The world of tax filing can be a complex and daunting one, especially when dealing with the intricacies of Form 7203, the S Corporation Shareholder Stock and Debt Basis Limitations. As a responsible taxpayer, it's essential to navigate these waters with confidence and accuracy. One crucial aspect of this process is understanding the stock block instructions, a critical component of Form 7203. In this article, we'll delve into the heart of the matter, providing you with 5 essential tips to help you master the stock block instructions and ensure a seamless tax filing experience.

Understanding the Basics of Form 7203

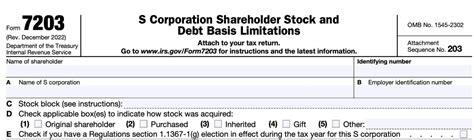

Before we dive into the stock block instructions, it's crucial to grasp the fundamental purpose of Form 7203. This form is used by S corporations to calculate the shareholder's stock and debt basis limitations. The information provided on this form helps determine the amount of losses that can be deducted by the shareholder, making it a vital component of the tax filing process.

Tip 1: Identify the Correct Stock Block

The first step in tackling the stock block instructions is to identify the correct stock block. The stock block is the section of Form 7203 where you report the shareholder's stock and debt basis. There are two types of stock blocks: the "Standard" block and the "Non-Standard" block. The Standard block is used for most S corporations, while the Non-Standard block is used for more complex situations, such as when the corporation has multiple classes of stock or has undergone a reorganization.

Tip 2: Calculate the Shareholder's Stock Basis

Once you've identified the correct stock block, it's essential to calculate the shareholder's stock basis accurately. The stock basis represents the shareholder's investment in the corporation and is used to determine the amount of losses that can be deducted. To calculate the stock basis, you'll need to consider the shareholder's initial investment, any subsequent investments or withdrawals, and any adjustments due to stock splits or other corporate actions.

Tip 3: Determine the Debt Basis

In addition to the stock basis, you'll also need to determine the debt basis. The debt basis represents the shareholder's debt obligations to the corporation and is used to calculate the amount of interest income that must be reported. To determine the debt basis, you'll need to consider the shareholder's initial debt obligations, any subsequent debt obligations or repayments, and any adjustments due to debt forgiveness or other corporate actions.

Tip 4: Complete the Stock Block Instructions Accurately

Now that you've calculated the shareholder's stock and debt basis, it's time to complete the stock block instructions. This section of Form 7203 requires you to report the shareholder's stock and debt basis, as well as any adjustments or limitations that may apply. It's essential to complete this section accurately, as errors can result in delays or even penalties.

Tip 5: Review and Verify the Stock Block Instructions

Finally, it's crucial to review and verify the stock block instructions to ensure accuracy and completeness. Take the time to double-check your calculations and ensure that all required information is included. It's also a good idea to have a tax professional review your work to ensure that everything is in order.

Common Mistakes to Avoid

When completing the stock block instructions, there are several common mistakes to avoid. These include:

-

Failing to Report All Stock and Debt Basis

Ensure that you report all stock and debt basis, including any subsequent investments or withdrawals.

-

Incorrectly Calculating the Stock and Debt Basis

Double-check your calculations to ensure accuracy and completeness.

-

Failing to Complete the Stock Block Instructions Accurately

Take the time to complete the stock block instructions accurately, as errors can result in delays or even penalties.

Conclusion: Mastering the Stock Block Instructions

Mastering the stock block instructions is a crucial component of completing Form 7203 accurately. By following these 5 essential tips, you'll be well on your way to navigating the complex world of S corporation tax filing with confidence. Remember to identify the correct stock block, calculate the shareholder's stock and debt basis accurately, complete the stock block instructions accurately, and review and verify your work to ensure accuracy and completeness.

What is Form 7203 used for?

+Form 7203 is used by S corporations to calculate the shareholder's stock and debt basis limitations.

What is the difference between the Standard and Non-Standard stock blocks?

+The Standard block is used for most S corporations, while the Non-Standard block is used for more complex situations, such as when the corporation has multiple classes of stock or has undergone a reorganization.

What is the stock basis?

+The stock basis represents the shareholder's investment in the corporation and is used to determine the amount of losses that can be deducted.