The SBA Form 413, also known as the Personal Financial Statement, is a crucial document required by the Small Business Administration (SBA) for various loan programs and other financial assistance. Completing this form accurately and thoroughly is essential to ensure a smooth loan application process. In this article, we will provide a step-by-step guide on how to fill out the SBA Form 413, as well as some tips and best practices to keep in mind.

What is the SBA Form 413?

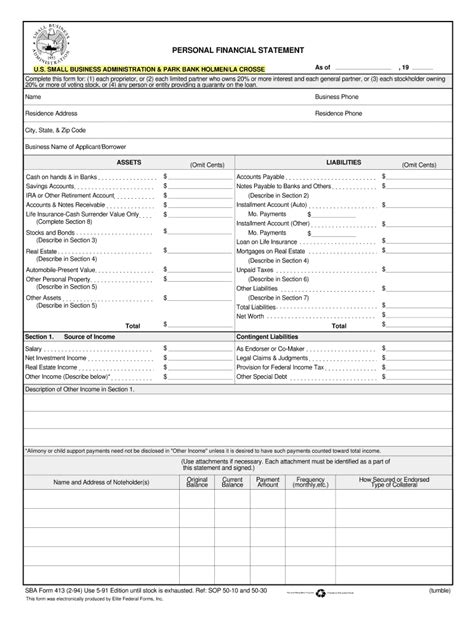

The SBA Form 413 is a standardized form used by the SBA to assess an individual's financial situation. The form requires applicants to provide detailed information about their income, assets, liabilities, and expenses. This information is used to evaluate the creditworthiness of the applicant and determine their ability to repay the loan.

Why is the SBA Form 413 Important?

The SBA Form 413 is a critical component of the loan application process. The information provided on this form helps lenders and the SBA to:

- Evaluate the creditworthiness of the applicant

- Determine the applicant's ability to repay the loan

- Assess the risk associated with lending to the applicant

- Make informed decisions about loan approvals and terms

How to Fill Out the SBA Form 413: A Step-by-Step Guide

Filling out the SBA Form 413 requires careful attention to detail and accuracy. Here's a step-by-step guide to help you complete the form:

- Section 1: Personal Information

- Provide your name, address, and contact information

- List your Social Security number or Employer Identification Number (EIN)

- Section 2: Income

- Report your gross income from all sources, including employment, investments, and self-employment

- List any other sources of income, such as alimony or child support

- Section 3: Assets

- List all your assets, including:

- Cash and bank accounts

- Investments (stocks, bonds, etc.)

- Real estate (primary residence, rental properties, etc.)

- Retirement accounts (401(k), IRA, etc.)

- Vehicles and other personal property

- List all your assets, including:

- Section 4: Liabilities

- List all your liabilities, including:

- Credit card debt

- Loans (personal, student, mortgage, etc.)

- Other debt obligations (alimony, child support, etc.)

- List all your liabilities, including:

- Section 5: Expenses

- Report your monthly expenses, including:

- Housing costs (rent/mortgage, utilities, etc.)

- Transportation costs (car loan/lease, insurance, etc.)

- Food and entertainment expenses

- Insurance premiums (health, life, disability, etc.)

- Report your monthly expenses, including:

- Section 6: Additional Information

- Provide any additional information that may be relevant to your loan application

Tips and Best Practices for Filling Out the SBA Form 413

To ensure accuracy and completeness, follow these tips and best practices when filling out the SBA Form 413:

- Use the latest version of the form: Make sure you're using the most recent version of the SBA Form 413, as forms are periodically updated.

- Be thorough and accurate: Provide complete and accurate information to avoid delays or rejections.

- Use clear and concise language: Avoid using jargon or technical terms that may be unfamiliar to lenders or the SBA.

- Include all required documentation: Make sure to include all required supporting documentation, such as tax returns, pay stubs, and bank statements.

Conclusion

Filling out the SBA Form 413 requires attention to detail and accuracy. By following the step-by-step guide and tips outlined in this article, you can ensure that your loan application is complete and accurate. Remember to use the latest version of the form, be thorough and accurate, and include all required documentation.We hope this article has been helpful in guiding you through the process of filling out the SBA Form 413. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the purpose of the SBA Form 413?

+The SBA Form 413 is used to assess an individual's financial situation and determine their creditworthiness.

How long does it take to fill out the SBA Form 413?

+The time it takes to fill out the SBA Form 413 can vary depending on the complexity of your financial situation. However, on average, it can take around 1-2 hours to complete.

Can I use a fillable version of the SBA Form 413?

+Yes, you can use a fillable version of the SBA Form 413, which can be downloaded from the SBA website or obtained from your lender.