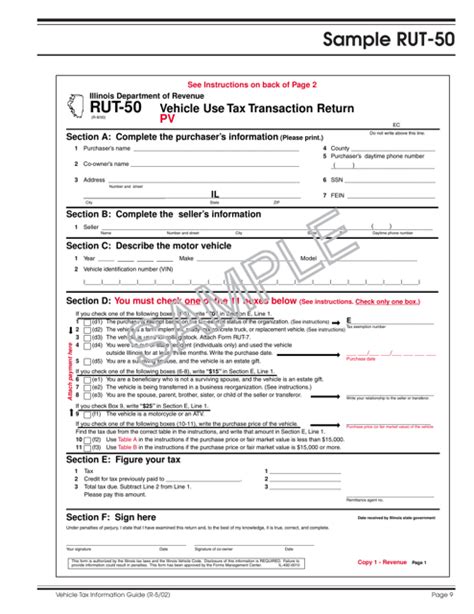

Filling out forms can be a daunting task, especially when it comes to government documents. The RUT-50 form, also known as the "Vehicle Use Tax Return" form, is a crucial document for Illinois residents who have purchased a vehicle. It's essential to fill out this form accurately to avoid any delays or penalties. In this article, we'll guide you through the process of filling out the RUT-50 form correctly, highlighting the most critical sections and providing valuable tips.

Understanding the RUT-50 Form

The RUT-50 form is used to report and pay the vehicle use tax in Illinois. This tax is levied on the purchase or lease of a vehicle, and it's the buyer's responsibility to file the form and pay the tax. The Illinois Department of Revenue requires this form to be filed within 30 days of purchasing or leasing a vehicle.

Section 1: Vehicle Information

The first section of the RUT-50 form requires you to provide information about the vehicle. This includes:

- Vehicle Identification Number (VIN)

- Year

- Make

- Model

- Vehicle type (e.g., car, truck, motorcycle)

Make sure to enter the correct VIN, as it's a critical piece of information. You can find the VIN on the vehicle's title or registration.

Filling Out the Form: Step-by-Step Guide

Now that we've covered the basics, let's dive into the step-by-step guide to filling out the RUT-50 form.

Step 1: Gather Required Documents

Before starting to fill out the form, gather the necessary documents, including:

- Vehicle title

- Registration

- Bill of sale

- Proof of residency (e.g., driver's license, utility bill)

Step 2: Fill Out Section 1: Vehicle Information

Enter the vehicle's VIN, year, make, model, and vehicle type. Double-check the information to ensure it's accurate.

Step 3: Fill Out Section 2: Purchaser Information

Provide your personal and contact information, including:

- Name

- Address

- Phone number

- Email address

Step 4: Fill Out Section 3: Purchase Information

Enter the purchase details, including:

- Date of purchase

- Purchase price

- Trade-in value (if applicable)

Step 5: Calculate the Vehicle Use Tax

Use the Illinois Department of Revenue's tax calculator or consult the tax rate schedule to determine the vehicle use tax amount.

Common Mistakes to Avoid

When filling out the RUT-50 form, it's essential to avoid common mistakes that can lead to delays or penalties. Here are some mistakes to watch out for:

- Inaccurate VIN or vehicle information

- Incorrect purchaser information

- Failure to report trade-in value

- Miscalculation of vehicle use tax

Tips for Filling Out the RUT-50 Form

To ensure a smooth process, follow these tips:

- Read the instructions carefully before starting to fill out the form.

- Use black ink to fill out the form.

- Make sure to sign and date the form.

- Keep a copy of the completed form for your records.

What to Do After Filing the RUT-50 Form

After filing the RUT-50 form, you'll receive a confirmation from the Illinois Department of Revenue. Make sure to:

- Keep the confirmation for your records.

- Pay the vehicle use tax amount due.

- Register your vehicle with the Illinois Secretary of State.

By following these steps and tips, you'll be able to fill out the RUT-50 form correctly and avoid any potential issues. Remember to double-check your information and calculations to ensure accuracy.

Now that you've completed the RUT-50 form, take a moment to share your experience or ask any questions you may have in the comments below. Don't forget to share this article with others who may find it helpful.

What is the deadline for filing the RUT-50 form?

+The deadline for filing the RUT-50 form is 30 days from the date of purchase or lease.

Can I file the RUT-50 form online?

+No, the RUT-50 form must be filed by mail or in person at an Illinois Department of Revenue office.

What happens if I make a mistake on the RUT-50 form?

+If you make a mistake on the RUT-50 form, you may need to file an amended return. Contact the Illinois Department of Revenue for assistance.