Navigating the complexities of tax season can be a daunting task for many individuals. As the annual deadline for filing taxes approaches, it's essential to understand the intricacies of Form 1040, the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. Two crucial lines on this form are 6a and 6b, which pertain to health care coverage. In this article, we'll delve into the details of these lines, providing a step-by-step guide to help you accurately complete your tax return.

Understanding the Affordable Care Act (ACA)

Before diving into the specifics of lines 6a and 6b, it's essential to grasp the basics of the Affordable Care Act (ACA), also known as Obamacare. The ACA requires most individuals to have minimum essential coverage (MEC) or face a penalty, unless they qualify for an exemption. This coverage can be obtained through various means, including employer-sponsored plans, individual market plans, Medicare, Medicaid, or other government-sponsored programs.

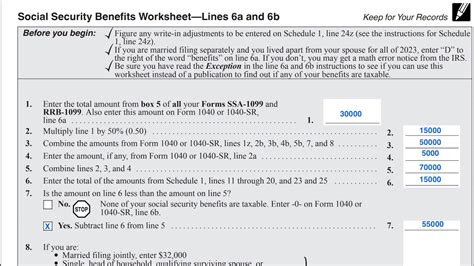

Form 1040 Line 6a: Health Care Coverage

Line 6a on Form 1040 asks if you, your spouse (if filing jointly), and your dependents had health care coverage for the entire year. You'll need to check one of the following boxes:

- Full-year coverage

- No coverage

- Part-year coverage

If you or any of your dependents had health care coverage for the entire year, you'll check the "Full-year coverage" box. This includes coverage through:

- Employer-sponsored plans

- Individual market plans

- Medicare

- Medicaid

- Other government-sponsored programs

If you or any of your dependents didn't have health care coverage for the entire year, you'll check the "No coverage" or "Part-year coverage" box, depending on your specific situation.

Form 1040 Line 6b: Health Care Exemptions

Line 6b on Form 1040 pertains to health care exemptions. If you checked "No coverage" or "Part-year coverage" on line 6a, you may be eligible for an exemption from the penalty. You'll need to complete Form 8965, Health Coverage Exemptions, to claim an exemption.

There are several types of exemptions, including:

- Coverage exemptions: You're exempt if you're incarcerated, a member of a recognized Indian tribe, or a resident of a foreign country.

- Income-based exemptions: You're exempt if your income is below a certain threshold, which varies depending on family size and income level.

- Hardship exemptions: You're exempt if you experienced a hardship, such as homelessness, eviction, or domestic violence.

If you're eligible for an exemption, you'll need to complete Form 8965 and attach it to your tax return. You'll also report the exemption on line 6b of Form 1040.

Step-by-Step Guide to Completing Lines 6a and 6b

To accurately complete lines 6a and 6b on Form 1040, follow these steps:

- Gather necessary documents: Collect proof of health care coverage, such as insurance cards, statements, or a letter from your employer.

- Determine your coverage status: Review your coverage for the tax year and determine if you had full-year, part-year, or no coverage.

- Check the boxes on line 6a: Based on your coverage status, check the corresponding box on line 6a.

- Determine if you're eligible for an exemption: If you checked "No coverage" or "Part-year coverage" on line 6a, review the exemption types and determine if you're eligible.

- Complete Form 8965 (if necessary): If you're eligible for an exemption, complete Form 8965 and attach it to your tax return.

- Report the exemption on line 6b: If you're claiming an exemption, report it on line 6b of Form 1040.

Common Mistakes to Avoid

When completing lines 6a and 6b on Form 1040, be aware of the following common mistakes:

- Inaccurate coverage reporting: Ensure you accurately report your coverage status on line 6a.

- Incomplete exemption documentation: If claiming an exemption, ensure you complete Form 8965 and attach it to your tax return.

- Failure to report exemptions: If eligible for an exemption, ensure you report it on line 6b.

Conclusion and Next Steps

Completing lines 6a and 6b on Form 1040 requires attention to detail and an understanding of the Affordable Care Act. By following the step-by-step guide outlined above, you'll be able to accurately report your health care coverage and claim any eligible exemptions. Remember to review the IRS instructions and seek professional assistance if you're unsure about any aspect of the process. Don't hesitate to reach out to a tax professional or the IRS if you have questions or concerns.

Take Action

- Review your health care coverage for the tax year

- Complete Form 1040 accurately, including lines 6a and 6b

- Claim any eligible exemptions using Form 8965

- Seek professional assistance if you're unsure about any aspect of the process

What is the penalty for not having health care coverage?

+The penalty for not having health care coverage varies depending on the tax year and your income level. For tax year 2022, the penalty is $695 per adult and $347.50 per child, up to a maximum of $2,085.

How do I know if I'm eligible for an exemption?

+You may be eligible for an exemption if you meet certain criteria, such as being incarcerated, a member of a recognized Indian tribe, or a resident of a foreign country. You can also qualify for an exemption if you experienced a hardship, such as homelessness or domestic violence. Review the IRS instructions and Form 8965 to determine if you're eligible.

What documentation do I need to prove health care coverage?

+You'll need to gather proof of health care coverage, such as insurance cards, statements, or a letter from your employer. This documentation will help you accurately complete lines 6a and 6b on Form 1040.