Paying taxes is an essential civic duty, and for residents of New Jersey, understanding the New Jersey Income Tax Payment Voucher NJ-1040-V is crucial for ensuring timely and accurate tax payments. As the Garden State's tax authority, the New Jersey Division of Taxation, requires taxpayers to file their income tax returns and make payments using the NJ-1040-V voucher. In this article, we will delve into the details of the NJ-1040-V, its importance, and provide a step-by-step guide on how to complete and submit it.

Why is the NJ-1040-V Important?

The NJ-1040-V is a critical document for New Jersey residents who need to make income tax payments. It serves as a voucher that allows taxpayers to make payments towards their tax liability, either by check, money order, or electronic funds transfer. The voucher is usually attached to the taxpayer's income tax return (NJ-1040) and ensures that payments are accurately applied to the taxpayer's account. Failing to submit the NJ-1040-V or making errors on the voucher can lead to delayed processing, penalties, and interest on unpaid taxes.

When to Use the NJ-1040-V

Taxpayers are required to use the NJ-1040-V in the following situations:

- Making a payment with their income tax return (NJ-1040)

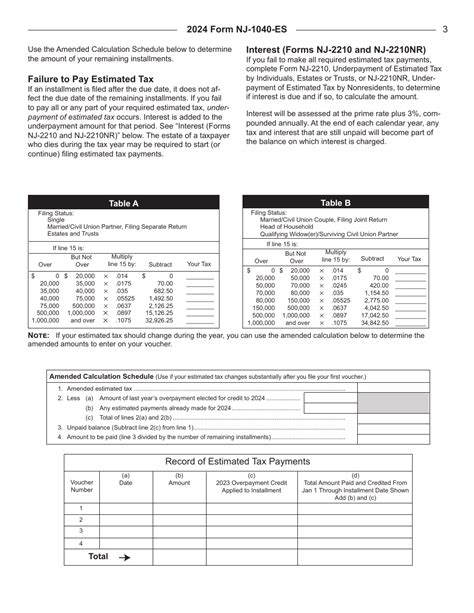

- Making an estimated tax payment

- Making a payment for a prior year's tax liability

- Responding to a notice from the New Jersey Division of Taxation

How to Complete the NJ-1040-V

Completing the NJ-1040-V is a straightforward process. Here's a step-by-step guide:

- Taxpayer Information: Enter your name, address, and Social Security number or Employer Identification Number (EIN) in the designated fields.

- Tax Year: Indicate the tax year for which you are making the payment.

- Payment Amount: Enter the payment amount you are making.

- Payment Method: Choose your payment method: check, money order, or electronic funds transfer.

- Signature: Sign and date the voucher.

Submission Options

Taxpayers can submit the NJ-1040-V and payment using the following options:

- Mail: Send the voucher and payment to the address listed on the voucher.

- Electronic Funds Transfer: Use the New Jersey Division of Taxation's online payment system to make an electronic payment.

- Check or Money Order: Include a check or money order with the voucher and mail it to the address listed.

Penalties and Interest

Failing to make timely payments or submitting an incomplete NJ-1040-V can result in penalties and interest on unpaid taxes. The New Jersey Division of Taxation may assess penalties and interest on a quarterly basis, so it's essential to make payments on time.

Common Mistakes to Avoid

To avoid delays and ensure accurate processing, taxpayers should avoid the following common mistakes:

- Incorrect or missing taxpayer information

- Incorrect payment amount

- Missing signature

- Incorrect payment method

Additional Tips

Here are some additional tips to keep in mind:

- Keep a copy of the NJ-1040-V: Keep a copy of the completed voucher and payment for your records.

- Verify payment: Verify that your payment has been processed by checking your account online or contacting the New Jersey Division of Taxation.

- Address changes: Update your address with the New Jersey Division of Taxation to ensure timely delivery of tax-related correspondence.

FAQs

Q: Can I use the NJ-1040-V for prior year tax payments? A: Yes, you can use the NJ-1040-V to make payments for prior year tax liabilities.

Q: Can I make electronic payments? A: Yes, you can make electronic payments using the New Jersey Division of Taxation's online payment system.

Q: What happens if I miss the payment deadline? A: If you miss the payment deadline, you may be subject to penalties and interest on unpaid taxes.

Q: Can I use the NJ-1040-V for estimated tax payments? A: Yes, you can use the NJ-1040-V to make estimated tax payments.

What is the deadline for submitting the NJ-1040-V?

+The deadline for submitting the NJ-1040-V varies depending on the tax year and payment method. Check the New Jersey Division of Taxation's website for specific deadlines.

Can I use the NJ-1040-V for amended returns?

+No, you should not use the NJ-1040-V for amended returns. Instead, use the NJ-1040X voucher.

How do I know if my payment has been processed?

+You can verify that your payment has been processed by checking your account online or contacting the New Jersey Division of Taxation.

Conclusion

The NJ-1040-V is an essential document for New Jersey residents who need to make income tax payments. By following the steps outlined in this article and avoiding common mistakes, taxpayers can ensure timely and accurate payments. Remember to keep a copy of the completed voucher and payment for your records and verify payment processing to avoid any issues. If you have any questions or concerns, don't hesitate to contact the New Jersey Division of Taxation or a tax professional for guidance.