As a taxpayer, you're likely no stranger to the various forms and credits that can help reduce your tax liability. One such credit is the Earned Income Credit (EIC), a refundable tax credit designed to benefit low-to-moderate-income working individuals and families. If you're eligible, claiming the EIC can significantly impact your tax refund. In this article, we'll delve into the world of Form 8862, the necessary form to claim the EIC, and provide a comprehensive guide to help you navigate the process.

The Importance of Form 8862

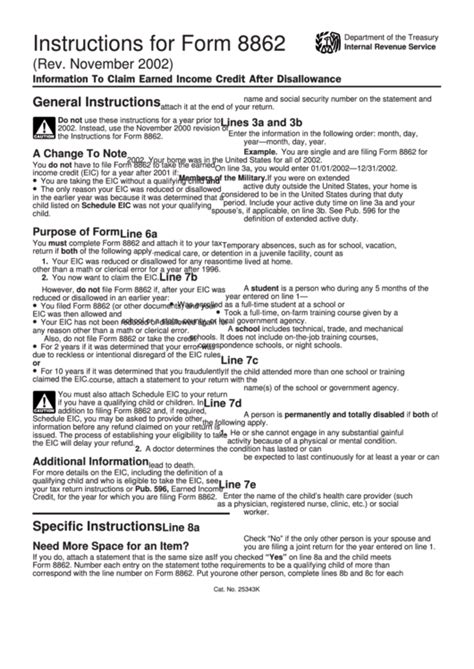

To claim the EIC, you'll need to file Form 1040 and complete Schedule EIC (Form 1040). However, if you've been disqualified from claiming the EIC in the past or have a qualifying child, you'll also need to file Form 8862, also known as the Information to Claim Earned Income Credit After Disallowance. This form serves as a way to reassert your eligibility for the EIC, providing additional information to support your claim.

Eligibility Requirements for the EIC

Before diving into Form 8862, it's essential to understand the basic eligibility requirements for the EIC. To qualify, you must:

- Have earned income from a job or self-employment

- Be a U.S. citizen or resident alien

- Have a valid Social Security number

- Meet certain income and family size requirements

- Not be a qualifying child of another taxpayer

- Not file Form 2555 (Foreign Earned Income) or Form 2555-EZ (Foreign Earned Income Exclusion)

If you meet these requirements, you may be eligible to claim the EIC.

Understanding Form 8862

Form 8862 is a relatively straightforward form, consisting of two main sections: Part I and Part II.

Part I:

In this section, you'll need to provide basic information, including:

- Your name and Social Security number

- The tax year for which you're claiming the EIC

- The reason for filing Form 8862 (e.g., disqualification or qualifying child)

Part II:

This section requires more detailed information to support your EIC claim. You'll need to provide:

- A detailed explanation of why you're eligible for the EIC

- Information about your qualifying child (if applicable)

- Supporting documentation (e.g., proof of income, residency, or family size)

How to Complete Form 8862

Completing Form 8862 requires attention to detail and accurate information. Here's a step-by-step guide to help you navigate the process:

- Gather necessary documents: Make sure you have all required documentation, including proof of income, residency, and family size.

- Review eligibility requirements: Double-check that you meet the basic eligibility requirements for the EIC.

- Complete Part I: Fill in the necessary information, including your name, Social Security number, and tax year.

- Complete Part II: Provide a detailed explanation of why you're eligible for the EIC, including information about your qualifying child (if applicable).

- Attach supporting documentation: Include all necessary documentation to support your EIC claim.

- Review and sign: Carefully review your form for accuracy and sign it.

Common Errors to Avoid

When completing Form 8862, it's essential to avoid common errors that can lead to delays or disqualification. Some common mistakes include:

- Incomplete or inaccurate information

- Failure to provide supporting documentation

- Not signing the form

- Submitting the form late

Tips and Tricks

Here are some additional tips to help you navigate the Form 8862 process:

- Keep accurate records: Maintain detailed records of your income, residency, and family size to support your EIC claim.

- Consult the IRS website: Visit the IRS website for the most up-to-date information on the EIC and Form 8862.

- Seek professional help: If you're unsure about the process or have complex tax situations, consider consulting a tax professional.

Conclusion

Claiming the EIC can significantly impact your tax refund, and Form 8862 is an essential step in the process. By understanding the eligibility requirements, completing the form accurately, and avoiding common errors, you can successfully claim the EIC and receive the refund you deserve.

If you have any questions or concerns about Form 8862 or the EIC, don't hesitate to comment below or share this article with a friend who may benefit from this information. Remember to stay informed and take advantage of the tax credits available to you.

What is the purpose of Form 8862?

+Form 8862 is used to claim the Earned Income Credit (EIC) after being disqualified or to provide additional information to support an EIC claim.

Who is eligible for the EIC?

+To be eligible for the EIC, you must have earned income from a job or self-employment, be a U.S. citizen or resident alien, have a valid Social Security number, meet certain income and family size requirements, and not be a qualifying child of another taxpayer.

What is the deadline for submitting Form 8862?

+The deadline for submitting Form 8862 is typically the same as the deadline for filing your tax return (usually April 15th).