information about their:

- Income and employment

- Assets, including real property, personal property, and financial assets

- Liabilities, including debts and obligations

- Expenses and financial obligations

- Other financial information, such as tax returns and bank statements

How to Complete the FL 142 Form

Completing the FL 142 form can be a daunting task, especially for those who are not familiar with the process. Here are some tips to help you navigate the form:

- Be thorough and accurate: Make sure to provide all required information and be honest about your financial situation.

- Use supporting documentation: Attach supporting documents, such as pay stubs, tax returns, and bank statements, to substantiate your financial information.

- Seek professional help: If you are unsure about how to complete the form or need help with the disclosure process, consider consulting with a divorce attorney or financial advisor.

Consequences of Not Completing the FL 142 Form

Failure to complete the FL 142 form or provide accurate financial information can have serious consequences, including:

- Sanctions and penalties: The court may impose sanctions and penalties on the party who fails to comply with the disclosure requirements.

- Delayed or denied divorce: The divorce process may be delayed or denied if the court is not satisfied with the disclosure process.

- Loss of credibility: Failure to provide accurate financial information can damage your credibility and trustworthiness in the eyes of the court.

Best Practices for Completing the FL 142 Form

Here are some best practices to keep in mind when completing the FL 142 form:

- Be proactive: Start gathering financial information and documents early in the divorce process.

- Be organized: Use a checklist or spreadsheet to keep track of the required information and documents.

- Be accurate: Double-check your financial information and documents to ensure accuracy and completeness.

- Seek professional help: If you are unsure about the disclosure process or need help with the form, consider consulting with a divorce attorney or financial advisor.

Conclusion and Next Steps

In conclusion, the FL 142 form is a critical document in the California divorce process. By understanding the purpose and requirements of the form, you can ensure a smooth and successful disclosure process. Remember to be thorough, accurate, and proactive when completing the form, and don't hesitate to seek professional help if needed.

We hope this guide has provided you with valuable insights and information about the FL 142 form. If you have any questions or concerns, please don't hesitate to reach out to us. Share your thoughts and experiences in the comments section below, and don't forget to share this article with others who may benefit from this information.

What is the purpose of the FL 142 form?

+The primary purpose of the FL 142 form is to promote transparency and fairness in the divorce process by requiring both parties to disclose their financial information, assets, and liabilities.

What information is required on the FL 142 form?

+The FL 142 form requires both parties to provide detailed information about their income and employment, assets, liabilities, expenses, and other financial information.

What are the consequences of not completing the FL 142 form?

+Failure to complete the FL 142 form or provide accurate financial information can result in sanctions and penalties, delayed or denied divorce, and loss of credibility in the eyes of the court.