The Transamerica hardship withdrawal form is a crucial document for individuals who need to access their retirement savings due to unforeseen financial difficulties. If you're facing a financial hardship and need to withdraw funds from your Transamerica account, it's essential to understand the process and requirements involved. In this article, we'll guide you through the process of completing the Transamerica hardship withdrawal form, highlighting the key aspects and providing valuable tips to ensure a smooth experience.

Understanding the Transamerica Hardship Withdrawal Process

Before diving into the form completion process, it's essential to understand the Transamerica hardship withdrawal rules and regulations. A hardship withdrawal is a type of withdrawal that allows you to access your retirement funds before age 59 1/2, but it's subject to certain conditions and penalties. The IRS permits hardship withdrawals for specific reasons, such as:

- Unreimbursed medical expenses

- Purchase of a primary residence

- Tuition and related educational expenses

- Prevention of eviction or foreclosure

- Burial or funeral expenses

5 Ways to Complete the Transamerica Hardship Withdrawal Form

Now, let's move on to the five ways to complete the Transamerica hardship withdrawal form:

Method 1: Online Submission through Transamerica Website

Transamerica allows you to submit your hardship withdrawal request online through their website. To do this, follow these steps:

- Log in to your Transamerica account online

- Navigate to the "Withdrawals" or "Distributions" section

- Select the "Hardship Withdrawal" option

- Fill out the online form, providing required documentation and information

- Review and submit your request

Method 2: Phone Request with a Transamerica Representative

If you prefer to speak with a representative, you can call Transamerica's customer service number to request a hardship withdrawal. Here's how:

- Call Transamerica's customer service number

- Inform the representative that you'd like to request a hardship withdrawal

- Provide required documentation and information over the phone

- The representative will guide you through the process and answer any questions you may have

- Once the request is processed, you'll receive a confirmation and instructions on the next steps

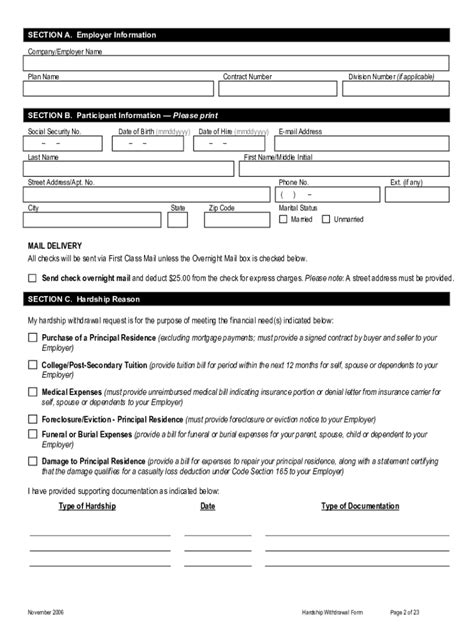

Method 3: Mail or Fax Request with a Completed Form

You can also submit your hardship withdrawal request by mail or fax using a completed form. Here's how:

- Download and print the Transamerica hardship withdrawal form from their website

- Fill out the form, providing required documentation and information

- Sign and date the form

- Mail or fax the completed form to Transamerica

- Wait for processing and confirmation

Method 4: In-Person Request at a Transamerica Office

If you prefer to speak with a representative in person, you can visit a Transamerica office to request a hardship withdrawal. Here's how:

- Find a nearby Transamerica office using their website or customer service number

- Schedule an appointment with a representative

- Bring required documentation and information

- Meet with the representative and complete the hardship withdrawal request

- Wait for processing and confirmation

Method 5: Using a Third-Party Administrator (TPA)

Some employers or plan administrators may use a third-party administrator (TPA) to manage their Transamerica accounts. If this is the case, you can request a hardship withdrawal through the TPA. Here's how:

- Contact your HR department or plan administrator to determine if a TPA is used

- Reach out to the TPA to request a hardship withdrawal form

- Fill out the form, providing required documentation and information

- Submit the completed form to the TPA

- Wait for processing and confirmation

Additional Tips and Considerations

Before completing the Transamerica hardship withdrawal form, keep the following tips and considerations in mind:

- Review the Transamerica hardship withdrawal rules and regulations to ensure you meet the eligibility requirements

- Gather required documentation and information before submitting your request

- Understand the potential tax implications and penalties associated with a hardship withdrawal

- Consider alternative options, such as a loan or emergency assistance programs, before requesting a hardship withdrawal

Final Thoughts

Completing the Transamerica hardship withdrawal form requires attention to detail and a clear understanding of the process and requirements involved. By following the five methods outlined above and considering the additional tips and considerations, you can ensure a smooth experience and access the funds you need during a financial hardship. If you have any questions or concerns, don't hesitate to reach out to Transamerica or a financial professional for guidance.

What is the Transamerica hardship withdrawal form used for?

+The Transamerica hardship withdrawal form is used to request a withdrawal from a Transamerica retirement account due to a financial hardship.

What are the eligibility requirements for a Transamerica hardship withdrawal?

+To be eligible for a Transamerica hardship withdrawal, you must meet specific requirements, such as having an immediate and heavy financial need, and the withdrawal must be necessary to alleviate the financial hardship.

How long does it take to process a Transamerica hardship withdrawal request?

+The processing time for a Transamerica hardship withdrawal request may vary, but it typically takes several days to several weeks for the request to be reviewed and processed.