As a taxpayer with foreign financial interests, you're likely familiar with the complexities of reporting your international activities to the IRS. One of the most critical forms you'll need to file is the Form 5471, specifically Schedule O. In this article, we'll delve into the world of Schedule O and provide you with five valuable tips to ensure accurate and timely filing.

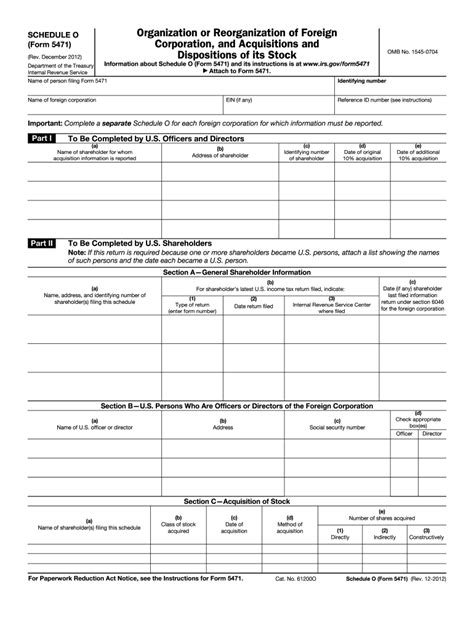

Form 5471 is a comprehensive form used by the IRS to collect information about a foreign corporation's activities, including its income, assets, and ownership structure. Schedule O is a crucial part of this form, requiring taxpayers to report the foreign corporation's organization or reorganization. In this section, you'll need to provide detailed information about the foreign corporation's formation, mergers, acquisitions, and other structural changes.

Tip 1: Understand the Purpose of Schedule O

Before diving into the specifics of Schedule O, it's essential to grasp its purpose. The IRS uses Schedule O to assess the foreign corporation's tax liability and ensure compliance with tax laws. By providing accurate and detailed information, you'll help the IRS determine the correct tax treatment for the foreign corporation's activities.

Tip 2: Gather Required Documents and Information

To complete Schedule O accurately, you'll need to gather various documents and information, including:

- Articles of incorporation or similar documents

- Bylaws or operating agreements

- Shareholder agreements

- Merger or acquisition documents

- Financial statements

Ensure you have all the necessary documents and information readily available to avoid delays or errors in the filing process.

Tip 3: Report All Required Information

Schedule O requires you to report specific information about the foreign corporation's organization or reorganization. This includes:

- The date of formation or reorganization

- The type of entity (e.g., corporation, partnership, etc.)

- The jurisdiction of formation or reorganization

- The foreign corporation's tax identification number (if assigned)

Carefully review the instructions and ensure you report all required information to avoid errors or omissions.

Tip 4: Complete All Required Schedules and Attachments

In addition to Schedule O, you may need to complete other schedules and attachments, such as:

- Schedule A (Information Regarding Certain Entities)

- Schedule B (Information Regarding Certain Transactions)

- Schedule C (Information Regarding Certain Accounts)

Carefully review the instructions and ensure you complete all required schedules and attachments to avoid errors or omissions.

Tip 5: Seek Professional Help If Needed

Filing Form 5471, including Schedule O, can be a complex and time-consuming process. If you're unsure about any aspect of the filing process, consider seeking professional help from a qualified tax professional or attorney. They can guide you through the process, ensure accuracy, and help you avoid potential penalties.

By following these five tips, you'll be well on your way to accurately and timely filing Form 5471, Schedule O. Remember to stay organized, gather all required documents and information, and seek professional help if needed.

We hope this article has provided valuable insights into the world of Schedule O. If you have any questions or comments, please don't hesitate to share them with us.

What is the purpose of Schedule O?

+Schedule O is used to report the foreign corporation's organization or reorganization, including its formation, mergers, acquisitions, and other structural changes.

What documents do I need to gather for Schedule O?

+You'll need to gather documents such as articles of incorporation, bylaws, shareholder agreements, merger or acquisition documents, and financial statements.

Can I seek professional help with filing Form 5471, Schedule O?

+Yes, it's highly recommended to seek professional help from a qualified tax professional or attorney if you're unsure about any aspect of the filing process.