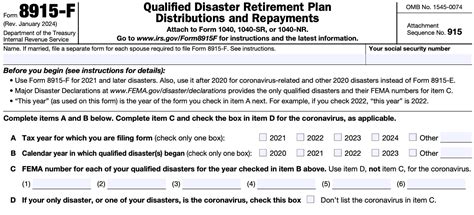

The Internal Revenue Service (IRS) provides various forms to help individuals report their income accurately. One such form is Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments form. This form is designed for individuals who received qualified disaster retirement plan distributions in tax years 2018 through 2025 and want to report repayments or income earned from these distributions.

What is Form 8915-F?

Form 8915-F is a supplemental income report that helps individuals account for qualified disaster retirement plan distributions. This form is typically filed by taxpayers who received distributions from a qualified retirement plan, such as a 401(k) or an IRA, due to a qualified disaster. A qualified disaster refers to a disaster declared by the President and designated as a qualified disaster for tax relief purposes.

Who needs to file Form 8915-F?

You need to file Form 8915-F if you meet the following conditions:

- You received a qualified disaster retirement plan distribution in tax years 2018 through 2025.

- You want to report repayments of qualified disaster retirement plan distributions.

- You earned income from qualified disaster retirement plan distributions.

Benefits of filing Form 8915-F

Filing Form 8915-F provides several benefits, including:

- Tax relief: Filing this form allows you to report repayments of qualified disaster retirement plan distributions, which can help reduce your tax liability.

- Income reporting: By filing this form, you can report income earned from qualified disaster retirement plan distributions, ensuring accurate tax reporting.

- Compliance: Filing Form 8915-F demonstrates your compliance with tax laws and regulations.

How to complete Form 8915-F

To complete Form 8915-F, follow these steps:

- Gather required information: Collect your qualified disaster retirement plan distribution records, including the amount distributed, the type of plan, and any repayments made.

- Determine the tax year: Identify the tax year for which you are reporting the qualified disaster retirement plan distribution.

- Complete Part I: Fill out Part I of the form, providing information about the qualified disaster retirement plan distribution, including the amount distributed and the type of plan.

- Complete Part II: Fill out Part II of the form, reporting any repayments made to the qualified retirement plan.

- Complete Part III: Fill out Part III of the form, reporting any income earned from the qualified disaster retirement plan distribution.

Tips for filing Form 8915-F

- Consult the IRS instructions: Refer to the IRS instructions for Form 8915-F to ensure accurate completion of the form.

- Seek professional help: If you are unsure about completing the form, consider consulting a tax professional or financial advisor.

- File electronically: File the form electronically through the IRS website or through a tax preparation software to ensure accuracy and efficiency.

Common mistakes to avoid

When filing Form 8915-F, avoid the following common mistakes:

- Inaccurate information: Ensure that all information provided is accurate and complete.

- Missing required information: Make sure to provide all required information, including the qualified disaster retirement plan distribution records.

- Incorrect tax year: Verify that the tax year reported on the form is accurate.

Tax implications

Failing to file Form 8915-F or reporting incorrect information can result in tax implications, including:

- Penalties and fines: You may be subject to penalties and fines for failure to comply with tax laws and regulations.

- Interest and additional taxes: You may be required to pay interest and additional taxes on the unreported income.

Conclusion

Form 8915-F is an essential tool for individuals who received qualified disaster retirement plan distributions. By accurately completing and filing this form, you can ensure compliance with tax laws and regulations, report repayments and income earned, and reduce your tax liability. If you are unsure about completing the form, consider consulting a tax professional or financial advisor.

What is the purpose of Form 8915-F?

+Form 8915-F is a supplemental income report that helps individuals account for qualified disaster retirement plan distributions.

Who needs to file Form 8915-F?

+You need to file Form 8915-F if you received a qualified disaster retirement plan distribution in tax years 2018 through 2025 and want to report repayments or income earned from these distributions.

What are the benefits of filing Form 8915-F?

+Filing Form 8915-F provides tax relief, accurate income reporting, and compliance with tax laws and regulations.