The Gem State, Idaho, is known for its breathtaking natural beauty and outdoor recreational opportunities. But, as a resident of Idaho, you're also responsible for filing your state income tax return. This is where Idaho Form 41 comes in – the primary form used for filing individual income tax returns. In this comprehensive guide, we'll walk you through the process of filing your Idaho income tax return, highlighting the key components of Form 41, and providing valuable tips to ensure a smooth and error-free filing experience.

Understanding Idaho Form 41

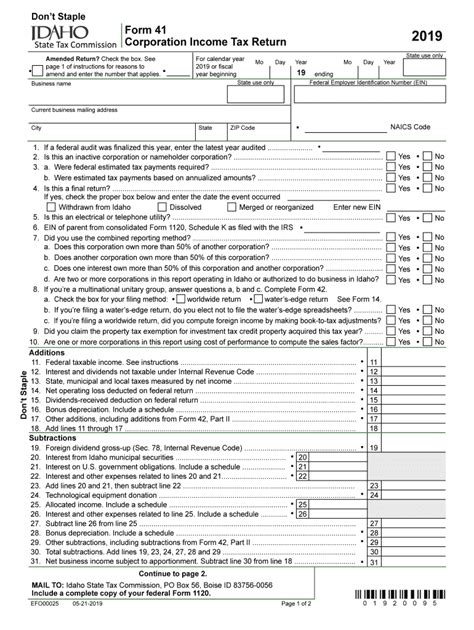

Idaho Form 41 is the standard form used for filing individual income tax returns. The form is divided into several sections, which we'll outline below. It's essential to understand the different parts of the form to ensure accurate and complete filing.

Who Needs to File Idaho Form 41?

You're required to file Idaho Form 41 if you're a resident of Idaho and have taxable income. This includes:

- Residents who earned income from Idaho sources

- Residents who earned income from non-Idaho sources

- Non-residents who earned income from Idaho sources

However, if you're a non-resident with no Idaho income, you're not required to file a state tax return.

Residency Status

Idaho considers you a resident if you've lived in the state for at least 270 days in a calendar year. If you're unsure about your residency status, consult the Idaho State Tax Commission's guidelines.

Filing Status and Dependents

When filing Idaho Form 41, you'll need to choose your filing status and report any dependents. Your filing status determines the tax rates and deductions you're eligible for. Idaho recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You can claim dependents on your Idaho tax return, which may include:

- Children under the age of 19

- Full-time students under the age of 24

- Disabled or elderly relatives

Gathering Required Documents

Before starting the filing process, gather the necessary documents to ensure accuracy and efficiency. You'll need:

- W-2 forms from your employer(s)

- 1099 forms for freelance or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Filing Idaho Form 41

Now that you've gathered the necessary documents, it's time to start filing your Idaho tax return. You can file electronically or by mail.

E-Filing

E-filing is a convenient and efficient way to file your Idaho tax return. You can use tax preparation software or the Idaho State Tax Commission's online portal. E-filing ensures faster processing and reduces the risk of errors.

Mailing Your Return

If you prefer to mail your return, ensure you sign and date the form, and attach all required documents. Use the correct mailing address:

Idaho State Tax Commission PO Box 36 Boise, ID 83722-0410

Idaho Tax Credits and Deductions

Idaho offers various tax credits and deductions to reduce your tax liability. Some of the most common credits and deductions include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Credits

- Mortgage Interest Deduction

- Charitable Donations Deduction

Avoiding Common Filing Mistakes

To avoid delays or errors, steer clear of common filing mistakes, such as:

- Inaccurate or missing Social Security numbers

- Incorrect or missing filing status

- Failure to report all income

- Incomplete or missing signatures

What to Expect After Filing

After filing your Idaho tax return, you can expect:

- A refund, if you're due one

- A bill, if you owe taxes

- A notification, if your return requires additional review or documentation

Keep in mind that Idaho's tax filing deadline is typically April 15th. If you need an extension, you can file Form 40, Application for Automatic Extension of Time to File.

Conclusion and Next Steps

Filing your Idaho income tax return may seem daunting, but with this comprehensive guide, you're well-equipped to tackle the process. Remember to gather all necessary documents, choose the correct filing status, and report any dependents. Take advantage of Idaho's tax credits and deductions to minimize your tax liability. If you have any questions or concerns, don't hesitate to reach out to the Idaho State Tax Commission.

FAQ Section:

What is the deadline for filing Idaho Form 41?

+The deadline for filing Idaho Form 41 is typically April 15th.

Can I file Idaho Form 41 electronically?

+Yes, you can file Idaho Form 41 electronically using tax preparation software or the Idaho State Tax Commission's online portal.

What is the Earned Income Tax Credit (EITC)?

+The Earned Income Tax Credit (EITC) is a tax credit for low-to-moderate-income working individuals and families.